Game on! ESG debt issuance passes $3 trillion with record speed

This analysis is by Bloomberg Intelligence Head of ESG and Thematic Investing EMEA Adeline Diab. It appeared first on the Bloomberg Terminal.

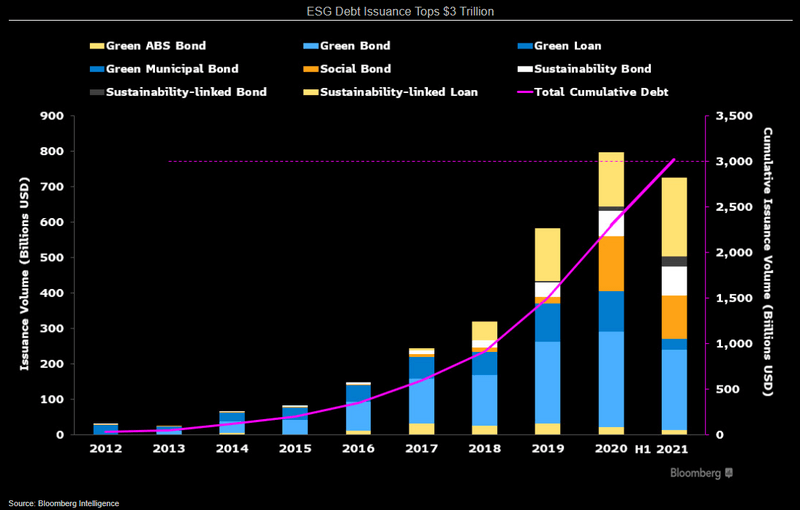

ESG green, social and sustainability debt issuance is growing at an exponential pace, surging past $3 trillion in cumulative sales this week — just 15 years after the first sale. While it took more than a decade to reach the first $1 trillion, it’s taken a record six months to add the latest trillion in bonds and loans prompted by the pandemic, race to net-zero emissions, global green fiscal stimulus plans and record low interest rates.

ESG debt’s red-hot leap to $3 trillion sets new mark

ESG debt issuance surpassed $3 trillion this week as both green and sustainability-linked debt expanded at an exponential rate. While 12 years were needed for the first $1 trillion, it took another year to top $2 trillion, and only six months this year to add the latest trillion. The surging growth shows no end in sight. Sales of green, social and sustainability bonds and loans in the first half this year have already reached a record — about $730 billion — more than 90% of 2020’s record year.

While green bonds continue to dominate, sustainability-linked bonds jumped the most with a threefold increase. Sustainable loans have also emerged as a serious asset class, reaching more than $583 billion, or about half of the $1.2 trillion in total debt issuance, in the past four years.

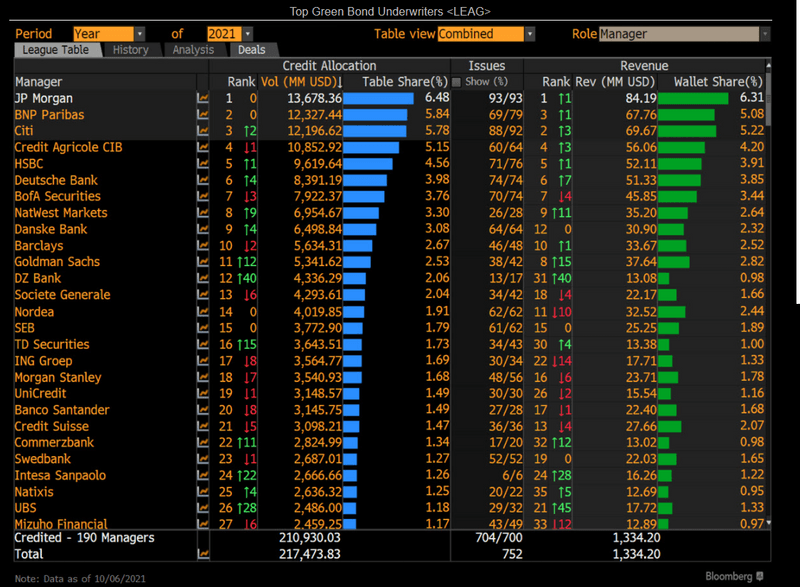

Who’s big on green? JPMorgan, BNP Paribas lead issuers

JPMorgan remains the top green bond underwriter so far in 2021, fulfilling its commitment to facilitate $213 billion in financing toward companies and projects that support green and social objectives. While European banks such as BNP Paribas, Credit Agricole and HSBC dominate green underwriting, U.S. banks like JPMorgan, Citigroup, Bank of America, Morgan Stanley and Goldman Sachs represented about 19.75% of corporate and governmental green deals in 2020, up from 2% in 2019.

