This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

China’s largest steelmaker, Baowu Steel, has committed to carbon neutrality by 2050, ten years earlier than the Chinese government’s national target. This is the first net-zero target from China’s steel sector, which collectively makes up more than half of global supply. However, the pathway to decarbonization for China’s steel industry will be long and in many ways more difficult than in other countries, due to the relatively young operating fleet that is heavily reliant on coal and constraints of steel scrap availability.

A new-year surprise: On January 20, at its first cadre meeting of the new year, Baowu Steel announced that the company will try to reach carbon neutrality by 2050. Baowu Group made 95.5 million metric tons of crude steel in 2019, equal to approximately 5% of global production. It is the largest steelmaker in China, and the second largest in the world (as per 2019 production figures). The announcement also included interim targets: to publish a low-carbon roadmap in 2021, to reach peak emissions in 2023, to reduce its carbon emissions by 30% by 2025. This is the first net-zero goal announced by a major Chinese steel company.

Aligning with the government: The announcement is in line with the Chinese government’s pledge to reach net-zero emissions by 2060 made on September 22, 2020, at the United Nations General Assembly by president Xi Jinping. China is the largest emitting nation and its net-zero goal has a huge impact on global decarbonization. The country-level commitment sent strong signals to domestic industries to plan a transition away from fossil fuels. Steel production alone accounts for 15% of China’s CO2 emissions, making the hard-to-abate industry’s efforts critical to the country’s overall decarbonization. China’s steel sector is booming, with production surpassing 1 billion metric tons in 2020, despite the impact of the Covid-19 pandemic, record high raw material prices, and ongoing government efforts to rein in the industry. As the top producer in China, Baowu’s announcement sets an important precedent for the rest of the industry.

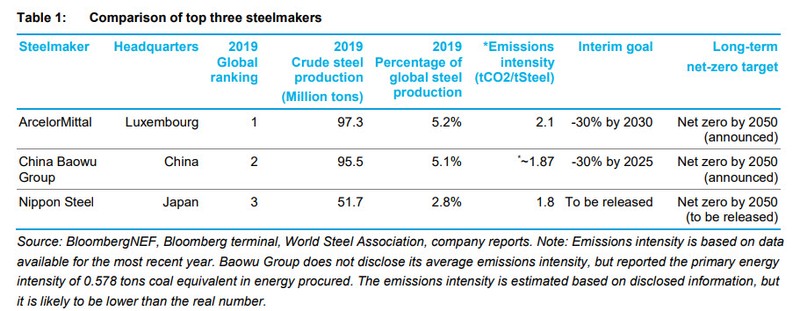

Top players on road to net-zero: The announcement means the world’s three largest steelmakers are all on a path to decarbonize their production (Table 1). ArcelorMittal was the first to make the commitment. Europe as a region is leading in carbon neutrality announcements and has the strictest and most comprehensive carbon emissions regulation. In October 2020, Japan followed China to announce its own net-zero commitment by 2050. Soon after, Japan’s largest steelmaker, Nippon Steel, also revealed its intention to reach net-zero and is expected to officially announce its roadmap in March. The fifth largest, South Korea’s Posco, has also made a net-zero commitment. That leaves only Hebei Iron and Steel (HBIS) among the top five producers yet to make an announcement. Baowu’s goal means that a total of 19.6% of global steel production has committed to net-zero by 2050.

