Five BI Charts on Gen Z

This analysis is by Bloomberg Intelligence Regional Market Analyst John Lee. It appeared first on the Bloomberg Terminal.

Three Chinese companies are leveraging Gen Z’s significant growth opportunities and these five charts show how. Shein and TikTok turbocharged their popularity during the pandemic and are now disrupting rivals across social media and fast fashion. Tencent dominates global video games and is now using esports as a launchpad outside China.

Is Shein Beating Fast Fashion at Their Own Game?

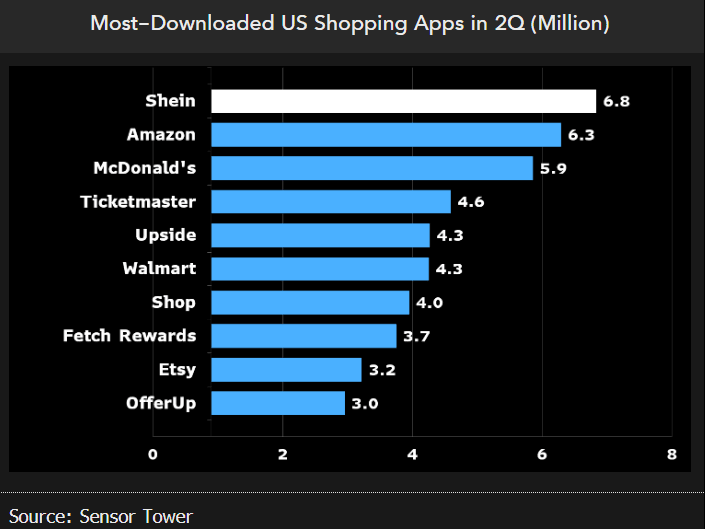

Sales of 8-year-old Chinese fashion brand Shein have soared, rising 250% in 2020 to $10 billion and 60% last year to $16 billion. Surprisingly it focuses on exports and doesn’t sell clothes in China. Shein topped Amazon as the most-downloaded shopping app in the US in 2Q. What’s puzzling is how it’s been able to achieve this. Shein is close to its supply chain but China is hardly cheap compared with rivals’ production sites like Bangladesh and India.

Like Boohoo, Shein has 1-2 production cycles a week, but this is balanced by extra time needed for shipping from China, according to BI analyst Charles Allen. Some commentators have pointed to its proprietary AI technology and a US tax loophole allowing shipments to individuals under $800 to avoid duty as potential reasons for its success.

Is Shein Really Worth $100 Billion?

Shein has attracted some of the world’s largest venture capital investors, including Sequoia Capital China, Tiger Global Management and IDG Capital. Its latest round of funding in April valued the company at $ 100 Billion — larger than Inditex (Zara) and H&M combined. Can Shein maintain its breakneck growth? It has already attracted its fare share of detractors, ironically from ESG-conscious Gen Z customers. The complaints appear to be the same facing the fast-fashion industry in general: a wasteful model which encourages over-consumption (often single use), copyright theft and a plethora of labour issues.

