Companies may soon long for IRS Commissioner Rettig

This analysis is by Bloomberg Intelligence Government Analyst Andrew Silverman. It appeared first on the Bloomberg Terminal.

IRS Commissioner Charles Rettig retires in November, and the agency could be led by a series of acting leaders, leaving the agency in flux and extending its enforcement concerns. Time is running out for a commissioner to be confirmed, leaving the IRS with little choice other than to rely on help from Palantir.

Acting IRS Commissioners Could Be Hard on Crypto

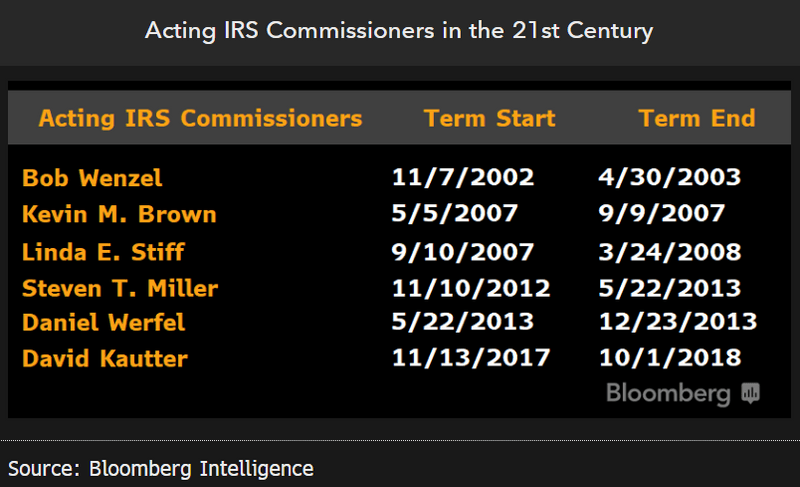

If an acting commissioner replaces Rettig — because confirmation is time-consuming and combative — we think it’s likely that initiatives in place when Rettig leaves, including a dogged pursuit of cryptocurrency, could stay and new ones won’t be pursued. The IRS is a top-down managed agency and acting commissioners maintain the status quo. That’s due to the Federal Vacancies Reform Act, which bars acting commissioners from confirmation — they’re lame ducks. Most acting commissioners aren’t in the position long enough to implement an agenda.

Crypto exchanges like Coinbase and Kraken have been issued tax summonses from the IRS in the past several years. Polychain Capital and Pantera Capital, the biggest crypto hedge funds, could keep feeling pressure from the tax agency at least until a new commissioner is confirmed.

IRS Can’t Meet Tax Challenges With Shrinking Staff

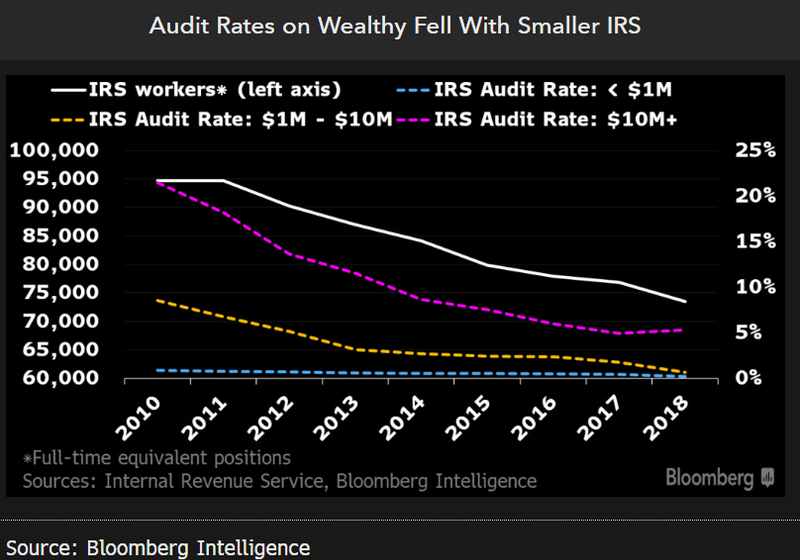

Though the IRS got $80 billion in the Inflation Reduction Act, the agency’s longstanding funding and staffing shortfalls could linger and its tax-enforcement remain undermined. From 2010-18, the IRS’ budget and workforce fell 20%, despite an 8% rise in US tax-return volume. A smaller workforce has led to reduced tax enforcement, especially on the wealthiest, whose audit rates fell 75% in that period. The IRS expects to lose 52,000 of its historically low 79,000 employees over the next six years to retirement and attrition. Full employment is typically above 100,000. Under an acting commissioner, IRS hiring doesn’t expand quickly.