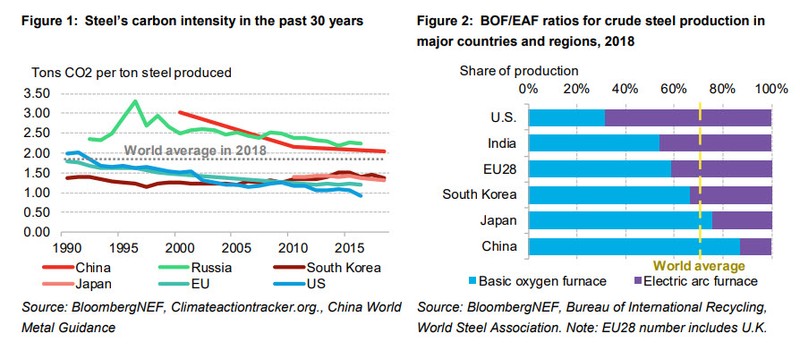

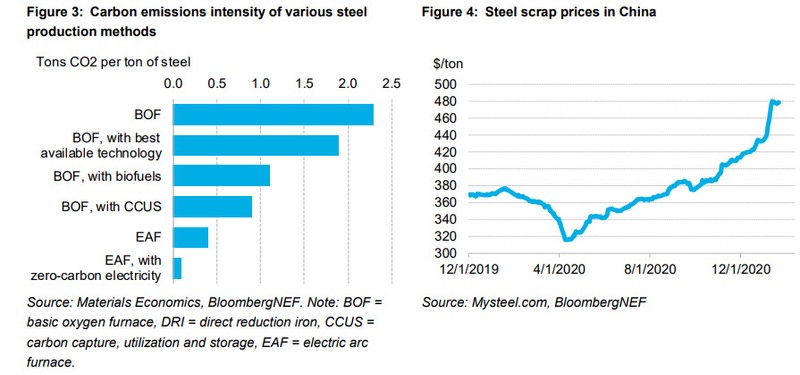

More difficult to decarbonize: China’s steel sector will have a difficult path to net-zero. Its emissions intensity is higher than the global average (Figure 1). According to the IEA, China’s current operating fleet of steel plants is only around 10-15 years old. This means large-scale replacement or retrofitting of existing plants is unlikely in the near term. The country primarily focuses on primary steel production (including pig iron sintering) using blast-oxygen furnaces (BOF). BOF plants are harder to decarbonize than electric arc furnaces (EAF) because of their reliance on high-temperature industrial heat (Figure 2). EAFs can be decarbonized by switching to cleaner sources of electricity, but BOFs will have a harder time with fuel switching, relying on potentially more expensive fuels like natural gas and hydrogen to replace coal. The remaining options are to retrofit existing coal-fired plants with carbon capture and storage systems, or dramatically accelerate hydrogen and recycling.

From plan to practice: While these targets are clear, the technology pathway and potential financial costs are still uncertain. In the near term, process efficiency improvements and steel recycling will be the first step thanks to their commercial availability. However, both options have their limitations. In the longer term, carbon-free fuels and carbon-negative technologies will be needed to tackle primary steel emissions and accelerate the reductions. Hydrogen has attracted a great deal of attention recently with demonstration projects for steel emerging around the world. Carbon capture, utilization and storage is also being considered as a way to retrofit existing plants for net-zero. However, neither solution is commercially available today while both still contain a lot of risks and uncertainty. An upcoming note will analyze pathways and financial costs to net-zero steel.

Availability of scrap is a constraint: Steel recycling that makes steel out of scrap, is the first logical step to cut emissions. Steel made from recycling through the EAF process has much lower carbon than the one made through BF-BOF process (Figure 3). The U.S. and European steelmakers that are leveraging scrap use have lower emissions intensity than their Asian peers (Figure 1). However, there is a limit to how much secondary steel can be produced, due to scrap availability. This is particularly problematic for China. Compared to developed economies, China’s domestic scrap is scarcer because steel stock per capita is lower, industrial assets are younger and the steel recycling supply chain is less organized. China lifted an import ban on steel scrap in December 2020, which indicates the supply insufficiency. However, with more crude steel production needing to slash carbon emissions in the near term globally, scrap demand could surge and prices may go up. That will add costs to the balance sheets of steelmakers wishing to decarbonize by recycling. In fact, there are early signs already. Steel scrap prices soared in the past quarter worldwide (Figure 4), as a result of supply slow down and firm demand.

The green wave to come: Of the top ten steel producers in 2019, six are Chinese companies. With China’s national net-zero goal in place, and the industry leader setting out its plans to match the goal, we expect more Chinese steel companies to follow with net-zero announcements. Baowu Group’s carbon neutrality commitment not only marks the start of the Chinese steel industry’s decarbonization, but could also bolster wider industry efforts by scaling up and lowering costs for technologies like carbon capture and hydrogen. Already, regulators and the Chinese Steel Industry Association is developing a national technology road map for low-carbon. A more detailed plan is likely to be released after the 14th Five-Year Plan for steel has been announced, later this year. Besides promoting lower carbon production technologies, China’s regulators are looking at capacity controls and production caps, setting lower energy-efficiency targets, and higher recycling requirements.