Covid curbs threaten Hong Kong as hub

This analysis is by Bloomberg Intelligence Senior Industry Analyst Francis Chan. It appeared first on the Bloomberg Terminal.

Will anyone come? Hong Kong covid curbs threaten financial hub

Global bank executives’ cool response to Hong Kong’s planned November financial summit speaks to Covid curbs’ threat to the city’s hub status. Economic recovery is distant, partly due to the continuing restrictions. Fewer financial workers are choosing Hong Kong while elsewhere in Asia offers better returns for financial institutions led by HSBC.

Hong Kong lags other hubs as global bankers stay away

Hong Kong’s reduction of international arrivals’ hotel quarantine to three nights from seven is insufficient for global business travelers. Many top international bank executives indicated they will skip a HKMA-organized financial summit in the city in early November if they have to quarantine. Other financial hubs New York, London, Singapore and Tokyo have scrapped quarantine requirements for fully vaccinated travelers from most developed regions, leaving Hong Kong isolated. Beijing’s determination to exclude Covid-19 cases may prevent the special administrative region removing all restrictions.

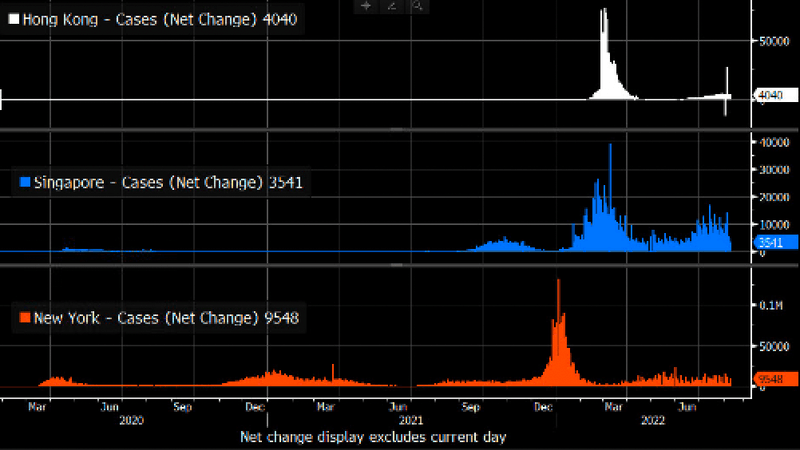

Hong Kong’s daily Covid cases have been stable at about 4,000, vs. Singapore’s 3,500, London’s 7,000, New York’s 10,000 and Tokyo’s 18,000.

2022 economic outlook still bearish for Hong Kong

Hong Kong’s 2H economic outlook may stay dire as Covid restrictions including for inbound travelers may remain through year-end. Prospects for financial institutions in the city, led by HSBC, could be muted as economic recovery looks distant. Five of 12 economists surveyed by Bloomberg in early August forecast a GDP decline for 2022, with Daiwa Securities the most bearish at -1.7%. Bloomberg Economics expects a 0.6% contraction. Quarantine for arrivals limits the city’s cross-border business activities, hurting consumption, capital investments and exports. Private consumption failed to grow in 2Q while fixed capital investments fell 3%. Hong Kong’s exports declined 8.6% due to China’s Covid lockdowns in April and May.

Lack of inbound travelers threaten Hong Kong as hub

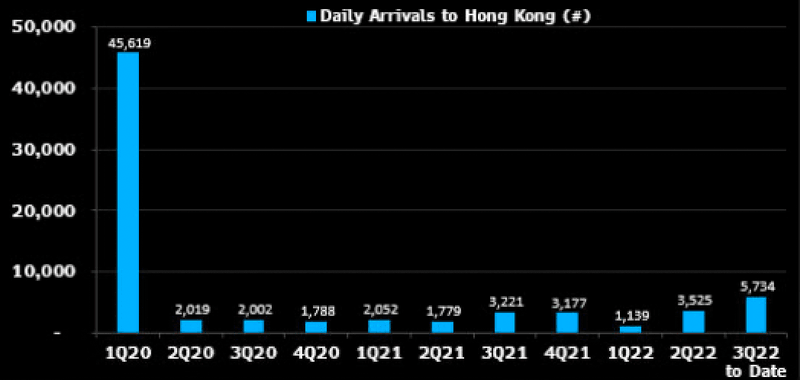

No sign of a recovery in international arrivals is one of Hong Kong’s main threats as a financial hub, especially when rival cities have mostly opened their borders. Business travelers led by financial workers can attend conventions and meetings easily in Singapore compared with Hong Kong and more global banks and multinational firms may move their regional headquarters accordingly. Restrictions on foreign arrivals may continue to diminish business flows of financial institutions in Hong Kong.

