ChinaAMC Hong Kong: Two-way connections with China’s financial markets are the real opportunity

Outbound investments by increasingly experienced mainland investors will drive the next phase of growth for Chinese financial institutions outside the mainland market, according to Gan Tian, Chief Executive of ChinaAMC Hong Kong.

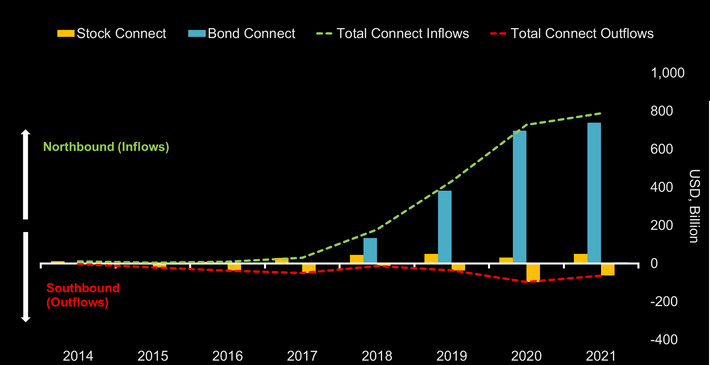

Since China began to liberalize market access with the internationalization of the renminbi in the late 2000s, cross-border capital flows have been dominated by inward investments by offshore investors.

The prospects of attractive returns from currency appreciation, a fast-growing stock market and relatively higher government bond yields continue to lure billions of dollars into the domestic Chinese markets.

But the expansion of so-called “southbound” connections, allowing mainland investors access to the Hong Kong market, is adding a new dimension.

Trading began on the Southbound leg of Bond Connect on September 24, 2021. It provides mainland institutional investors with a convenient and secure channel to invest in the Hong Kong bond market via the connection between the mainland and Hong Kong financial infrastructure services institutions. It completes the Bond Connect program, following the launch of northbound trading in 2017, with an initial annual quota of RMB500 billion.

Alongside the Wealth Management Connect in the Greater Bay Area, the expansion of the Bond Connect framework is the latest addition to a series of trading links that have turbo-charged cross-border trading volumes in recent years. Gan Tian at ChinaAMC Hong Kong expects the Southbound leg to play to the firm’s strengths.

“Several cross-border projects have just been announced that will provide us with a period of strategic opportunities,” he says. “The bond market really plays to our strengths, and we are looking forward to the opportunities brought by the new Southbound link.”

ChinaAMC Hong Kong has established itself as a leader in fixed income in Hong Kong and is now looking to offer overseas bond exposure to domestic institutions.

“Few Chinese asset management companies can do global investment-grade bond funds,” said Gan. “When domestic institutional investors begin to invest in overseas bonds, whether it is in the U.S. dollar bond market or the Dim Sum bond market, we can lean on our experience over the past six years.”

Hong Kong’s Securities and Futures Commission has also reported growing interest in fixed income asset management. As of September 30, 2021, the regulator has authorized 171 Hong Kong bond funds, an 18.8% jump from a year earlier.

Technology-driven growth

ChinaAMC’s overseas expansion comes with serious investments — both in new products as well as the technology needed to support them.

ChinaAMC bought BMO’s suite of Hong Kong ETFs in 2021 — the largest acquisition in the sector — including an Asian investment-grade bond fund as well as equity funds focused on Japan and Europe.

The acquisition continues ChinaAMC’s expansion into more thematic funds, new asset classes and new sectors. All of this means investing in technology to upgrade digital services and expand product offerings.

ChinaAMC Hong Kong has stepped up its investment in technology in the past two to three years and now invests 3 to 5% of its revenues each year in technology development.

Gan expects this ratio to increase as the firm expands, “because we need technology to support the growth of our product’s quantity and quality.”

He is not alone. Consultants Alpha FMC found 97% of global asset managers see digital transformation as a top priority, and only 23% believe they are meeting customers’ expectations. For those that are spending more on technology, data use and customer experience are top priorities, and 45% of firms expect to increase their digital spend by more than 5%.

