Bloomberg Market Specialist Wendy Tan and Ardha V K contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

A looming debt wall looks set to hit Chinese developers in the third quarter, setting the stage for a potential flurry of mergers and acquisitions.

Issue

China real estate industry reeling from several dollar bond defaults since October, faces a debt maturity wall of $50.6 billion in the third quarter of 2022. As authorities seek to stabilize the situation, local media reported that borrowings used to fund takeovers won’t be included in calculations toward meeting the government’s so-called “three-red lines” policy. This opens up a potential source of funding for strong property developers to rescue their distressed counterparts. The People’s Bank of China has cut its key interest rate for the first time in almost two years amid efforts to revitalize a sagging economy hit by a property slump and recurrent virus outbreaks. The easing may help facilitate M&A and debt refinancing among developers.

Tracking

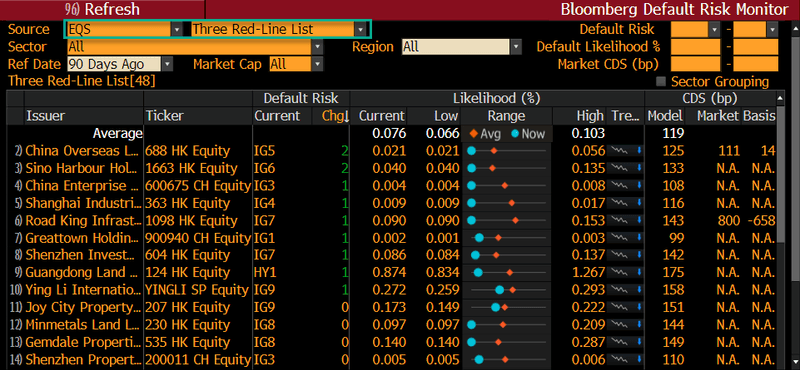

For Bloomberg Terminal subscribers, use Equity Screening (EQS <GO>) function to screen out property developers according to the “three red lines” policy, to identify those in the best position to rescue distressed counterparts. Out of the 211 major debt issuers tracked by Bloomberg, 48 developers met the three-red lines targets: a 70% ceiling on liabilities to assets, net debt not exceeding equity and cash being at least equal to short-term borrowings.

Track non-payment risks among these developers in the coming 12 months using the Bloomberg Default Risk Model (DRAM GO <GO>) function. The model calculates default risk using various metrics, including market capital, debt and cash flow.

Out of 48 screened above, 12 developers saw their credit risk improving over the past three months with Sino Harbour Holdings Group Ltd. topping the list. Ten firms saw their probability of default risk rise.

To see maturity distribution of debt for the property industry, use intelligent search function and debt distribution function DDIS <GO> in the terminal.

For more information on this or other functionality on the Bloomberg Professional Service, request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.