This article was written by Todd Sibilla. It appeared first on the Bloomberg Terminal.

China has become the world’s dominant maker of steel. Last year the country produced 943 million metric tons, 54% of the global total of 1.75 billion metric tons, according to Bloomberg Intelligence.

Ups and downs in China’s market thus reverberate not only within the country but also outside, particularly as they affect the export of iron ore from key trading partners Australia, Brazil, and others.

The growth of steelmaking in China isn’t entirely surprising. Yet the rate, especially during the Covid‑19 pandemic, showcases the country’s determination to support a vital industry. One highlight: China produced 99.45 million metric tons of steel in May, its highest monthly total ever.

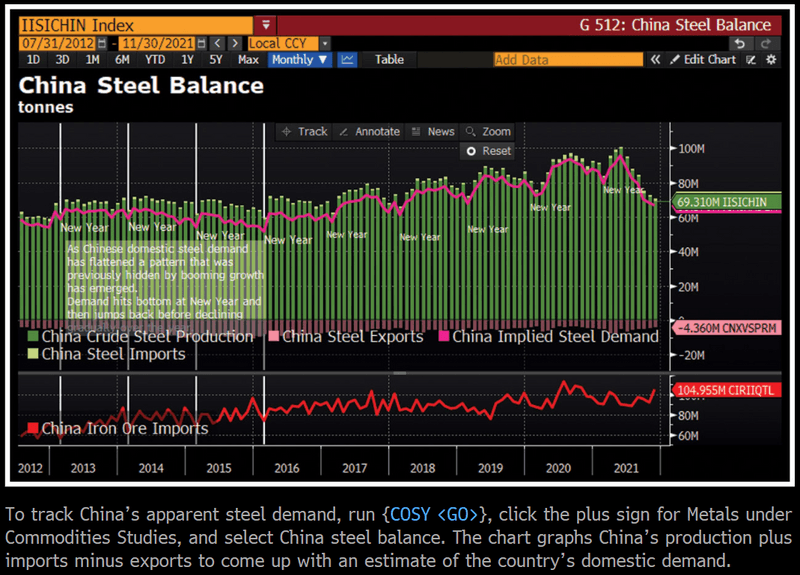

You can track China’s demand for steel with a ready-made commodities study. Run COSY <GO>. Under the Commodities Studies menu, click the plus sign to expand the Metals tree and click on China steel balance. The chart graphs China’s steel production plus imports minus exports to come up with an estimate of the country’s domestic demand. The red line in the bottom chart tracks China’s total iron ore imports. In the top chart, implied demand—the magenta line—tends to follow an annual pattern.

Demand dips each year around the Lunar New Year, jumps back up, then tends to decline gradually until the next holiday season. In 2021 demand hit a record high in May but then dropped steeply. Should that trend continue, the impact on iron ore prices will likely be evident this year. While prices reached record highs in 2021, they dropped in the second half: Run ISIX62IU GP <GO> to chart 62% grade iron ore deliverable to Qingdao, which hit $238 in May and fell to $114 by the end of the year.

Australia remains the leading exporter of iron ore to China, with 60% of the market. Brazil is second with 25%. Most analysts forecast that China’s iron ore demand and steel production will weaken this year, with the construction sector slowing, Covid impact continuing, and the government seeking to reduce carbon emissions. Steelmakers cut output in late 2021 because of the country’s carbon objectives but also to help meet air quality goals set by the government ahead of the Winter Olympics, starting in February. The record production in the first half of 2021 is thus unlikely to be repeated unless there’s a major shift in policy.

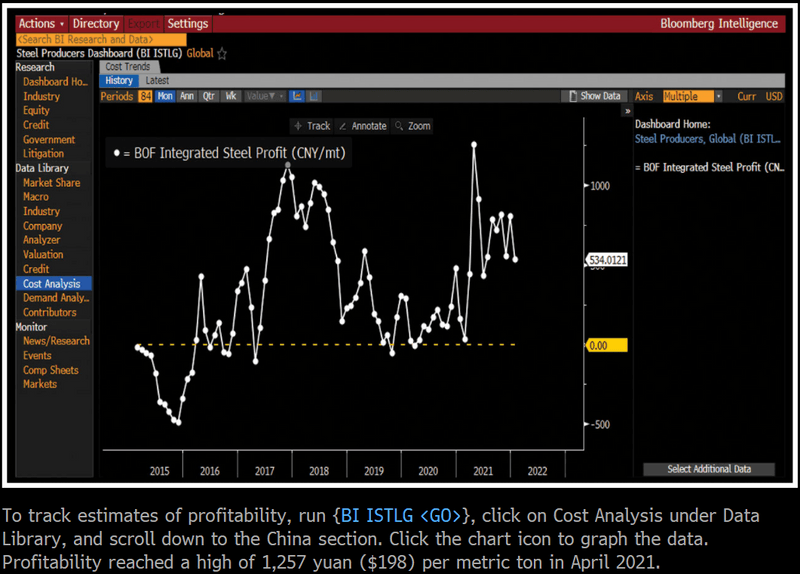

Profit margins were strong for global steelmakers through 2021. You can find estimates of profitability for Chinese steelmakers on the Bloomberg Intelligence Steel Producers Dashboard. Run BI ISTLG <GO>, click on Cost Analysis under Data Library, and scroll down to the China section. To graph the data, which is based on BI’s China basic oxygen furnace (BOF) model, click the chart icon to the right of BOF Integrated Steel Profit (CNY/mt). After a high of 1,257 yuan ($198) per metric ton in April 2021, profitability fell to 534 yuan in January.

The vast majority—about 85%—of China’s steel production is done in blast furnaces using the BOF process. Only about 15% is electric arc furnace (EAF), the far “cleaner” process that uses scrap steel. China EAF production has increased from about 6.5% of the total in 2018, and the government wants more to reach emission goals. The country’s scrap steel supply and domestic power pricing are likely to become key catalysts of global EAF production in coming years. Outside of China, EAF production accounts for a far greater proportion of overall production, with North America at about 70% and Europe at 40%. To meet global climate goals, there’s a push to build more EAF and develop even cleaner processes.

Steel production is a major contributor to global CO2 emissions, accounting for 7% of the total. Complicating the outlook for electric arc furnaces is that the “raw material”—scrap steel—is imported in many cases from developing economies. Ukraine, for example, in 2021 extended its export duty on scrap steel, in hopes of protecting its own potential supply. Other suppliers will likely take similar steps, making China’s move toward a “green” steel transition harder.

As the world’s largest steel producer, China wants to adopt new manufacturing processes while maintaining the dominant role. New production technologies using hydrogen rather than coal or natural gas will have a positive impact on producers looking to use iron ore instead of scrap steel.