This article was written by Bradley Foster, Global Head of Content (Enterprise) and Murat Bozdemir, Head of Regulatory, Risk & Climate Data Solutions at Bloomberg.

There is a growing consensus among policymakers and practitioners that climate change could impact banks’ profitability due to a potential increase in expected credit losses. Regulators are increasingly focused on financial risks arising from future climate policies and physical risks, such as heat, droughts, and floods, and short- and long-term risks stemming from the transition to a greener economy.

Understanding climate transition risk factors has become a top priority for banks. However, measuring the impact of climate risk on lending and investment decisions and integrating it into risk and valuation frameworks is not going to be an easy task. The unique, far-reaching, and complex features pose a major data and analytical challenge for the sector.

Supervisors are stepping up globally

Under a scenario where climate change is not addressed, banks risk being severely affected. In the European Central Bank’s (ECB) 2021 economy-wide climate stress test, losses on corporate loan portfolios were projected to rise significantly over time, with the average corporate loan portfolio 8% more likely to default. Half of the 112 banks assessed by the ECB, which have combined assets of $27/€24 trillion, expect climate risks to have a material impact. However, with only 28% of the banks integrating climate risk in their credit risk classification, the supervisor recognizes that the industry lacks adequate assessment tools and climate data to address these risks thoroughly.

The ECB isn’t alone in its efforts to create greater awareness about the climate risks facing banks. The Bank of England continues to emphasize that climate risk is a strategic priority and launched its Climate Biennial Exploratory Scenario assessment to test the resilience of banks to climate‑related risks. In the United States, the Federal Reserve said last year that it’s committed to working within its mandate to address the implications of climate change. Many of the larger Asia-Pacific regulators have also started publishing climate risk guidelines and announcing future climate stress tests. For example, at the end of last year, the Hong Kong Monetary Authority published its pilot Climate Risk Stress Test, which aims to assess the climate resilience of the Hong Kong banking sector as a whole and facilitate bank’s capability for measuring climate risks. These efforts globally underscore that accurately accounting for the impact of climate risk on bank’s balance sheets is a top priority and if not addressed, will have long-term ramifications.

The pivotal role of carbon data

To help create further awareness about climate risk and facilitate industry discussion on key challenges, Bloomberg hosts a quarterly Climate Risk Lab working group. During these events held throughout 2021 and into 2022, we have surveyed banks to better understand where they are in their climate risk analysis journey. The majority of banks reported that they currently perform qualitative assessments using questionnaires during the loan approval processes on areas like transition and physical risks. Banks indicated they are focused on bolstering quantitative risk approaches, which require quality climate risk data that is not always available due to limited and often inconsistent corporate disclosure.

One area of data that is critical for conceptualizing climate risk is having data on firms’ Scope 1, 2 and 3 carbon emissions. Carbon emissions information is foundational not only for bank’s climate risk management but also for realizing a net zero carbon footprint and complying with new disclosure regulations, such as the Green Asset Ratio (GAR), which is part of compliance with CRR Pillar 3 risk disclosures. GAR provides insight about banks’ EU Taxonomy alignment and the carbon footprint of loans and investments on a bank’s balance sheet. The idea behind this is that carbon-intensive industries carry a higher transition risk to move to a low carbon economy. The more exposure a bank has to companies with high carbon emissions, the more it could be impacted by transition risk.

To help banks quantitatively understand their carbon exposure, Bloomberg provides a combination of company reported and estimated carbon emissions data on over 50,000 public and private companies globally. For companies that do not report, Bloomberg’s proprietary machine learning model leverages more than 800 data points to estimate company level Scope 1 and 2 emissions and Scope 3 estimates on certain industry sectors. These estimates help fill the gaps for banks so they can build out their climate risk models. For example, during our latest Climate Risk Lab, we conducted Proof of Concepts with clients demonstrating how Bloomberg’s carbon data could be integrated into a bank’s credit risk models to gauge carbon-intensive companies’ ability to absorb immediate carbon emission pricing shocks.

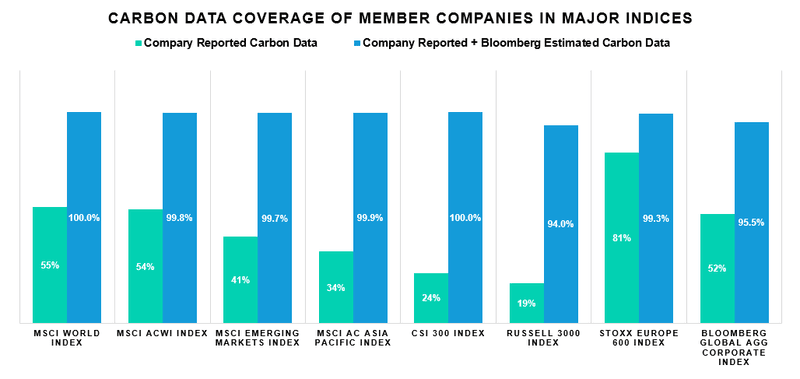

To put the roll of estimates in perspective, the following chart shows a breakdown of how much carbon data is available for the member companies of major indices versus how much carbon emission estimates data Bloomberg provides. By combining company reported and estimated carbon emissions, significant coverage can be achieved for member companies of major indices. Estimates go a long way toward filling the gap so banks can begin assessing their climate risk today, but more company reported carbon emissions data is necessary to glean the full picture.

Looking ahead: Climate risk data

Investing in climate risk capabilities is far more than just another compliance exercise, it entails critical scrutiny from the general public and is mission critical to the future health of bank’s business models. The key question every risk officer and sustainability manager will need to answer is, ‘How will their organization ensure that their risk models, analytics, stress testing and reported metrics use – and are based on – reliable climate data that accurately reflects exposures to climate risk’?

There is a clear regulatory expectation that firms should continue to progress their climate risk agendas and invest in reliable data coverage and quality. At this stage, as the ECB formulates, this is a ‘learning exercise’. The expectation over time is that climate and environmental risk will impact the capital requirement dialogue supervisors have with banks. As industry discussion and regulations evolve, Bloomberg will continue to host the quarterly Climate Risk Lab as a forum to bring together industry participants.