This analysis is by Bloomberg Intelligence Senior Industry Analyst Ann-Hunter Van Kirk and Bloomberg Intelligence Industry Analyst Diana Rosero-Pena. It appeared first on the Bloomberg Terminal.

As pet population gains combine with higher spending, our analysis points to the global market reaching $500 billion by 2030. Complex pharmaceuticals and longer animal life spans may drive health care to the sharpest growth, while stable gains in food — the largest category — should be sticky. Pricing can help push e-commerce penetration to 30% by 2030.

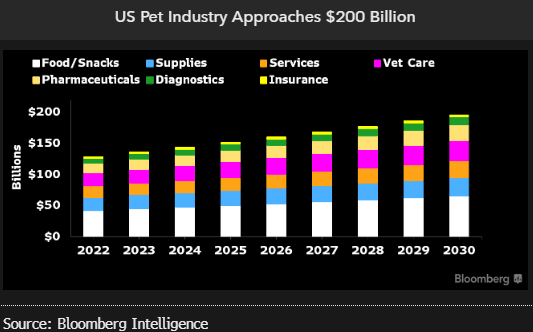

US to lead with 40% of global sales

The US should remain the largest pet market, with sales approaching $200 billion by 2030. Growth will be led by spending on health (including diagnostics, pharmaceuticals and veterinary services) as nutritional advances extend life spans, requiring expensive care for aging companions. We see the US pet population expanding 13% over the period, driven by younger generations. Globally, the industry could swell to almost $500 billion from $320 billion, as the pet population increases and greater devotion to animal companions spurs increasingly premium food and services.

Emerging markets may notch outsize growth, fueled by rising per capita disposable income, more single-person households and an increase in nuclear families in urban areas.

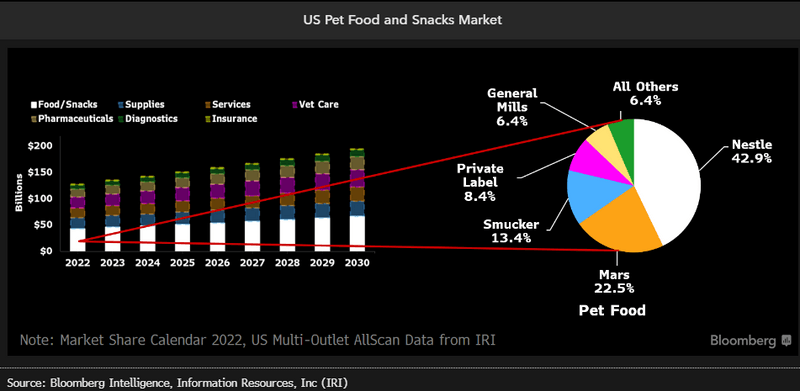

Fresh frozen is poised for rapid food gains

Sales of food, the global pet industry’s biggest category, may increase 52% to top $135 billion by 2030, fueled by trends such as higher prices and owner reluctance to switch companions’ diets. Food will likely remain the largest expense in the US, proving resilient through economic downturns as humans increasingly treat pets as family members and become more willing to spend on them. That could spur healthy sales gains for General Mills, Nestle and Smucker, which make up more than 60% of the market.

Growth for premium fresh frozen, now only 1% of food spending, could outpace other sections as awareness of ingredients and health effects rises. We believe the category may spark competition and M&A activity.

Advanced therapies fuel prescription growth

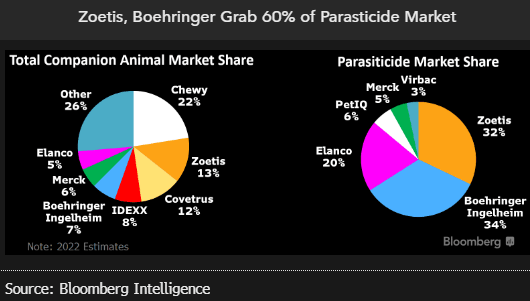

The pet pharmaceutical market could top $25 billion by 2030 from $15 billion today, according to our analysis, boosted by development of complex, expensive therapies like monoclonal antibodies and by a faster, more lucrative path to approval than for human drugs. Treatments for pain, parasites and dermatitis will drive growth, with the roughly $400 million in sales of analgesics possibly doubling by 2030.

The global parasiticide market could expand by more than $700 million as owner compliance with veterinarian recommendations rises 5%. That may spark sales for Zoetis and Boehringer Ingelheim, each of which has a combination flea/tick/worm treatment that has captured more than 30% of the market.

Longer lives to accelerate diagnostics

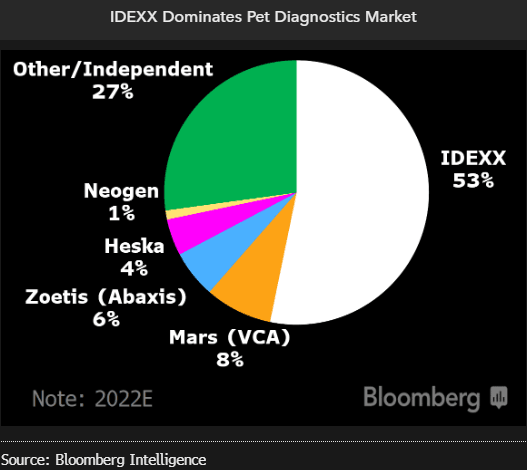

Increased life spans for companion animals due to improved nutrition and health care may accelerate the use of preventive diagnostics for the foreseeable future, which our analysis sees generating more than $30 billion in global sales by 2030. Europe may represent the biggest opportunity, having tapped only 8% of a roughly $12 billion total addressable market. The US also has room for growth, with only 22% penetration. IDEXX Laboratories, which has over half of companion animal diagnostic revenue, could reap the largest sales gains.

In-clinic consumables may be the biggest growth driver, though opportunities to cross-sell and bundle services with reference labs are valuable since veterinary practices use both elements for diagnostics.

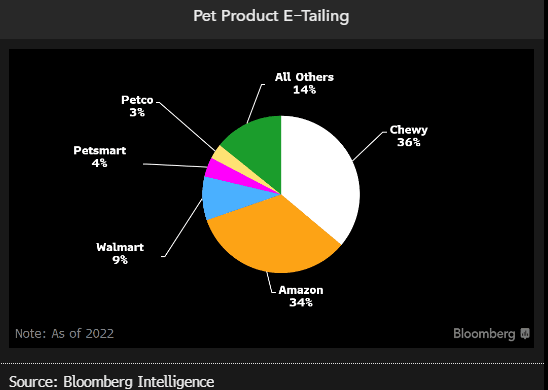

Chewy, Amazon are in line to lead e-commerce

Though brick-and-mortar still captures nearly three-quarters of pet-product spending, e-commerce could expand as digital-native retailers’ use competitive pricing and free shipping to grab a greater share. We calculate that online sales will double to nearly $60 billion by 2030, grabbing about 30% of the market compared with 22% now. E-tailers Chewy and Amazon.com may continue to dominate with over 70%.

Our proprietary survey indicates that mass merchants, like Target and Walmart, are the favored retail channel for pet products, possibly due to the convenience of bundling such purchases with other shopping.