Facebook’s TikTok Problem

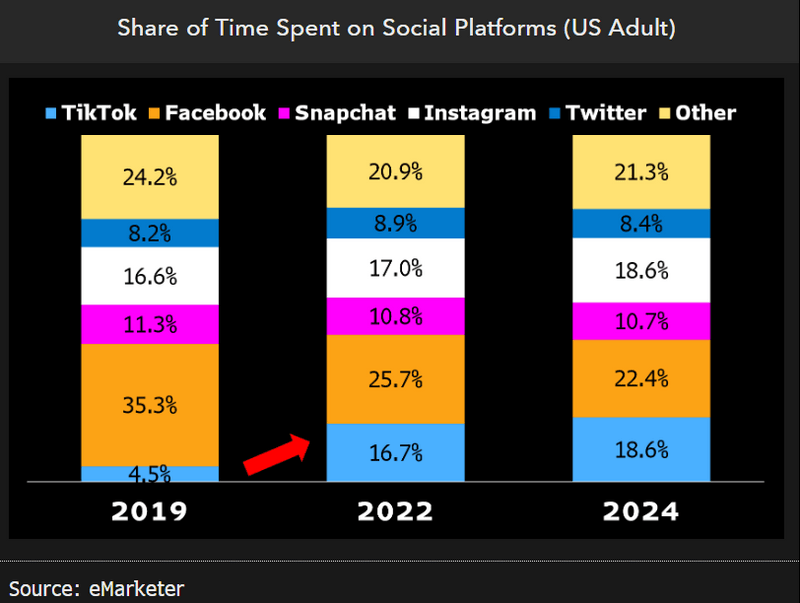

Short-video app TikTok has been one of the pandemic’s biggest winners. The chart below shows its share of total time spent on social media platforms by US adults is forecast to jump to 16.7% in 2022 from 4.5% in 2019, by far the highest rise among social platforms. This has come apparently come at the expense of Facebook and to a lesser degree Snapchat, while Twitter and Instagram have been largely flat. BI analyst Mandeep Singh partially attributes Facebook’s parent Meta’s market cap drop of more than 50% this year, the most among large-cap peers, to user engagement loss to TikTok. Facebook and Instagram have responded by pivoting toward short videos or reels, although this has drawn criticism including Kylie Jenner and Kim Kardashian famously urging Instagram to “stop copying TikTok” in July 2022.

TikTok and Snapchat Have the Youngest User Base

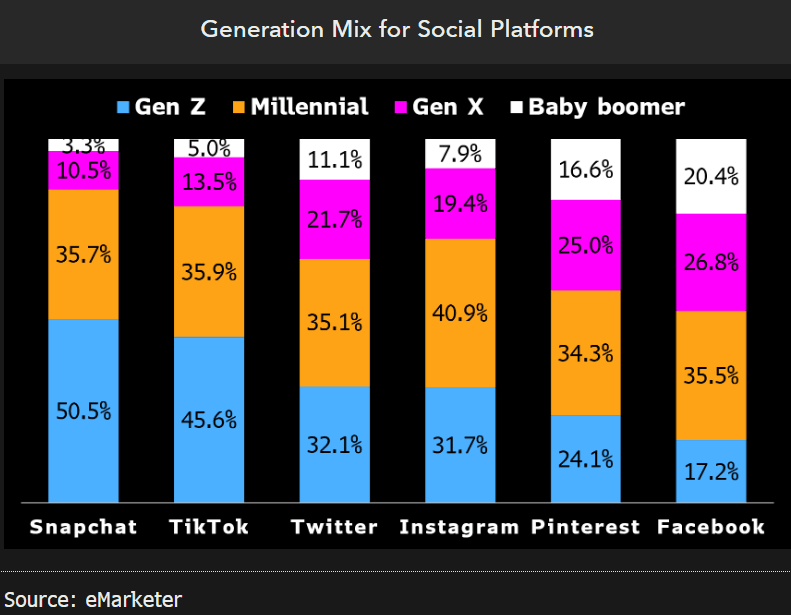

What’s worrying for competitors is how young TikTok’s user base is. TikTok’s Gen Z users –born between 1997 and 2012 — in the US are on track to exceed 40 million this year, more than quadruple the figure in 2018. Gen Z now comprises 45% of its total users and millennials a further 36%. Only Snapchat has a similarly young user base. On the other end of the spectrum, Facebook actually has more Baby Boomer users than from Gen Z.

Tencent Seeks Growth Beyond China Via Esports

Gen Z consumers spend over 7 hours a week on average playing video games, more than any other form of entertainment, according to Newzoo. This is an area where Tencent, the Chinese behemoth that publishes the world’s top 2 mobile games in 2021 — PUBG (co-published with Korea’s Krafton) and Honor of Kings — dominates. With tightened regulations restricting growth in its home market of China, Tencent is increasingly focusing on overseas markets and esports serves as a launch pad to capture new players, according to BI’s Nathan Naidu. Already, 6 of the top 10 esports games by Prize money belong to Tencent or Tencent-backed companies.