CSOP: Diversification and technology are key to growth beyond mainland China

For CSOP Asset Management, the promise of greater connectivity between wealthy individuals in Hong Kong and mainland China is another opportunity to expand its product suite and diversify its revenues, according to CEO Ding Chen.

Ding Chen, CEO of CSOP Asset Management, keeps a framed newspaper article on her desk from an interview with the Hong Kong Economic Journal in December 2014. The headline reads, “Foreign capital retreats by 30bn yuan from CSOP’s largest fund”.

Back then, CSOP’s biggest product, the CSOP FTSE China A50 exchange-traded fund, endured heavy outflows amid broader market volatility. That fund accounted for about 80% of the firm’s revenues at the end of 2014, leaving CSOP exposed when the renminbi’s steady appreciation suddenly came to an end: from a peak of almost RMB50 billion, redemptions over the following year were close to RMB30 billion.

“We were the leading fund management company in the market at that time, and our development had been very smooth,” says Ding. “But our product range was too narrow. Because there had been high overseas demand for renminbi assets, all our products were in renminbi and we relied heavily on a single fund,” she says.

“Since then, we have made big adjustments to our product strategy. We have explored different products that are suitable for different types of customers,” she adds. “This is why we have doubled the number of products in the past few years.”

The clipping serves as a reminder to learn from past challenges. For CSOP, the next phase of growth in its cross-border business will be driven by diversification and technology.

Pioneering liberalization

CSOP was established in 2008 by China Southern Asset Management, based in neighboring Shenzhen, as the first offshore fund set up by a regulated mainland asset manager. The firm now manages over US$10bn, mainly through exchange-traded funds offering international investors exposure to onshore investment products. Its product range has expanded to include fixed income as well as leveraged and inverse ETFs – where it commands a market share of over 90% in Hong Kong.

CSOP also manages around RMB2 billion from mainland investors seeking access to Hong Kong through the Hong Kong-Mainland ETF Cross-listing Scheme, launched in 2020.

Hong Kong-based CSOP has been at the heart of the internationalization of China’s capital markets since its early days in 2010. The firm has been closely involved in a number of major milestones, from the launch of the Renminbi Qualified Foreign Institutional Investor (RQFII) system in 2011 to the opening of the Stock Connect trading link with Shanghai in 2014 and the establishment of mutual fund recognition in 2015.

“The next step is to promote Wealth Management Connect, which will have a significant impact on the Hong Kong wealth management sector and allow greater access to domestic capital,” she says.

The Wealth Management Connect Pilot Scheme between Hong Kong, Guangdong and Macau started in October 2021 with an initial quota of RMB150 billion (US$23.2 billion).

Covering a population of 70 million people in the Greater Bay Area with a combined GDP of almost $1.7 trillion, the framework could double the accessible wealth market of Hong Kong-based asset managers within a decade, according to a 2021 report by Bloomberg and the Chinese Asset Management Association of Hong Kong.

For CSOP, Wealth Management Connect is the latest in a series of initiatives that are opening up more sophisticated products to onshore and offshore investors.

“Complex derivatives, valuations, bookkeeping and trading all demand more of the company. These need to be supported by more powerful technologies and experienced people.”

Drive to diversify

CSOP’s diversification strategy means expanding into more complex products. That requires considerable investment in talent, risk management and technology. This is such a priority for Ding that she personally interviews all new technology and IT recruits.

“It is not easy to acquire scientific and technological talent,” she says. “If there is no effective strategic investment in technology, you will struggle to keep up with the times.”

CSOP’s technology strategy serves two main goals: supporting products and enabling growth. While the firm’s expansion into leveraged and inverse ETFs and other sophisticated products has required more technical support, Ding is also a strong believer in the power of technology to scale the investment business by freeing staff from mundane tasks.

“Complex derivatives, valuations, bookkeeping and trading all demand more of the company. These need to be supported by more powerful technologies and experienced people,” says Ding. “In the past two years, although our products have more than doubled, our headcount has grown less than 20%. This shows how much our use of technology supports the development of our business.”

