This analysis is by Bloomberg Intelligence Senior Industry Analyst Julie Chariell. It appeared first on the Bloomberg Terminal.

Digital payments investing has legs even after a strong performance since 2H20. Concerns about a 2022 growth slowdown will give way to consolidation, as the play by tech and fintech companies to add services and become financial super apps is crowded, and consumers make their choice. A short list of winners can emerge to enjoy outsized growth, and we suspect it to include PayPal and Block (formerly Square).

Digital-wallet adoption and monetization will rise as fintechs advance new, non-cash payment and underwriting methods such as QR codes, buy now, pay later and crypto, with seamless availability online and in-store as retail goes omnichannel. Traditional providers including Visa, Mastercard and Fiserv have invested to not be left behind, and these back-end scale players can remain critical as the front end consolidates.

Card empires to strike back with embedded buy now pay later

Growth in buy now, pay later (BNPL) could accelerate to 46% annually through 2024, but less may accrue to pure-plays Affirm, AfterPay and Klarna as traditional card issuers and processors add BNPL functionality to cards at the point of sale in 2022. This holds some advantages for consumers and merchants, and defends cards’ dominance.

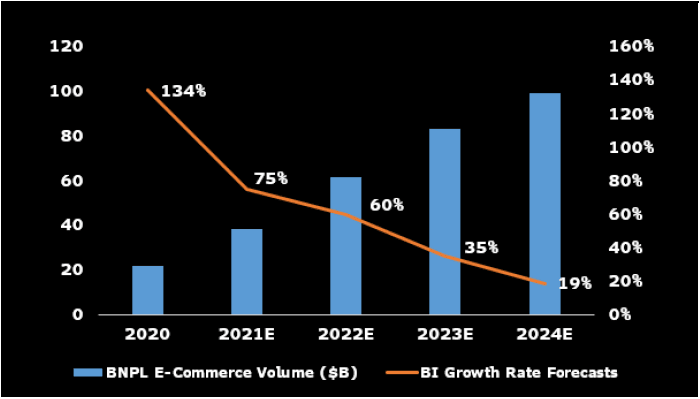

Buy now, pay later volume may rise 46% yearly to 2024

Given an influx of new providers, including PayPal and card issuers retrofitting accounts to pay under BNPL plans, our expectations for the sector’s annual growth have risen to 46%. This is up from 40% at the start of the year, based on 35% user growth, higher average spending per user and 30% share from providers other than Affirm, AfterPay and Klarna by 2024. Our calculations are higher than Worldpay’s volume and eMarketer’s user growth forecasts. The $22 billion market may reach 6% of U.S. online sales by 2024, or $99 billion, we believe, above Worldpay’s 4.5% estimate.

Drivers of BNPL remain strong, including easier budgeting and lower or no interest for consumers, plus 30% better cart conversion and millennial/generation Z access for merchants, while app adoption brings loyalty and marketing benefits to both.

BNPL forecast

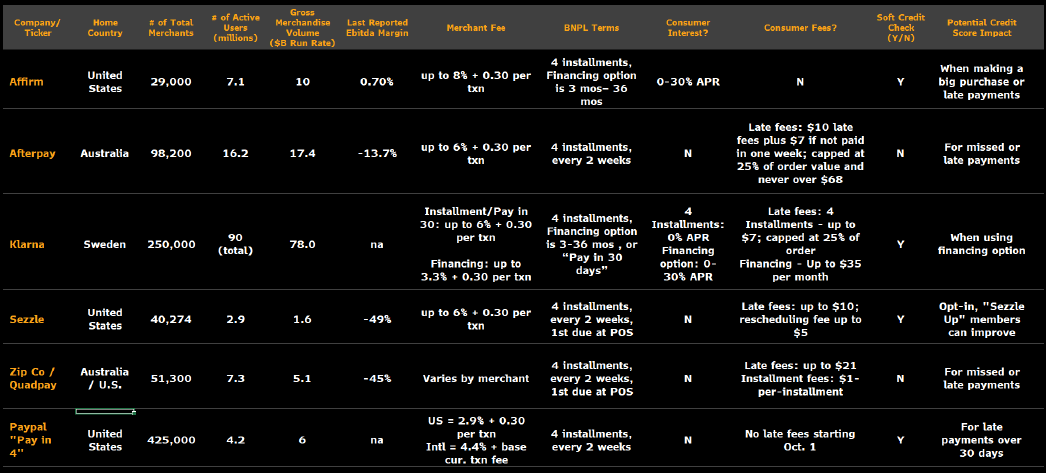

BNPL leaders’ offers drive growth, and cost

A handful of BNPL pure-play providers has dominated the land grab for merchants and consumers. While zero interest and no fees are headline attractions, the reality for many new, lower-credit-score borrowers and big-ticket or longer-term purchases, is some interest or fee. The appeal, nonetheless, is that buyers see their fixed monthly payments at the point of sale, for built-in budgeting with no surprises and revolving interest. Because BNPL has improved cart conversion by 30%, merchants have accepted higher discount rates.

