This analysis is by Bloomberg Intelligence Strategist Nitin Chanduka. It appeared first on the Bloomberg Terminal.

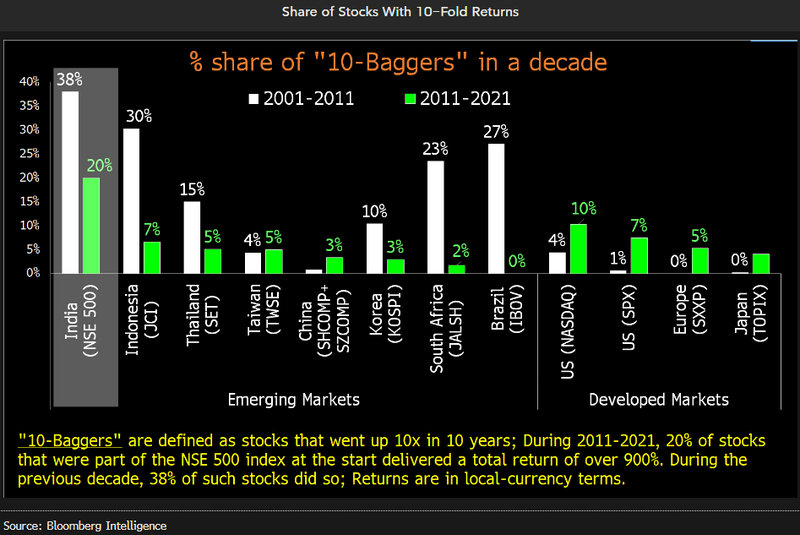

India has produced more “10-bagger” stocks — defined as those whose prices rise 10x over a decade — than other major markets globally during the past 20 years. In the past decade, 20% of NSE 500 index stocks rose more than 900% vs. 7% for the S&P 500 and 3% for China. Strong growth and multiple reratings were the key drivers of the Indian stocks.

20% of NSE 500 stocks are 10-baggers

Our analysis suggests investors have had a higher likelihood of latching onto “10-bagger” stocks — those which appreciate 10x in 10 years, in local-currency terms — in Indian markets than in major stock markets globally. Over the decade ending in 2021, one-fifth of NSE 500 index constituents (80 stocks) at the start of the period rose more than 900% by the end of it, the highest proportion of big global markets. The Nasdaq Composite saw 10% of stocks deliver returns of more than 900% while for the S&P 500, the share was 7%.

Despite faster economic growth in China, only 3% of mainland Chinese stocks rose more than 10X. During the previous decade of 2001-2011, India also saw the highest share of 10-baggers, followed by Indonesia and Brazil.

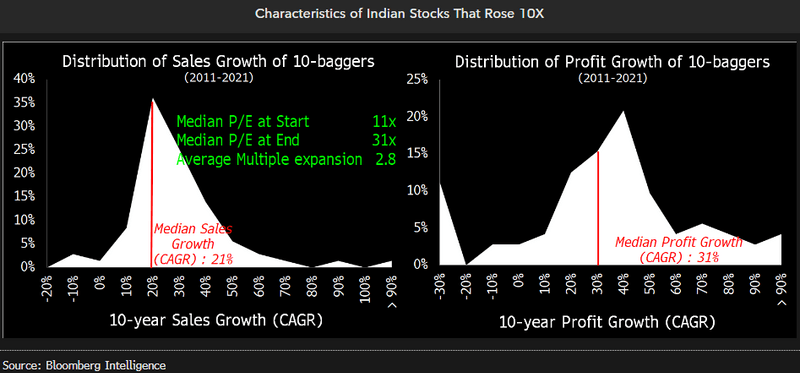

Multi-bagger drivers: Growth, low valuations

Strong sales and profit, besides multiple reratings, were key drivers of stocks that returned 10x in the past decade. Of the 80 Indian NSE 500 stocks that became 10-baggers, nearly 90% grew their top lines at a compound annual growth rate (CAGR) of more than 10%, while 70% of them posted profit CAGRs of over 20%. The median sales CAGR for those stocks was 21% while the median profit CAGR was 31%. Valuation rerating was also a common characteristic: the median price/earnings ratio expanded nearly 3x, from 11x to 31x. Results were similar during other periods such as 2001-2011.