Positioning for the future

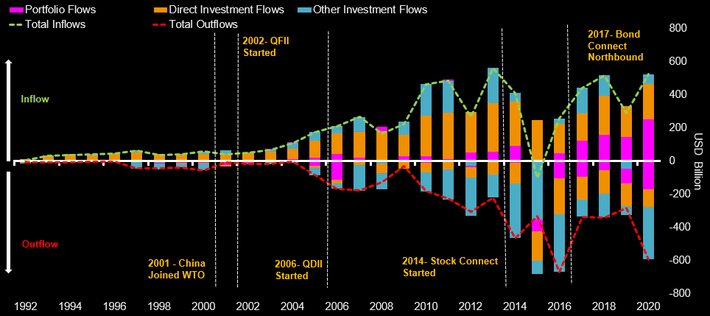

Global investment in China has grown rapidly in recent years but remains low relative to the size of the economy — and its capital markets, which are the world’s second largest.

International holdings of Chinese bonds in the onshore interbank market reached RMB4 trillion as of December 2021 — helped by the inclusion of domestic securities in global indices, including the Bloomberg Global Aggregate Index — but even this number is still less than 5% of onshore bonds outstanding.

“The current global share of Chinese assets is about 3% to 3.5%, but China’s share of international trade has surpassed 16%,” says Ding. “There will be more funds to allocate to China, whether it is stocks or bonds, and the flow of cross-border capital will continue to increase.”

CSOP in 2014 launched a Hong Kong-traded fund tracking the Bloomberg China Treasury + Policy Bank Index, and relaunched it in November 2021, which has grown to 5 billion yuan. Bloomberg was the first global index provider to complete the inclusion of Chinese government and policy bank bonds into its flagship benchmarks. Ding now sees more potential from the addition of Chinese bonds to global fixed income indices: FTSE Russell began adding onshore Chinese bonds to its World Government Bond Index from October 2021, following earlier moves from the JP Morgan and Bloomberg indices.

“The inclusion of Chinese bonds in the world’s major bond benchmark indices is a great stimulus for foreign capital to enter the Chinese bond market,” says Ding.

The extension of the Hong Kong-Mainland ETF Cross-listing Scheme, launched in 2020, has also accelerated interest in the booming ETF sector. According to a mid-2021 report by HKEX, as of May 28 that year, Hong Kong’s more than 140 listed ETFs were trading over $7.6 billion a day, up from an average daily turnover of $6.4 billion in 2020, with assets under management at over $400 billion.

In June 2021, the CSOP Huatai-PineBridge CSI Photovoltaic Industry ETF became the first Hong Kong vehicle to give the city’s investors exposure to a Shanghai ETF. Through the same scheme, Shanghai-based investors were able to gain exposure to CSOP’s Hang Seng Technology ETF.

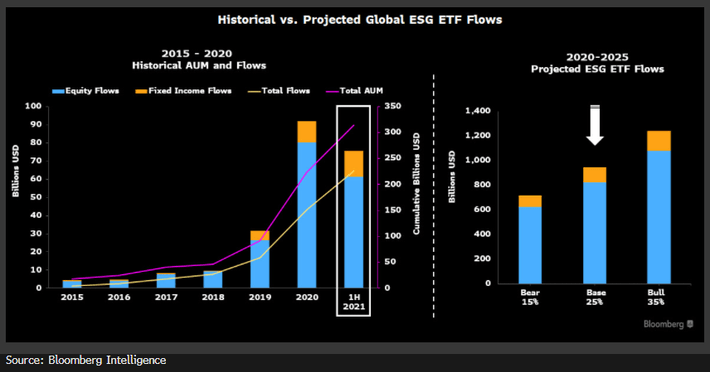

Sustainable investment is also proving an unmissable theme for asset managers globally. CSOP’s experience with the Shanghai solar ETF earlier this year proved to Ding the extent of demand for green and sustainable investments.

“We are also actively investing in ESG data and scoring cards, and at the same time attracting ESG experts to join us to enrich our ESG research capabilities,” she says.