Daily arrivals in the city rebounded to an average 5,734 this quarter to date. This is still a tiny fraction of the 45,619 per day in 1Q20, when Covid-19 had just started to spread widely.

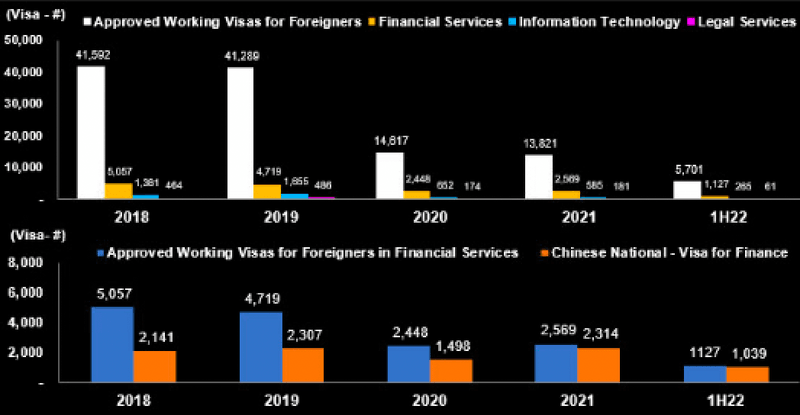

Fewer foreign financial professionals

Hong Kong’s attractiveness to foreign financial professionals has evaporated since the 2019 unrest and enactment of a national security law in 2020. Strict Covid curbs are another reason people are turning their back on the city. Approval of working visas for non-citizens plunged to 13,821 in 2021 from 41,289 in 2019, according to immigration department data, and was just 5,701 in 1H. Visas for those working in financial services dropped to 2,569 last year from 4,719 in 2019, and 1,127 in 1H. Meanwhile mainland Chinese citizens jumped to 92% of the visas approved in 1H, from half in 2019. Chinese financial firms expanding as some global banks retreat may also explain why fewer non-Chinese nationals arrived.

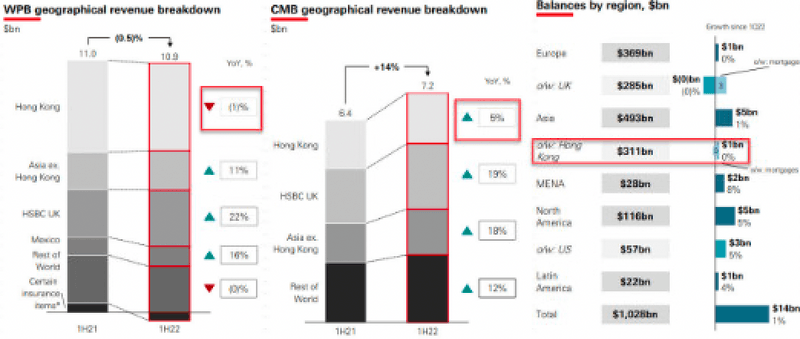

HSBC, StanChart results suggest weakening Hong Kong role

Hong Kong could global banks weakest Asian link as they pursue higher returns, HSBC and Standard Chartered’s 1H results suggest. More easing of Covid curbs could relieve some pressure on their business in the city, but loan demand and fee growth could stay soft in 2H and early 2023, while expectations of margin boosts to revenue have slipped. HSBC’s wealth and personal banking revenue declined in 1H and commercial banking revenue grew slower pace than the rest of Asia. Hong Kong failed to contribute much to recent group loan growth. StanChart’s business prospects in the city also trailed Singapore, India, Korea and mainland China, with a 5.8% drop in 1H revenue.