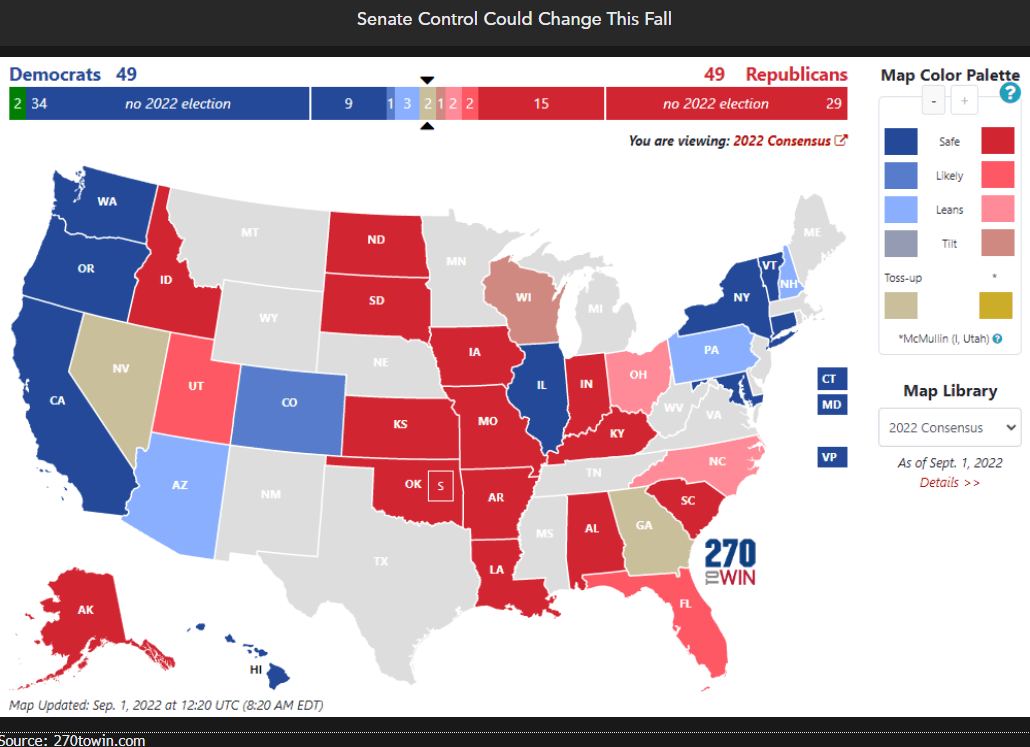

Congressional Republicans have vowed to withdraw the IRS’ increased budget if they take back control of Congress.

Palantir, Others May Benefit From Leadership Gap

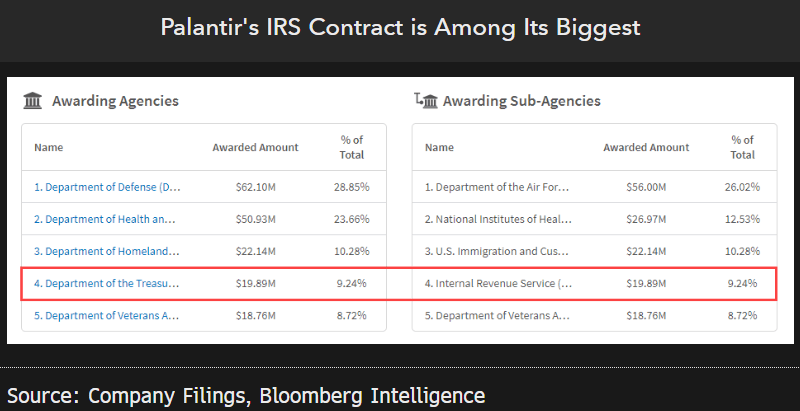

The IRS may need to spend more on tools like alternative intelligence tax-enforcement software to fill in for employment shortfalls. Rettig made investment in artificial intelligence a cornerstone of his tenure. Given the employment challenges facing his successor and little certainty that a larger budget can be relied upon, an acting commissioner might need lean more heavily on AI during their tenure. In 2018, the IRS entered into a seven-year, $99 million contract with Palantir. The IRS says it’s also contracted to use software offered by Chainalysis and Coinbase. If an acting commissioner is in charge of the IRS when these contracts expire, we think they’ll be expanded.

More AI may be a better solution. IRS employees’ error rate resulting from transcribing individuals’ tax returns in 2021 was 22%.

Companies Could Get Uncertainty With Acting IRS Head

An IRS led by an acting commissioner is seen as less dependable, creating business uncertainty, than one headed by a commissioner confirmed by the Senate. An acting commissioner’s legitimacy inside and outside of the agency is lacking because they’re temporary. Unconfirmed commissioners are more likely to be seen as simply an agent of the president since the Senate’s been unable to weigh in on their selection.

Also, the Vacancies Act invites plaintiffs to sue agencies with unconfirmed leaders to establish that an acting leader is serving improperly. It’s happened 12 times since 1998. Once that determination has been made, all actions taken by an agency head are deemed to have “no force or effect.” So guidance from an IRS led by an acting commissioner has less weight than that from one with a confirmed commissioner.

Acting IRS Commissioners Don’t Help the Agency

After Rettig leaves the IRS, his next two successors could be acting commissioners leading to a rudderless agency. Rettig wasn’t nominated until February 2018 and didn’t begin until that October. Even if President Joe Biden nominates a successor soon, if Democrats lose the Senate this fall, his pick could face an uphill confirmation battle, given the IRS is a hot-button issue for the GOP. If Biden chooses not to run in 2024, or loses, the next president might choose a different acting commissioner and the nomination process begins anew.

Long-term temporary leadership obscures the IRS’ direction and priorities and turmoil in leadership may leave it effectively unaccountable to congressional oversight. Yet political reality might make tax uncertainty unavoidable for companies in the next few years.