This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

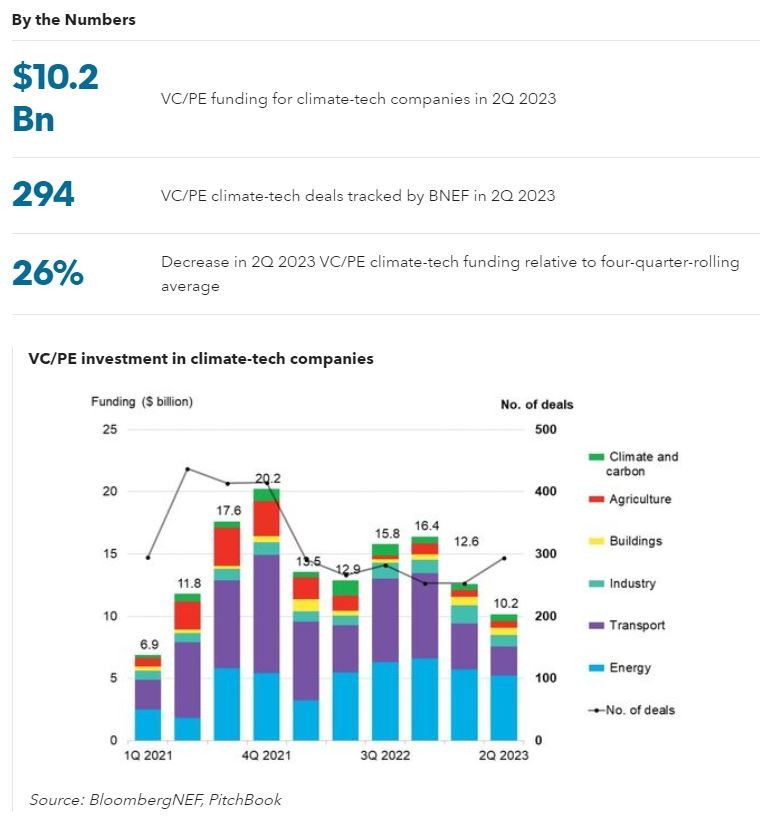

The second quarter of 2023 saw the lowest climate-tech VC/PE funding deployed since 1Q 2021, the quarter BNEF started tracking this data. Fundraising was down across all sectors except for low-carbon buildings. Low-carbon transport had the biggest drop in funding due to the absence of large nine-figure deals for automakers. Funding for 1H 2023 was also down almost 14% compared with 1H 2022, showing the low levels of funding these past two quarters are not simply a result of annual investment cycles.

- While funding was down, deal count was at its highest level since 4Q 2021, when the climate-tech market peaked. This suggests the decline in funding is more likely a result of the macro environment reducing valuations and investors’ appetite for risk, rather than a broader decline in the prospects of climate-tech startups.

- The US reclaimed the top spot as the world’s largest market for climate-tech VC/PE investment with startups there raising $3.5 billion, while Mainland China had one of its lowest funding totals ever. For the first time, India was the second largest market, measured by funding and deal count. European markets staged a recovery compared with last quarter.

- Some 34 new VC/PE funds with a climate-tech focus closed in 2Q 2023, amounting to $7 billion in new dry powder (14 of these funds announced a first, rather than final, close). Six of these newly launched funds have a regional focus for investment, more specifically in India, Africa, Latin America and the Caribbean.

- Lowercarbon Capital ranked as the most active climate-tech investor in 2Q 2023, investing in 11 deals. This was almost twice the number of deals of the next-most-active investor, Fifth Wall Ventures, which invested in six companies this quarter. Lowercarbon Capital was the only investor to rank in the top five most active investors for two consecutive quarters.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.