This analysis is by Bloomberg Intelligence Analysts Poonam Goyal, Jennifer Bartashus, Charles Allen, Drew Reading, Kevin Tynan, Anurag Rana and Abigail Gilmartin. It appeared first on the Bloomberg Terminal.

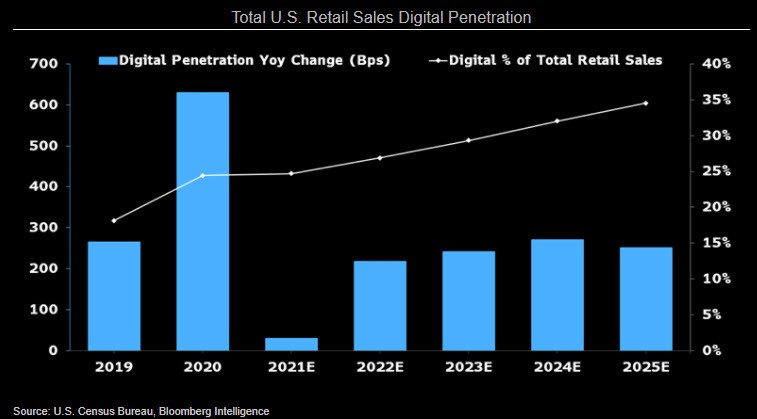

New sales channels such as social, voice and video commerce could compound the push provided by Covid-19 lockdowns, resulting in U.S. digital sales reaching 35% of total retail revenue by 2025 vs. 24% in 2020, based on our scenario analysis. The pandemic pushed forward digital adoption by about three years, and we expect more growth to come from a mix of both digital natives such as Amazon.com and brick giants like Walmart. These two groups could add another $1.15 trillion to online sales, with digital natives drawing more than 70% of the gains.

Virtual and augmented reality, e-wallets and cloud-based software that allows smaller merchants to create digital stores may also drive faster digital adoption. Home Depot, Nike, Kroger and Best Buy are among bricks well positioned to seize the opportunity.

Bottoms-up analysis shows tech to drive 14% CAGR in online sales

Our analysis that U.S. e-commerce sales may rise at a 14% CAGR from 2020-25 is based on new digital-shopping channels and a shift to more online activity. To better understand the potential for e-commerce in the U.S. we took a bottoms-up approach, analyzing the digital potential in each of the 11 retail trade industries reported by the U.S. Census Bureau.

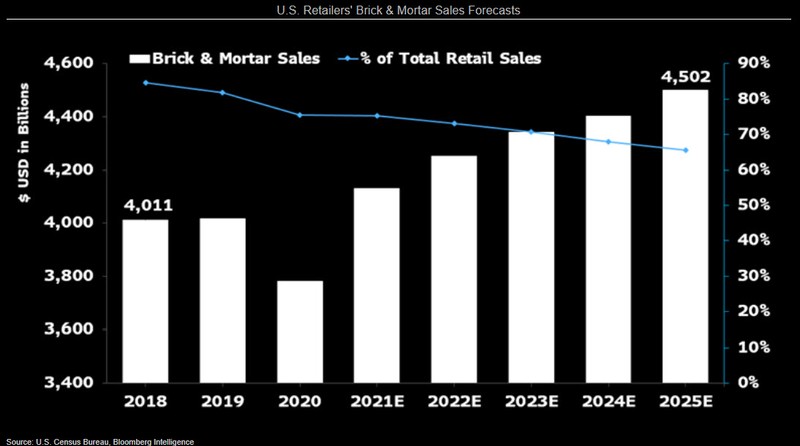

Digital gains to accelerate in 2022 after moderating in 2021

Digital is set to garner a larger share of U.S. retail sales, with our e-commerce scenario analysis projecting online to represent 35% of the total by 2025. This is on the heels of the pandemic having accelerated digital penetration to 24% in 2020, from 18% in 2019 and 15% in 2018. Tough year-ago comparisons and the potential shift of discretionary spending to restaurants and travel from physical goods curb our view of 2021. As such, we’re estimating only a less-than 100-bp increase in digital adoption this year.

Digital gains should pick up the pace in 2022, with penetration growing 200-300 bps each year through 2025, driven by new digitally native entrants, social commerce and emerging technologies such as augmented reality and voice-based shopping.

