Demand recovery, slower 2022 fleet growth aid LNG shipping view

This analysis is by Bloomberg Intelligence Industry Analyst Talon Custer. It appeared first on the Bloomberg Terminal.

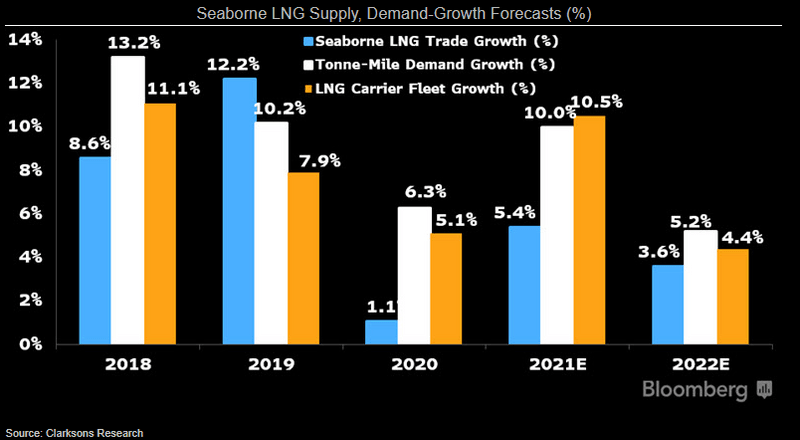

Robust demand that’s mitigating the pressure of a heavy vessel-delivery schedule this year and a slowdown in fleet growth expected in 2022 give us a more positive view of the liquefied natural gas shipping market. The rapid rise in one-year charter rates shows an improved outlook. Demand may outpace fleet growth in 2022, supporting rates, but a modestly oversupplied market adds risk.

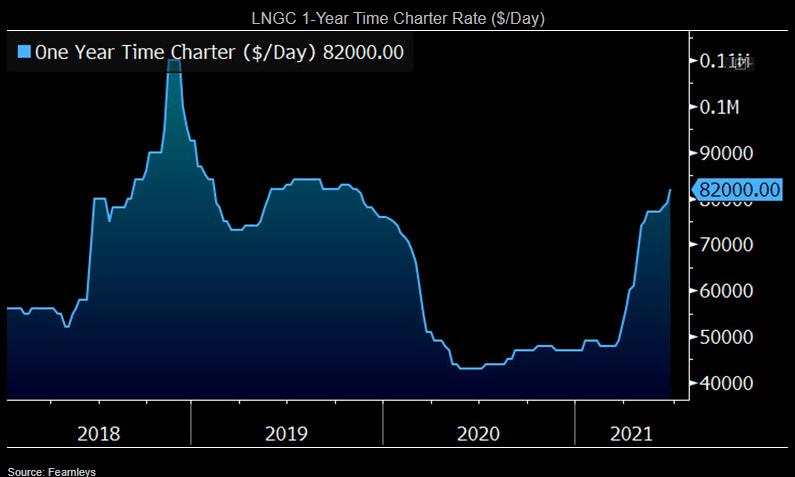

One-year rate signals optimism into next year

The benchmark one-year charter rate for LNG carriers jumped 74% to $82,000 a day since the start of 2021, according to Fearnleys, which is the highest since November 2019 and indicates an improved outlook continuing into next year. Golar and Flex, which have traditionally had higher spot exposure, have capitalized on price increases and signed more one-year and multiyear agreements with some floating-rate charters. Golar has 90% charter coverage in 2Q-4Q, while Flex has 88% over the same period. GasLog Partners has also increased chartering, with coverage likely increasing to about 85% from 75%.

Teekay and Dynagas have historically been more conservative, and are 100% and 98% booked, respectively, through the rest of 2021. Charter coverage provides revenue visibility, boosts utilization and mitigates earnings volatility.