Utilities, infrastructure and real estate, as is typical, issued the most corporate green bonds. France and Japan sold the largest sovereign green bonds so far this year.

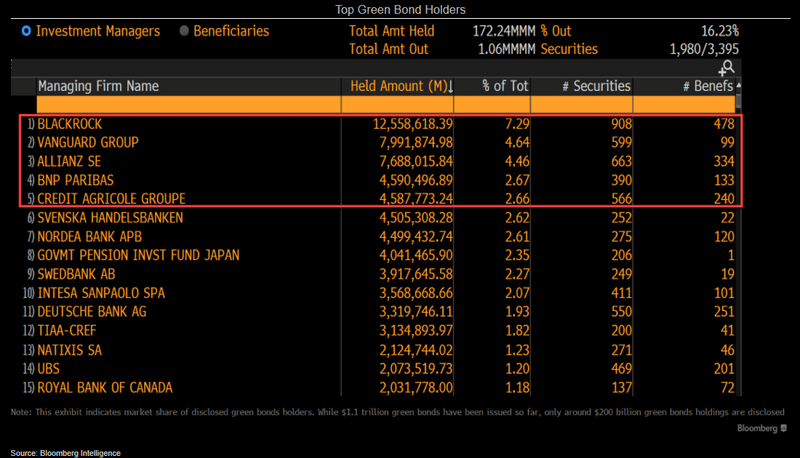

BlackRock bets biggest on green bonds with 7.5% market share

While the European Union’s pledge to issue 225 billion euros in green bonds and the ECB’s asset-buying program should sustain the ESG debt market, the global race to net-zero emissions may accelerate the market share of the debt as an asset class. Sellers include not only companies, but also countries such as the U.K. and Canada as well as potential issuance by emerging economies such as Ghana.

BlackRock was the top holder of green bonds with $12.5 billion in assets as of June (doubling its position within the past six months), increasing its market share by 2.5% to 7.3%, followed by Vanguard (4.65%), Allianz (4.47%), Credit Agricole and Japan Pension Fund (both at 2.6%). The top 15 Investment managers tend to be concentrated in the U.S., Europe and Japan.

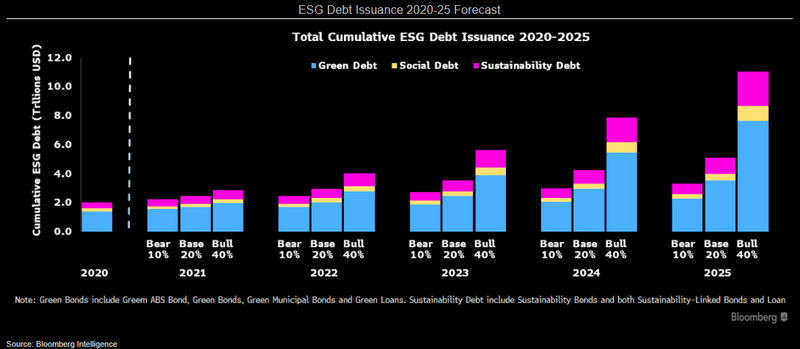

ESG debt on track for $11 trillion opportunity by 2025

The $3 trillion ESG debt market could swell to $11 trillion by 2025, assuming it expands at half the pace of the past five years. Organic growth is unlikely to slow — driven by companies, development projects and central banks — with pandemic and green-recovery efforts helping the market in the short term. EU pledges of 100 billion euros to support employment and 225 billion euros to fund a post-pandemic recovery, U.S. President Joe Biden’s $2 trillion energy strategy and the challenge of China’s 2023 green-debt maturities all signal ample room for new issuance.

The record-setting pace of investment is prompted by demand for ESG debt that meets social and sustainability objectives in the wake of the Covid-19, pandemic, the push to net zero, green fiscal stimulus plans worldwide and record low rates.