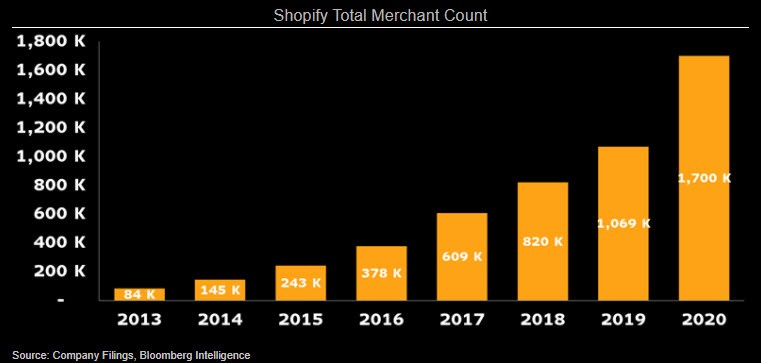

Low-cost software reducing barriers to entry

Inexpensive cloud-software products such as those sold by Shopify and BigCommerce enable smaller merchants to go digital with little to no up-front capital, giving them bundled enterprise-level functionalities. For example, Shopify’s platform provides full back-end capabilities in its out-of-the-box software product such as order management, shipping, payments, fulfillment and capital advances. This has reduced the barriers to entry for smaller merchants and is another key catalyst for the shift to digital commerce.

In 2020, Shopify’s total merchant count rose almost 60% to 1.7 million. The growth is primarily driven by enabling new entrants to launch digital stores within hours.

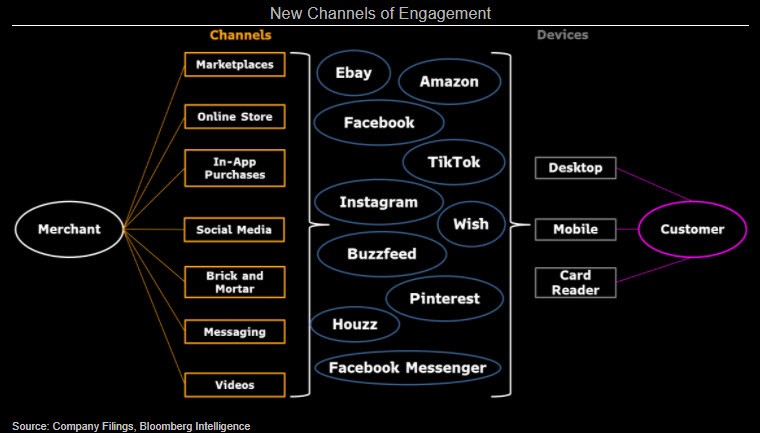

Rapid expansion in new sales channels to drive growth

Another key accelerator of digital commerce is the swift expansion of new sales channels such as social, marketplaces, in-app purchases, videos and voice in addition to mobile and online. Among these, social commerce on platforms such as Instagram and Pinterest is emerging as one of the biggest growth opportunities for both retailers to engage shoppers and drive better returns on investment. Video commerce is also a fast-emerging category, a key reason why Walmart has been keen on partnering and investing in TikTok.

Shoppable-image posts have helped retailers win new customers, and the rising popularity of video commerce may be the next big accelerator for digital, as video content increases conversion by 86%. Social commerce may more than double to $62 billion in 2024 from $27 billion in 2020, eMarketer forecasts.

Shrinking U.S. store footprint to further boost digital commerce

An accelerated pace of store closings and bankruptcies amid heightened digital disruption will keep transforming the U.S. retail-store landscape in coming years, with brick and mortar expected to drop to 65% of sales by 2025, vs. 76% in 2020. Many retailers can still reduce their physical footprint by as much as 50%, with the exception of mass merchants, grocers and off-price, where the value of shopping in a store still prevails.

Secular weakness has forced L Brands and Gap to reduce their store fleet, while Century 21, Stein Mart, Tailored Brands, True Religion, Lord & Taylor, Ascena Retail, Lucky Brand, J.C. Penney, Brooks Brothers, Francesca’s, J Crew, Neiman Marcus, Pier 1, Modell’s Sporting Goods, Papyrus and GNC have filed for bankruptcy.