Does sustainable investing have a future in the U.S. market? Part 3

This article was written by Chris Hackel, Head of Sustainable Indices at Bloomberg.

In this series, Bloomberg’s Sustainable Indices team takes account of current market sentiment and conditions surrounding sustainable and ESG investing in the U.S. market and explores opportunities for 2023. Catch up on the Introduction, Part 1 covering “Using ESG without using ‘ESG’,” and Part 2 which tackled “Opportunities in the low-carbon economy”.

Today, in the third practical part of this blog series, we take a closer look at sustainable investment opportunities being created by “going long” on new global regulations.

The closest thing to a sure thing?

Earlier this year the Bloomberg Sustainable Indices team met with one of our clients, an asset manager that has had considerable success with climate-focused strategies in the US market.

Given the challenging environment in the U.S. for climate and ESG strategies, this should be seen as no small feat: indeed, while there is wide consensus in Europe around confronting climate change, the topic remains contentious in the U.S. and asset flows to climate funds have remained relatively muted.

The client echoed some of the points made in Part 2 of this series, in particular the opportunities created by the trillions of dollars being invested globally in the energy transition. But they also noted the tailwinds for companies transitioning to low-emissions business models that have come from the passage of new regulations, particularly the Inflation Reduction Act (IRA) of 2022 in the U.S..

As described in The Atlantic, “the IRA’s programs and incentives will keep flowing no matter the macro environment, which makes betting on clean energy one of the most certain economic trends of the next few years. Clean energy is now the safe, smart, government-backed bet for conservative investors.”

Our client called this positioning being “long regulation”: namely, a growth theme that’s driven by government policy.

Stepping up as a climate leader

As a country with an on-again off-again commitment to the Paris Agreement – exiting in 2020 only to rejoin a year later – the U.S. has now clearly signaled its intention to become a climate and low-carbon world leader with the IRA.

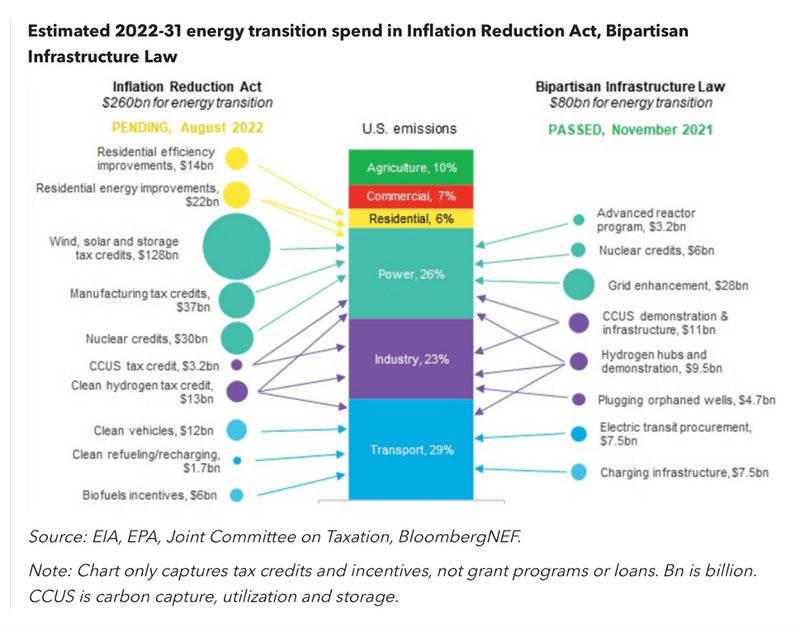

According to BloombergNEF, the IRA is by far the largest public sector commitment to decarbonization the U.S. has ever made, including almost $400 billion in spending and incentives for clean energy generation and storage and greenhouse gas reductions across the transportation, construction, and industrial sectors.

Those government-backed tax credits, grants, loans and subsidies are hoped to catalyze substantial private sector investment in clean energy, potentially up to $1.7 trillion, according to Credit Suisse.

And, so far, it’s working. In just the eight months since the federal clean energy incentives were passed in August 2022, over $150 billion has been invested in large clean energy projects, surpassing the total US clean energy investment between 2017 to 2021, according to a recent American Clean Power Association report.

Some of the indices with exposure to this environment include the Bloomberg Goldman Sachs Clean Energy Index, the Bloomberg BioEnergy Index, and the Bloomberg Hydrogen Index. And upstream of the companies in these indices are commodities such as lithium and cobalt that are essential to the electrification of transport and industry. These are captured in the Bloomberg Electrification Metals Index.

Further, emissions limits recently proposed by the EPA would force carmakers to make 67 percent of their American models electric by 2032. The state of California has already put in place a ban on sales of gas cars by 2035. With 30 percent of vehicle sales globally expected to be electric by 2025, electric vehicles will represent a $9 trillion market opportunity by 2030 according to the BloombergNEF Electric Vehicle Outlook. The Bloomberg Electric Vehicle index tracks this fast-growing market.

Proceed with caution

Our focus here has been the investment opportunities being created by regulation intended to accelerate the transformation of the global energy supply to one that is renewable, sustainable, and clean.

While fossil fuels will continue to play a significant role in the energy supply in the near term, it’s important to be aware that as the world approaches net-zero, the timely investment in the transition to low-carbon business models is an important competitive consideration, before the market (or future regulation) makes them less competitive.

Therefore, for broad market investors, it’s sensible to consider approaches that reduce allocations to high emission companies, especially those without well-defined transition plans, while increasing allocations to companies at the forefront of the energy transition. Bloomberg offers a variety of low carbon and climate transition indices that do just that.

Further, not all clean energy and low emissions companies are created equal. Although ESG scores have become a political target in recent years in the US, the scores can capture transition, regulatory, reputational, and other risks that these companies face that could lead to underperformance versus their peers. For that reason, Bloomberg also offers versions of its Clean Energy, Hydrogen, and other indices that account for these risk factors.

While regulation and the resulting shift in capital flows are making the energy transition look inevitable, investors will have diverse opinions about the future risks and opportunities. These views can be captured in thematic or broad market indices to measure a market or strategy, or be turned into investment vehicles.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.