Europe’s offices eye same fate as NYC if values drop, rates rise

This analysis is by Bloomberg Intelligence Senior Industry Analyst Susan Munden. It appeared first on the Bloomberg Terminal.

Widespread distress to loans financing major European city offices may ensue if property values sink 20% or more on higher interest rates, with problems already mounting for short-dated maturities and locations with 10%-plus vacancy like London’s City. Loans taken out five years ago or more may not breach covenants or have refinancing challenges yet.

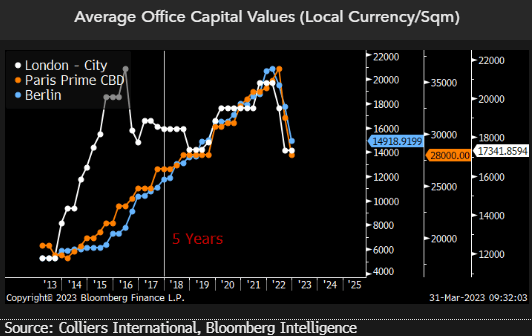

Tumbling office values to 2017 levels trouble expiring loans

Office values in the London, Paris and Berlin’s major business districts have tumbled close to the levels of five years ago since June 2022, and may make the expirations of short-maturity loans harder to refinance. Data from Colliers International show average capital values fell 17% in London’s City district, Paris (23%) and Berlin (28%) in 2H22. These values are reflected in portfolio valuations, with the exception of Paris, where further repricing looks inevitable. Secondary-property values and rents are at greater risk.

Property yields used in 2022 valuations for Gecina’s prime Paris offices expanded by just 20 bps, and 10 bps at Covivio. This suggests further adjustments to come which may require transactional evidence as a trigger. Values outside central Paris, where supply isn’t constrained, fell more sharply.

Stress builds for commercial real estate loans

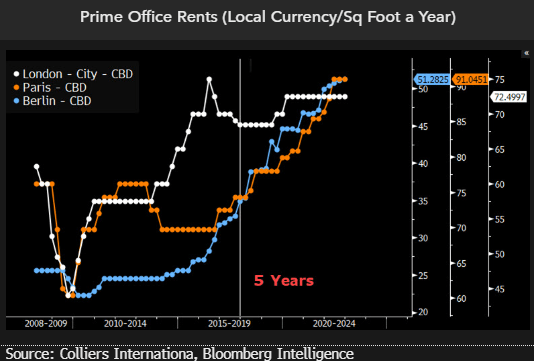

As office values sink below those prevalent five or more years ago, the potential is mounting for debt-refinancing challenges and defaults. If we look back five years to when the loans originated, prime rents increased sharply in several cities, whereas capital values are close to or below end-2017 levels. Covenants are typically at a loan-to-value ratio of 60%, so a lot of debt may still comply if the initial one wasn’t as high as 60%. If values continue to fall, distress is likely to escalate.

The position is less benign for non-prime properties, where vacancy has escalated with remote work becoming mainstream. Tenants may prefer to send employees home rather than renew leases on inflation-adjusted rent. For landlords with well-occupied offices, the extra rent is helping to service higher borrowing costs.

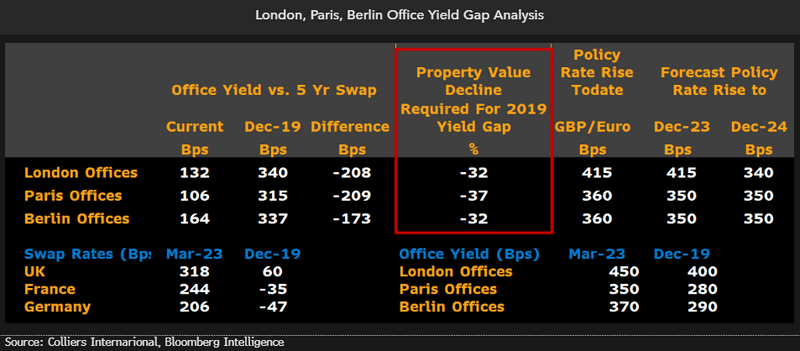

Adjusting risk premiums to norms triggers capital losses

London, Paris and Berlin office yields fail to reflect rising interest rates in full, with risk premiums — the yield gap — narrowing to 106-164 bps despite elevated risks. If yields were to reflect December 2019 levels, we calculate office capital values in those cities could plunge 30-40%. Those falls assume stable rent, but in Berlin and Paris (where rents are inflation-adjusted), tariffs are up between 4-6% in 2023 to moderate a fall. When leases are renewed and rents are marked to market, there’s a possibility rents will fall at which point capital values are more at risk.

London rents aren’t inflation-linked and vacancy is already over 10%, suggesting a tumble may be more immediate. Unrenovated space is particularly at risk, and debt may breach bank covenants for that set of assets.

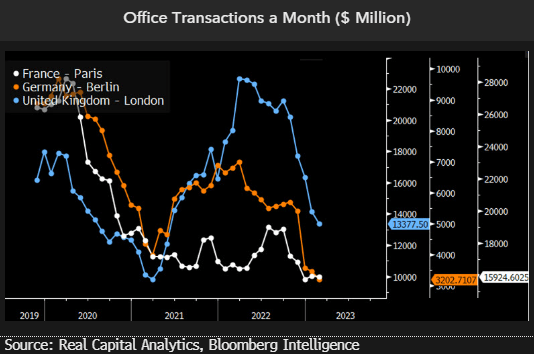

City-office prices in doubt as deals plummet

Office transactions in London, Paris and Berlin have dried up, revisiting pandemic lows, with inflation escalating and the pace and scale of interest-rate hikes in the UK and euro zone unclear. Property values are based on future cash flows with reference to market evidence, as the latter reflects confidence in those available funds and the discount rate. Completing deals tend to be special circumstances, often involving non-domestic buyers, where evidence could be misleading. Landsec’s January sale of a prime London office to Hong Kong developer, Chinachem Group, was priced 4% below the September 2022 value on a 4.8% yield vs. 4.5% for the market in December.

The inability to price may hold back property refinancing, and is reducing liquidity in real estate debt and equity markets where prices are heavily discounted.