Diversity in the U.K. asset management industry

This analysis is by Bloomberg Intelligence Senior Government Analyst Sarah Jane Mahmud. It appeared first on the Bloomberg Terminal.

Asset managers in the U.K. likely need to accelerate diversity efforts, in our view, with slow progress made so far. Laggards are at risk of investment-consultant downgrades and could lose out on generating strong returns using teams that are better representative of societal demographics. As gender-pay-gap reporting deadlines are extended, focus is shifting to ethnicity, LGBTQ+, and social diversity.

Pay gap reflects dearth of women in senior roles

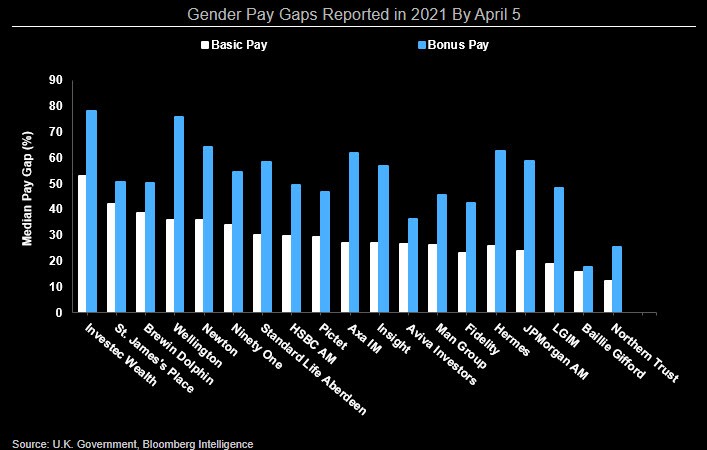

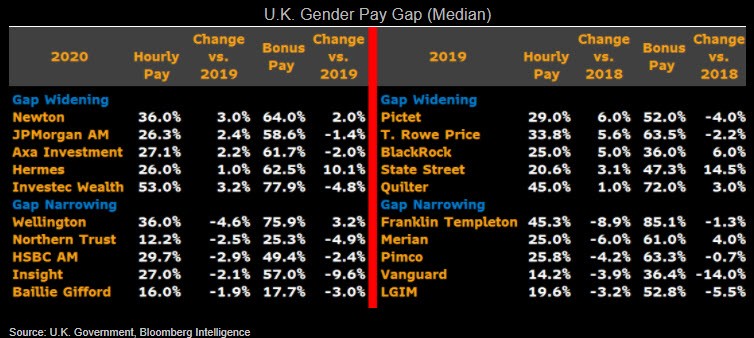

With a 29.4% gender pay gap, investment companies face rising demand to increase the number of women in senior, higher-paid roles. Wealth managers and U.S. asset managers in London may feel the greatest pressure, we believe. Targeted initiatives to strengthen the talent pipeline may proliferate, with good examples being Standard Life Aberdeen’s enhanced parental-leave policy and Janus Henderson’s global-mentor plan. The cross-industry average is 14.3%.

Progress still slow as managers build talent

Only slight progress has been made to narrow the asset management industry’s gender pay gap, with the difference in base pay only improving by half a percentage point year-over-year, based on our study of 19 asset managers thus far reporting in 2021. The base-salary gap is widening at several firms and last year’s worst offenders have yet to report. This trend could continue as companies increase the number of women in junior positions to build talent from the bottom up — the most rational way of closing the gender pay gap over the long term, in our view.

The gender pay gap reporting requirement has been extended six months to Oct. 5 due to Covid-19 disruption. Of 33 asset managers in our study, 19 reported early by the initial April 5 deadline.

More Black voices needed in asset management

As less than 1% of asset managers are Black, despite this ethnic group making up 13% of London’s population, the investment-management industry faces growing pressure to diversify and develop a pipeline of Black leaders. Ethnic pay-gap reporting could kick in from 2023, which would help build such a pipeline, as we believe the government may revisit its 2018 consultation in light of the Black Lives Matter movement.

About 200 investment companies, including Rathbone, Janus Henderson and Citadel, have signed up to the 100BlackInterns initiative, committing to hire at least 100 black interns a year. Meanwhile, few asset managers have disclosed specific goals. M&G is seeking to achieve 20% ethnicity in senior leadership by 2025, whereas St. James’s Place is targeting 10% by 2023.

Asset managers lagging with LGBTQ+ inclusion

As the LGBTQ+ investment space expands in the U.K., asset managers may face more pressure to foster a more inclusive workplace. While many have have instituted LGBTQ+ and allied networks, including LGIM, M&G, Schroders, Standard Life Aberdeen and Jupiter, trade group LGBT Great suggests there’s some way to go, with 62% of survey respondents saying they felt that they had no visible ally in the office. Moreover, no asset manager features in lobby group Stonewall’s list of top 100 employers for 2020 — though many banks including U.K. branches of Citigroup, Credit Suisse and Bank of America do.

T. Rowe Price is the only asset manager in the U.S. LGBTQ100 ESG Index, the first index benchmarking the top gay- and trans-friendly U.S.-listed companies. The index has outperformed the S&P 500 by 3.7% since its 3Q19 launch.

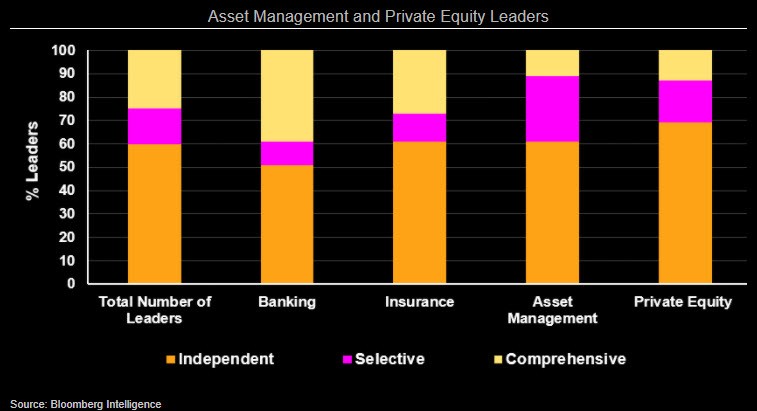

Social diversity still a sticking point

Within financial services, asset managers and private equity companies appear the least socially diverse, with 11% and 15% of new leaders and 39% and 25% of new recruits educated at comprehensive schools, according to Sutton Trust data. Moreover, a class pay gap prevails in the industry, with those from privileged backgrounds earning over 17,000 pounds a year more than peers from lower social classes, Investment Association research shows. Despite this, M&G is better positioned than its counterparts, we believe, having earned a place in the Social Mobility Index for four straight years since its 2017 launch.

Schroders is the only other asset manager in the 2020 index, with Standard Life Aberdeen dropping off the list despite being featured the three years prior. By contrast, four banks were included and ranked higher.