China bonds offers diversification to investors

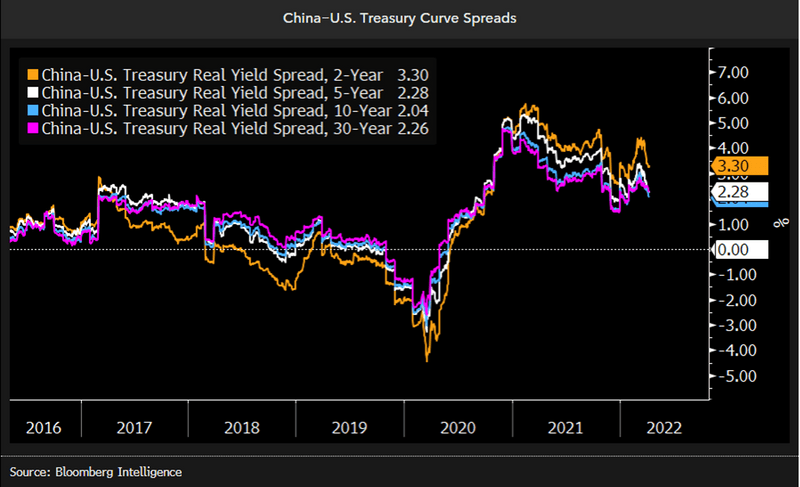

While market participants have been focused on the inversion of China-US nominal yield spread, China-U.S. treasury-yield gaps in real terms are still trading in positive territory. It may be important to also look at real yields in the current inflationary environment, as investors may care about achieving positive real returns.

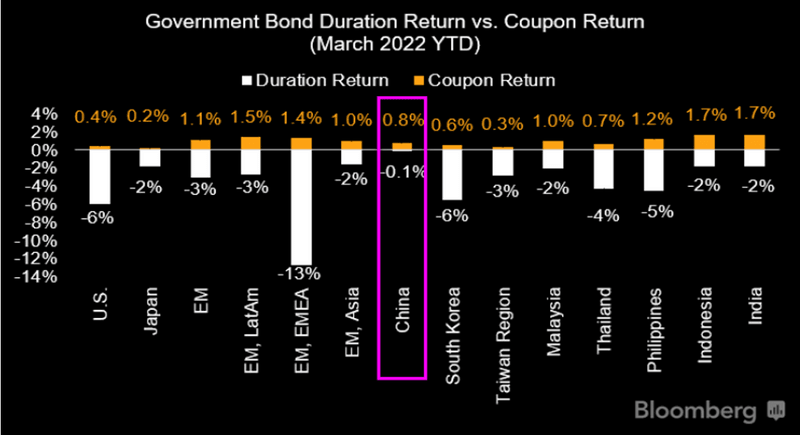

While China treasuries’ coupon income may become increasingly less alluring if compared to U.S. treasuries (and some other Asian government bonds) amid the narrowing China-U.S. yield gaps, they may be less prone to duration losses. China yields may be less likely to be affected by the continuation of the U.S. treasury selloff. Apart from investors whose plan is to hold the bonds until maturity, China treasuries may offer holding value against the backdrop of lower risks of mark-to-market losses. In fact, coupon income may not be able to make up for the duration losses. Furthermore, yuan stability may be another reason why global investors pursue China treasuries.

Bloomberg’s fixed income indices continue a nearly fifty-year tradition of market leadership, excellence and client service. For decades, these indices have been the most widely used for fixed income investors seeking objective, rules-based and representative benchmarks to measure asset class risk and return.

Bloomberg completed the inclusion of China government and policy bank bonds into the flagship Global Aggregate Index in November 2020. At the same time launched the Bloomberg Liquid China Credit (LCC) Index, designed to track the liquid, tradable portion of the RMB-denominated credit bond market. In order to represent the tradable, liquid component of the credit market, the LCC Index uses a unique methodology that incorporates CFETS trading volumes.

J.P. Morgan Asset Management (JPMAM) announced the debut of JPM Beta Builders China Aggregate Bond UCITS ETF (ticker: JCAG), the first global ETF to track Bloomberg China Treasury + Policy Bank + Liquid IG Credit Issuers Index, a bespoke index that constitutes of Bloomberg Liquid China Credit (LCC) Index, China treasury and policy bank bonds.

A combined China rates and credit exposure may offer diversification potential among otherwise uniform options and higher real returns compared to other FI markets.

“China bonds’ low correlation to traditional developed market bonds offers investors a good source of diversification, while the relatively high-yield potential supported by China’s easing monetary policy makes it a relatively attractive income generator in a low-interest-rate world,” said Sean Cunningham, Head of Asia ETFs at JPMAM. “For global investors seeking diversification and attractive yields, China bonds could be an increasingly accessible choice on the back of its evolving global index inclusion.”

“As the first product-tracking a variation of the Bloomberg Liquid China Credit Index, JCAG offers a new avenue to global investors to diversify their portfolios and seize opportunities in China’s fixed income,” said Ji Zhuang, Bloomberg Head of Indices, APAC. “China’s onshore credit market is an area often untapped by global investors, but interest is emerging.”

BLOOMBERG, BLOOMBERG INDICES and Bloomberg Fixed Income Indices (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited, the administrator of the Indices (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the Indices. Bloomberg does not guarantee the timeliness, accuracy or completeness of any data or information relating to the Indices. Bloomberg makes no warranty, express or implied, as to the Indices or any data or values relating thereto or results to be obtained therefrom, and expressly disclaims all warranties of merchantability and fitness for a particular purpose with respect thereto. It is not possible to invest directly in an Index. Back-tested performance is not actual performance. Past performance is not an indication of future results. To the maximum extent allowed by law, Bloomberg, its licensors, and its and their respective employees, contractors, agents, suppliers and vendors shall have no liability or responsibility whatsoever for any injury or damages – whether direct, indirect, consequential, incidental, punitive or otherwise – arising in connection with the Indices or any data or values relating thereto – whether arising from their negligence or otherwise. This document constitutes the provision of factual information, rather than financial product advice. Nothing in the Indices shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg or a recommendation as to an investment or other strategy by Bloomberg. Data and other information available via the Indices should not be considered as information sufficient upon which to base an investment decision. All information provided by the Indices is impersonal and not tailored to the needs of any person, entity or group of persons. Bloomberg does not express an opinion on the future or expected value of any security or other interest and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. Customers should consider obtaining independent advice before making any financial decisions. © 2022 Bloomberg. All rights reserved. This document and its contents may not be forwarded or redistributed without the prior consent of Bloomberg.

The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence shall not constitute, nor be construed as, investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest) or a recommendation as to an investment or other strategy. No aspect of the Bloomberg Intelligence function is based on the consideration of a customer’s individual circumstances. Bloomberg Intelligence should not be considered as information sufficient upon which to base an investment decision. You should determine on your own whether you agree with Bloomberg Intelligence.

Bloomberg Intelligence is offered where the necessary legal clearances have been obtained. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence June hold positions in the securities analyzed or discussed on Bloomberg Intelligence.