Fed’s new payments system may allay fintech’s peril to banks

This analysis is by Bloomberg Intelligence Senior Government Analyst Nathan R. Dean. It appeared first on the Bloomberg Terminal.

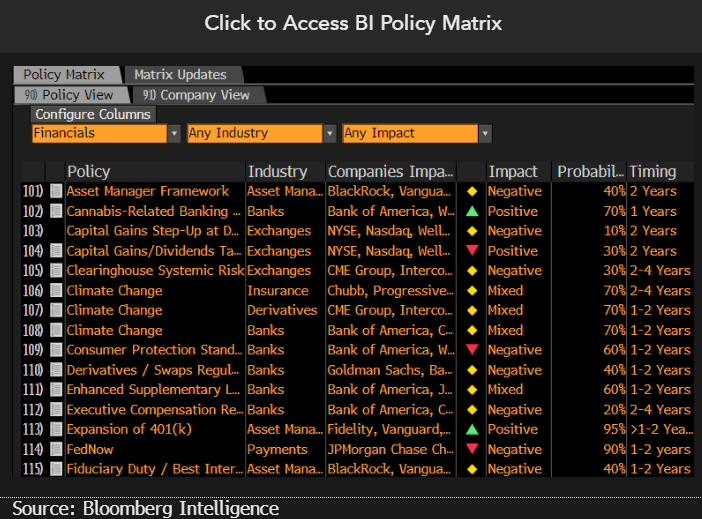

Fed Chairman Jerome Powell’s testimony to the House Financial Services Committee on March 8 reaffirms our view that FedNow, once launched, will allow banks to compete with fintechs in real-time payments. A separate service created by the big banks in 2017, however, will likely remain competitive over the next few years. Small banks could also be well positioned to take advantage of the new service.

Our thesis: US banks should be able to stave off some threats from the booming fintech sector under a new Fed real-time payments system set to go live in July, but FedNow, which only handles transfers of up to $500,000, likely won’t have dramatic effects on fintech industry players’ revenue either. Though it will compete with an existing real-time bank network, FedNow does offer banks the potential to diminish fintechs’ allure.

What’s at stake for banks?

Increased competition with fintechs.

FedNow is a blow for big banks — they spent over $1 billion to create a separate real-time payments system in 2017 — but at the same time FedNow will offer banks the ability to compete with up and coming technologies from the fintech industry. Additionally, the current system, called RTP and run by Clearing House (TCH) member banks, will remain competitive despite FedNow and may have several key advantages. The Fed continues to limit FedNow’s scope to domestic transactions, leaving lucrative cross-border payments to the private sector. Second, a liquidity tool developed by the Fed will let RTP participants settle in real-time every day, around the clock without overdrafts or unduly large joint account balances.

What’s at stake for fintechs?

Tougher competition with banks.

Creating the FedNow service gives the banking industry another tool to compete that fintechs lack, yet also means private-sector offerings will be unable to compete with or build technological layers on top of FedNow. Though only financial institutions with accounts at the Fed will have access to the service, third-party service providers, like Google and Amazon, could conceivably get more access to payments data. And yet while we don’t think the service will have much of an impact on the fintech industry’s overall revenue, the creation of the service could put a damper on attracting new customers when consumers seeking to send funds can do so instantaneously from their bank.

What’s the outlook?

100% chance of implementation.

A March 15 Federal Reserve announcement confirmed the service will go live in July. The US central bank will begin formal certification of participants in early April. This comes after the Fed issued a final rule governing the network that took effect in October. Further enhancements will be rolled out in following years.

What’s the issue?

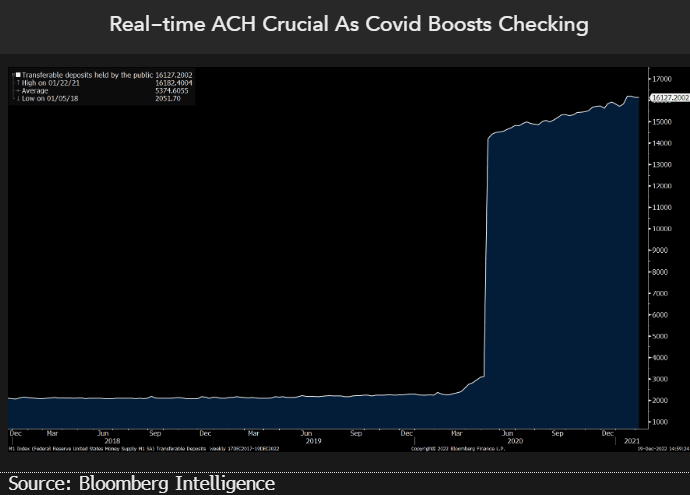

Real-time payments.

Designed to maintain round-the-clock processing and settlement seven days a week, FedNow comes as consumer desire for real-time payments has risen over the past few years. Implementation accelerated under Fed Chair Jerome Powell’s tenure and in 1Q22 the US central bank announced pricing for the service. Originally proposed in 2018, FedNow will allow banks to compete with non-financial institutions offering a faster payment service. Participants will be given a default limit of $100,000, yet would have the option to adjust it up to $500,000.