The BNPL market is led by companies shown in our table. Revenue for the four public pure-plays has grown almost 80% year-to-date, but profit isn’t sustained as they continue to invest in their risk models, marketing, merchant integration and apps for shopping discounts and rewards.

Leading buy now, pay later providers

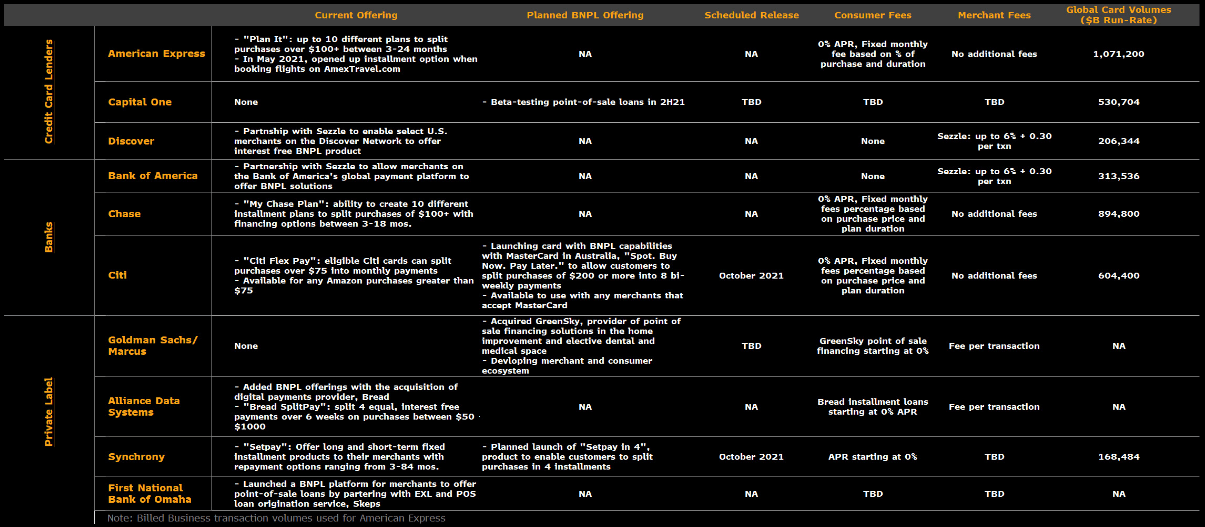

Card issuers aim to take back installment lending

BNPL has likely taken some share from credit cards, but the card ecosystem is going on offense. Several card issuers now allow holders to retroactively split purchases into installments, but often charge fees and miss the appeal of monthly payment previews for point-of-sale (POS) decisions. Goldman Sachs bought GreenSky for POS installment loans, while Capital One is in testing and Apple added BNPL in-store. Visa and Mastercard now help bank card issuers integrate BNPL, and Affirm is launching a Visa debit card.

With BNPL built into a card, there’s no extra merchant setup. Consumers won’t need to link to a BNPL firm for approval and setup, and can access BNPL anywhere cards are accepted. Still, new credit from a BNPL pure-play may appeal to those without a credit card (half of millennials) and those with lower credit scores.

Card issuer BNPL plans

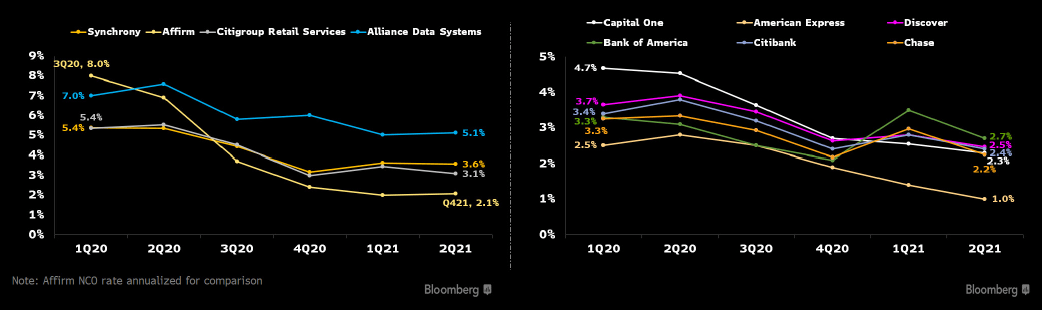

Minuscule net charge-offs are heading higher

BNPLs’ low credit-risk profile is likely headed for more dangerous territory as consumers are no longer buoyed by government stimulus and unemployment remains above pre-pandemic levels. For example, Affirm’s net charge-off rates plummeted to 2% in 2Q21 from 8% in 1Q20 , mostly since management tightened credit standards in response to the pandemic. Other consumer lenders saw similar declines in charge-offs, which remain near record lows. Another contributor of the dramatic decline may be greater funding capacity since 3Q20, when Affirm formed securitization trusts, allowing it to quickly scale its loan portfolio in a low-credit-risk environment.

Management expects delinquencies to rise as it eases credit standards. Net charge-off rates could eventually resemble those of pre-pandemic private-label cards, in the 5% range.

Affirm vs. peer net charge-off rates