ChinaAMC partnered with Bloomberg two years ago to upgrade its IT infrastructure and streamline communications between Hong Kong and its Beijing headquarters. By integrating front office trading systems with risk management and transaction management solutions, ChinaAMC has been able to improve its workflow and manage compliance and governance risks more effectively across the group.

“We need to support the continuous improvement of our product range, both in terms of quantity and quality,” he said.

“The front desk and middle and back offices need to grow in line with the new products that we are offering. We are increasing our investment in digitization to support the issuance of more and more of these products with limited manpower in the future.”

Cross-border expansion

This rapid, technology-enabled expansion strategy is typical of Chinese financial institutions in Hong Kong — and very different to earlier growth strategies employed by asset managers outside the Chinese mainland.

For Gan, the volatility in the Chinese stock markets in 2015 was a turning point. After a spectacular run to reach a peak in June, the CSI 300 index tumbled more than 40% over the next three months and ended the year close to where it had started. China’s deleveraging campaign in 2018 also dampened global appetite for onshore investments.

“After experiencing significant market volatility in 2015 and 2018, investors understood the need to hand over trading to professional managers,” he said. “Even more importantly, investors began to target diversification. That is really the core reason for handing over money to be professionally managed.”

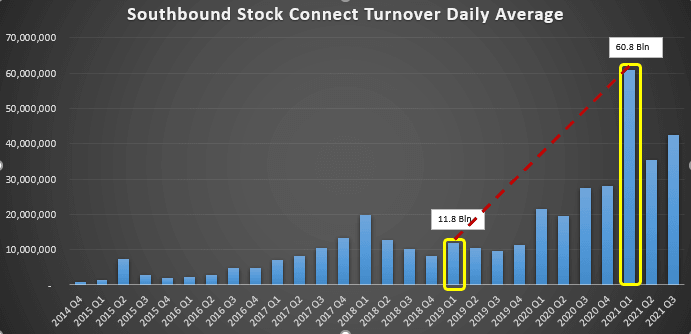

Domestic demand for Hong Kong stocks rose sharply in 2019, and this trend has since gathered pace. Inflows into Hong Kong accelerated in the first quarter of 2021: Southbound Stock Connect turnover hit a daily average of HK$60.8 billion, up from HK$11 billion in 2019, accounting for over 12% of all trading on the Hong Kong stock exchange.

Trading links with Shanghai and Shenzhen have brought around HK$2.1 trillion into the Hong Kong stock market since Stock Connect launched, but net inflows have accelerated over the past three years, reaching HK$1.4 trillion, according to data compiled by Bloomberg.

While investor eligibility rules act as a cap on Southbound Connect volumes, there are other channels that offer onshore buyers exposure to Hong Kong’s international market. Under the mutual fund recognition scheme, for example, according to the Securities and Futures Commission (SFC), the China Securities Regulatory Commission had approved 38 Hong Kong funds by September 30, 2021, with net subscriptions totaling RMB15.85 billion. By contrast, the 48 mainland funds authorized by Hong Kong’s SFC had pulled in just RMB946 million — about one 20th of the southbound volumes.

New economy opportunities

The growth of cross-border trading volumes owes much to the surge in demand for new economy companies.

“In November 2019 there was a landmark event: Alibaba returned to the Hong Kong market for a secondary listing. This opened a new chapter, with China’s new economy companies successively listing in Hong Kong,” said Gan.

“Domestic investors were already willing and able to invest in Hong Kong, and the arrival of new economy stocks offered something that they could not access at home. If the leading technology companies are listed in Hong Kong, mainland investors will invest more and more in the Hong Kong stock market.”

Demand for new-economy companies has also lifted northbound trading volumes and boosted products that offer exposure to sectors that are relatively scarce in the international markets, such as suppliers to the solar power and electric vehicle industries.

China’s 14th Five-Year Plan, approved by parliament in March 2021, set out goals for seven areas of technology development, including semiconductors, artificial intelligence, medicine, and quantum computing.

“The capital markets have definitely recognized the future direction of technology development,” said Gan. “Looking at the companies that are the most advanced in productivity and modern technology, most of them are in Hong Kong. I am full of hope for the underlying Hong Kong market.”