Five things you need to know about global carbon markets

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

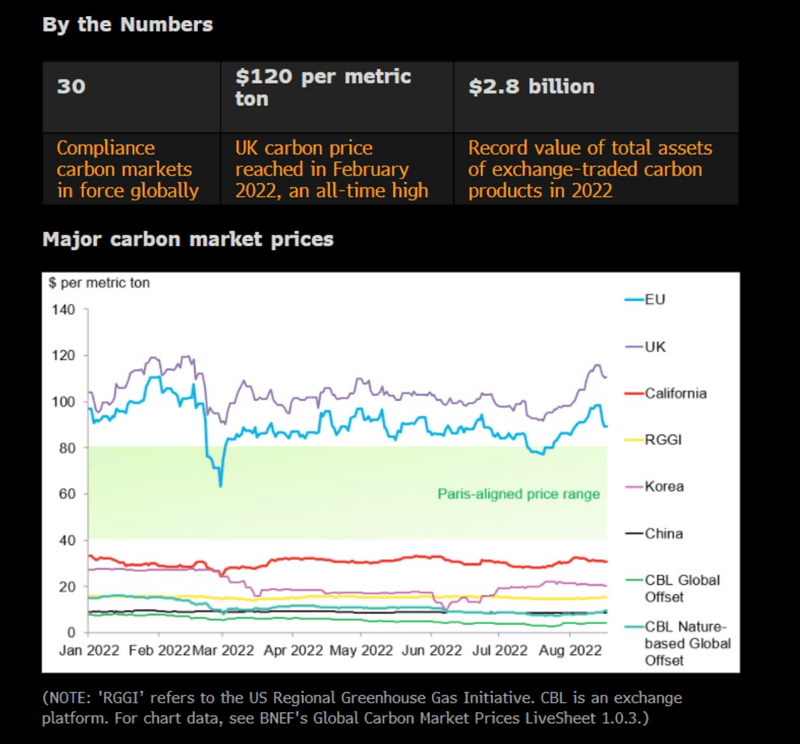

As more governments lay out net-zero emissions targets, many countries have implemented a carbon market to help achieve their climate goals. There are now 30 compliance markets around the world, covering almost a fifth of global greenhouse gas emissions. Meanwhile, voluntary markets are gaining traction as corporations increasingly embrace carbon offsets to help neutralize their emissions. Here are five things you need to know about the state of global carbon markets today.

- Compliance carbon markets expand: Carbon markets are getting bigger in terms of both the volume of emissions covered and traded value. This comes as both countries and regions adopt market-based pollution pricing as their cornerstone policy tool to curb emissions. Financial investors have rushed into this arena to benefit from the high returns and relatively low risks.

- Voluntary carbon markets gain momentum: Demand for carbon offsets has soared as companies race to net zero. Annual voluntary carbon offset retirement is in record territory for the fifth consecutive year. Despite the growing demand, the market is oversupplied today and prices remain low. However, this could change quickly if the market reforms.

- Compliance and voluntary markets move closer together: Seven major compliance carbon markets around the world now permit the use of offsets in some form. The European Union, UK and New Zealand remain hesitant about the addition of offsets to their compliance markets but are not ruling it out in the future. Allowing offsets would narrow the gap between regulated and voluntary carbon markets.

- Article 6 accelerates trading: Article 6 of the Paris Agreement could help to scale up and standardize offset markets. If Article 6.4 — the global market trading mechanism — were to become more robust, transparent and efficient than voluntary market registries and standards, this could result in a significant surge in both supply and demand for Article 6.4-compliant offset projects.

- Governments act to protect trade: This year could make or break efforts to put a carbon price on imported goods. As the EU negotiates its ‘carbon border adjustment’, consensus on devilish questions around coverage, timing and exports is lacking. Potential emulators Canada and the UK are taking notes, Meanwhile, the US debate over carbon border tariffs reeks of simple protectionism.

- This note was originally published on August 26, 2022.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.