More than 50% of the Indian stocks were from the infotech, chemicals and consumer-discretionary sectors. A global rise in software spending helped tech stocks while an increase in India’s per capita income aided discretionary spending.

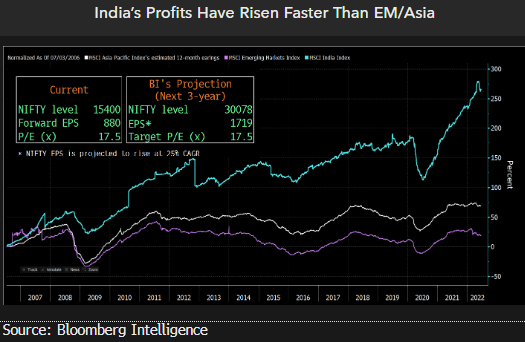

India market may double as reforms, capex take mantle

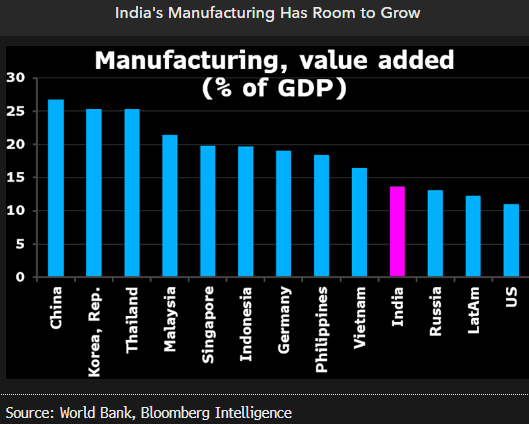

Despite pandemic-fueled disruptions, India’s economic overhaul is progressing, underscoring our belief that the headline SENSEX index could double over the next three years, led primarily by compounded annual corporate profit growth of 25%. This implies a relative outperformance of about 16% vs. the emerging-market index, which is modeled to gain 9% a year. Manufacturing exports have topped $400 billion, with “China Plus One” potentially a $1 trillion opportunity, suggesting a path to structural growth.

After the record de-risking since October 2021, foreign investor positioning is lighter, while the flow of domestic savings to equities remains on firm footing. Higher rates don’t derail equity returns if profit growth stays robust.

Corporate earnings’ upcycle just getting started

India’s corporate earnings have rebounded strongly, driven by pandemic effects, rising software exports, higher commodity prices and a clean-up of banks’ balance sheets, and this resilience should continue to provide an equity-market catalyst. Financials, representing over 25% of NIFTY index earnings, have recovered from corporate-loan stress, finding support in policy measures. Rising rates are likely to boost banks’ earnings further. Software services have seen a sharp upturn, buoyed by an uptick in global digital spending and strong deal wins.

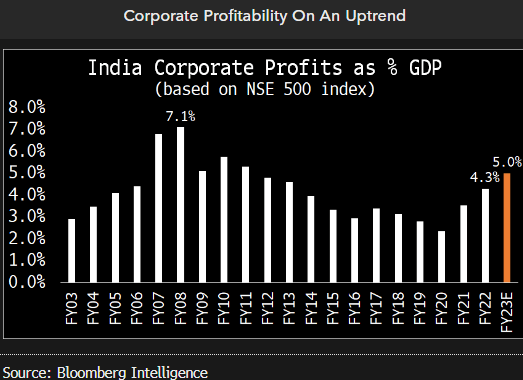

The pace of corporate profits to GDP is now in an uptrend after persistently declining for more than a decade. This is partly driven by reduced stress in sectors such as corporate banking, due to improving asset quality, in metals, as well as in pharma pricing.

`China plus one’: $1 trillion prospect for India

Despite the pandemic, India has staged a strong recovery in goods exports, crossing the $400 billion mark set for fiscal 2022, while also building its own vaccines, which is a testament to the nation’s manufacturing prowess. Though surging commodity prices have partly led to a rise in exports, momentum remains strong in electronics (led by import substitution), chemicals (driven by environmental norms) and textiles manufacturing.

About 30%, or $4 trillion, of global manufacturing is done in China, with even a one-third shift under “China Plus One” suggesting a $1 trillion opportunity for corporate India. India’s Production-Linked Incentive plan (PLI), corporate-tax cuts, infrastructure upgrades, low costs, skilled labor and strategic location support the “Make in India” initiative.