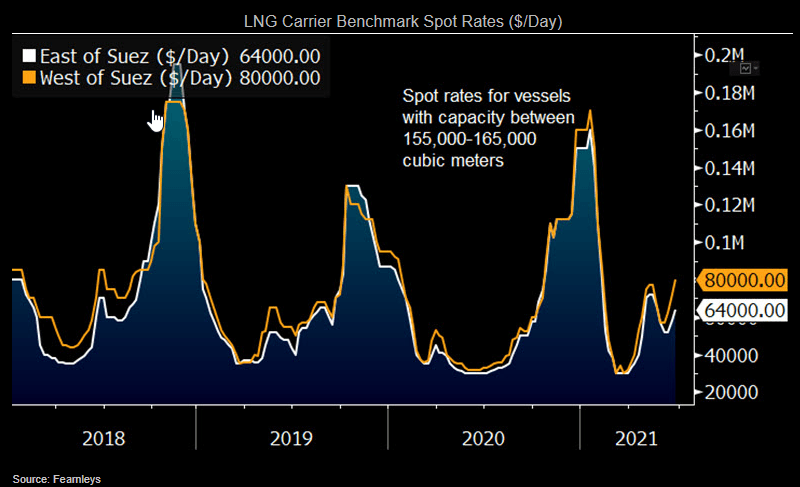

Spot rates may slip in 3Q before reaccelerating

Average rates west of the Suez Canal are 49% above 2020, based on Fearnleys data, driven by a cold winter, demand to rebuild gas stockpiles, recovery from Covid-19 and strong U.S.-Asia long-haul volume offsetting fleet growth.

U.S. cargo cancellations unlikely

U.S. LNG exports may increase by 20 million tons, or 42%, from last year based on our analysis, supporting demand for LNG carrier operators. After about 175-200 U.S. cargoes were canceled last summer, a repeat is highly unlikely this year amid the need to replenish global gas inventories. Forward natural gas and LNG prices indicate wide spreads and signal that U.S. LNG exports to Asia and Europe could be profitable all year. We expect U.S. cargoes to increasingly go to Europe in 3Q.

A shift in U.S. cargoes heading to Europe vs. Asia means vessels are tied up for shorter periods, loosening supply. However, demand will remain buoyed and could provide a floor for shipping rates. Cheniere signed charter agreements with Flex for 4-5 vessels and GasLog Partners for one, aiming to secure capacity in a tightening LNG market.

Fleet growth decelerates next year

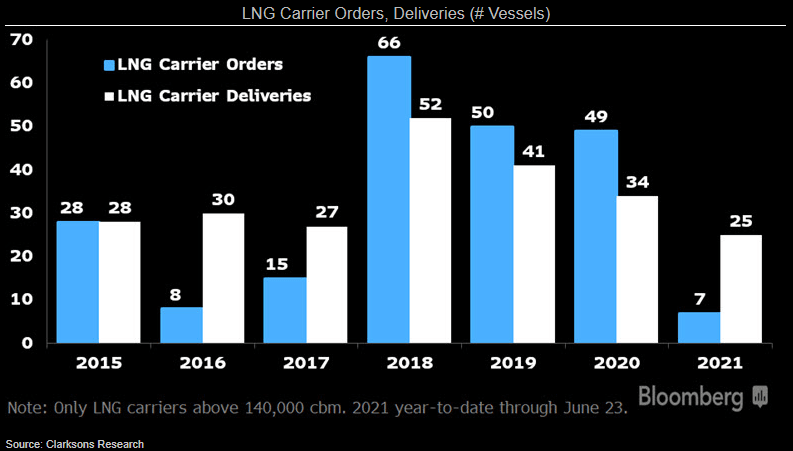

Delivery of another 30 LNG carriers is still expected this year, according to Clarksons, meaning excessive fleet expansion will likely outpace demand. Fleet growth may significantly slow to about 4.4% in 2022, increasing optimism that it will be outstripped by demand including the impact of tonne-miles. Better fundamentals should support pricing and are a likely driver of the surge in one-year charter rates. Clarksons’ LNG trade forecast may prove conservative next year, in our view, assuming a normal weather scenario and inventory drawdowns.

Cold winter weather and a sustained LNG demand recovery from the pandemic are key given the fleet expansion. We calculate about 45% of U.S. LNG exports delivered so far this year have gone to Asia, but more will likely head to Europe in 3Q.

Heavy delivery schedule means modest glut

QP made reservations with multiple shipyards for over 100 LNG carriers through 2027, aimed at matching demand for forthcoming liquefaction projects and to replace aging ships. It issued a tender offer to other LNG shipowners to participate.