ETF approval times shortened, costs slashed under SEC 2019 plan

This analysis is by Bloomberg Intelligence analyst Nathan R. Dean. It appeared first on the Bloomberg Terminal.

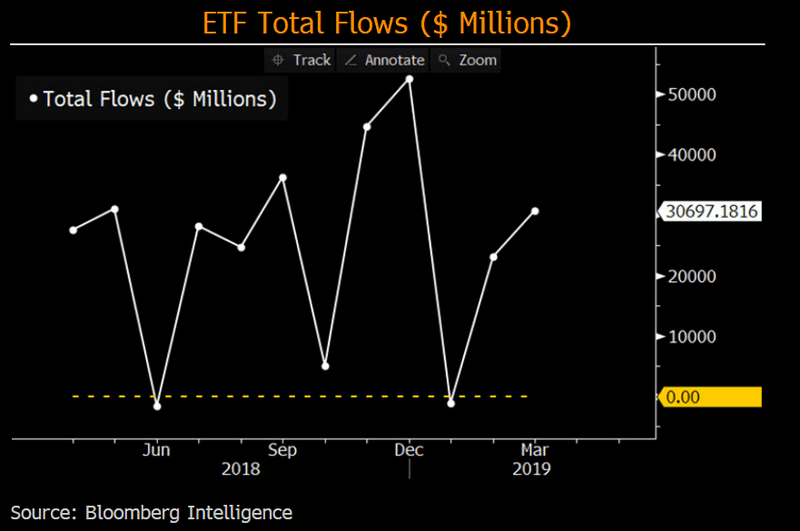

Exchange-traded fund sponsors seeking to launch ETFs would see shorter waiting times, reduced costs and favorable technical changes — such as elimination of a requirement that sponsors update their net-asset value every 15 seconds — under a proposal the SEC will likely finalize in 2H. Exchanges could see a small boost in trading as a result.

What’s at stake for ETF sponsors?

ETF approval times, flexibility.

ETF sponsors seeking to launch new products will likely have a shorter wait for SEC approval under the proposal. Today, approvals take a median of 221 days. The average $100,000 in costs with the approval process should decrease. The rule allows ETFs that are open-end funds and meet certain conditions to come directly to market without obtaining case-by-case relief. ETFs would be permitted to use custom “baskets” of holdings, which would give sponsors some flexibility in structuring the funds.

What’s at stake for exchanges?

Increased trading volumes.

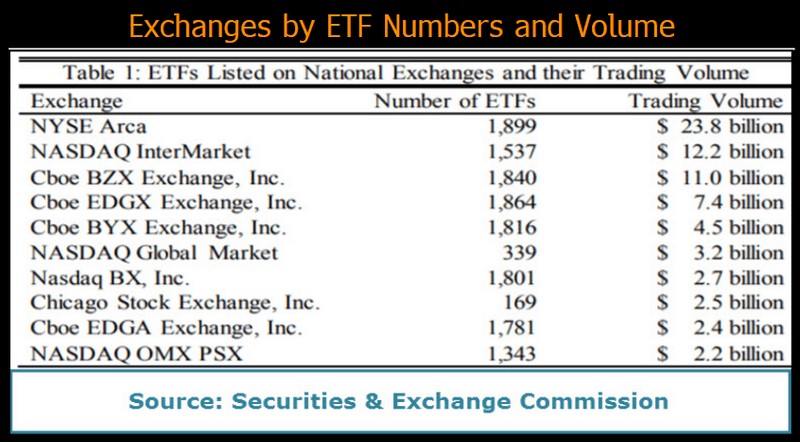

U.S. equity exchanges may get a small boost in trading volumes for exchange-traded funds as more products hit the market. According to SEC data, there were 1,900 registered ETFs, with $3.4 trillion in net assets (with an average of 141 new ETFs and $272.8 billion in growth annually since 2007). These increased volumes could come on NYSE Arca, NASDAQ InterMarket, Cboe BZX Exchange and Cboe EDGZ Exchange, top exchanges with average daily ETF trading volumes.

What’s the outlook?

More competition, innovation.

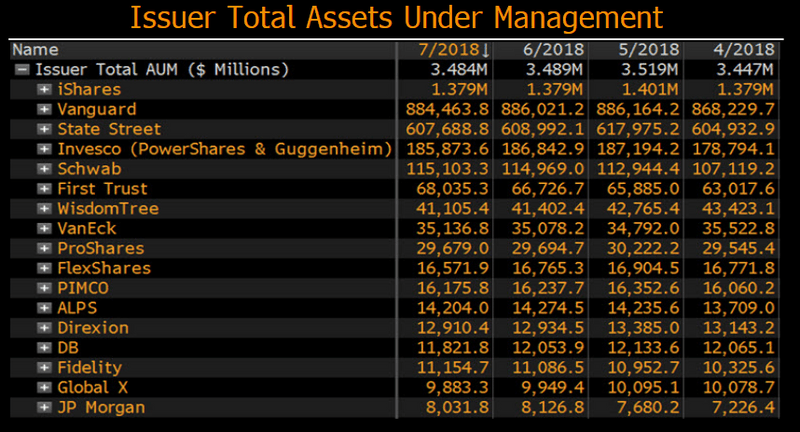

The number of ETFs hitting the market will likely rise if the proposal is finalized, yet few firms voiced concerns about the prospect of stiffer competition in comment letters. Higher competition, especially from smaller entrants, could increase pressure to lower fees. Decreased costs for launching ETFs should boost innovation. The plan scraps several requirements, which also should trim operational costs. The changes won’t have a significant impact on investors’ desire for passive investments.

What’s next?

Finalization.

The SEC will finalize the proposal with minor changes sometime within 3Q-4Q, in our view. The agency’s agenda has finalization earmarked for September, though a few months’ delay is always possible. Comments submitted show the industry is largely in favor of the rule and only had technical suggestions related to custom baskets, disclosures and recordkeeping. Democratic Commissioner Kara Stein’s 2018 departure shouldn’t cause a delay and the remaining Democratic commissioner is likely on board.

What’s the issue?

New ETF approval process.

The proposal changes the process, with an aim to make it less burdensome, where exchanges seeking to list ETFs must seek SEC approval before trading can begin. In 2016, the SEC allowed exchanges to approve on their own ETFs that meet a “generic” definition. But for most new or complex ETFs, usually due to its underlying securities or weighting aspects, the exchanges must submit an individual rule change. The agency can take upward of a year to give its approval, and further delays are common.