This analysis is by Fixed Income Data Analyst Kristine Lian. It appeared first on the Bloomberg Terminal.

Background

At the end of 2021, the emergence of Evergrande crisis altered the long-standing operation mode of China’s real estate industry. In the following months, one after another, China developers declared defaults due to onerous debt burdens.

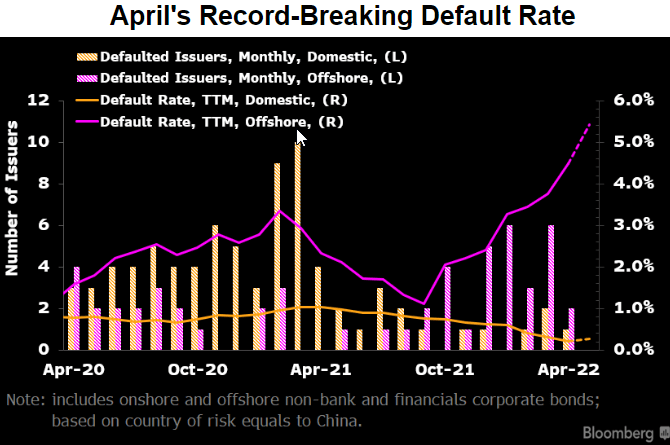

Along with the debt crisis came the shock and distress of the overall China credit market. As of April 2022, about 70% of China’s high-yield real-estate bonds have become uninvestable for funds with strict mandates, and the dollar-bond default rate hit a record-breaking 4.5%.

The issue

With the expectation that the market will progressively recover, China developers are attempting to mitigate the impact of outright defaults through corporate actions such as exchange or consent solicitation.

However, due to restricted liquidity, China developers may seek re-extensions or default even after bond exchanges, as witnessed recently with Zhenro, Yango, and Yuzhou. This could unnerve investors, exposing how debt extension without full restructuring or haircuts may fail to address capital structure and liquidity issues.

Inconsistent liquidity disclosure, particularly on restricted cash such as amount held in escrow, is making it even more difficult for investors to make critical decisions. By April 26, 30% of developers had not presented audited 2021 results. Six had changed auditors, and Evergrande, Fantasia, Sunac, Modern Land, Kaisa, and Sinic’s stock had been suspended from trading for failing to disclose unaudited annual results by the end of March.

Tracking

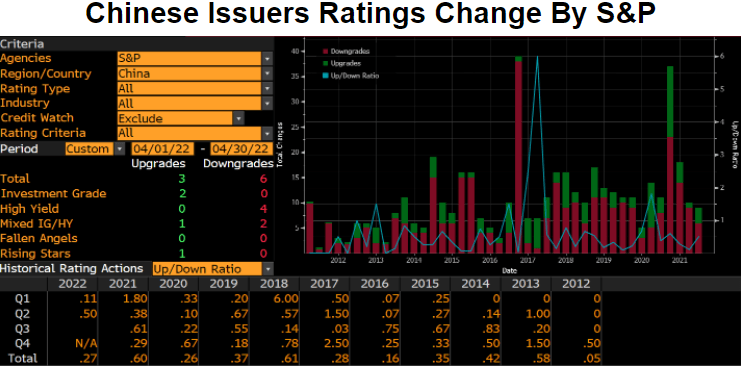

To determine trends for credit-rating agencies upgrading or downgrading borrowers, run RATT<GO> to analyze performance and length of historical ratings-change cycles. Use the drop-down to select China as Region/Country, set Industry to All, and custom the period. According to Bloomberg-compiled data, the number of Chinese firms downgraded by local agencies peaked in June 2021, followed by a surge in downgrades by international agencies since July, peaking in October.

Use TAGG<GO> to see a display of aggregated post-trade volumes for fixed-income securities, to show market direction and liquidity.

Launch full China Market Insights Report under BI BEST <GO> -> Monthly Notes -> Credit

Subscribe to the complete China Market insights to learn more about China credit market and read the full analysis.