Challenges facing the China EV market

This article was written by Global Data Fixed Income Analyst Adrian Yim and Global Data Interns Michelle Leung and Qiaohang He. It appeared first on the Bloomberg Terminal.

Background

China’s local auto brands are seeking earnings recovery from the economic downturn in the first half of 2022. XPeng recorded a 43 percent vehicle delivery increase year-on-year, while Nio and Li Auto disclosed a 26.7 and 20 percent rise respectively. Yet, fueled by global geopolitical tension — including from Russia-Ukraine conflict and U.S.-China friction — China’s plan to achieve 20 percent electric vehicle (EV) deployment by 2025 may be delayed.

Policy

Although the sector’s earnings appear promising, with a significant 3.52 -million-unit increase in 2021, subsidies play a huge role in this growth. The Chinese government has spent more than RMB200 billion on EV subsidies since 2009 — more than the expenditure on internal combustion engine (ICE) vehicles. From 2020 to 2022, China’s subsidies dropped annually by 10 to 30 percent, paving the way to phase out subsidies and allow organic consumer demand to grow. Combating decreased consumer spending and supply-chain disruption, the plan to phase out EV subsidies is yet to be affirmed. However, in the long term, stimulus measures may change from direct subsidies to investments on complementary goods and services, including NEV charging stations and clean energy.

Batteries

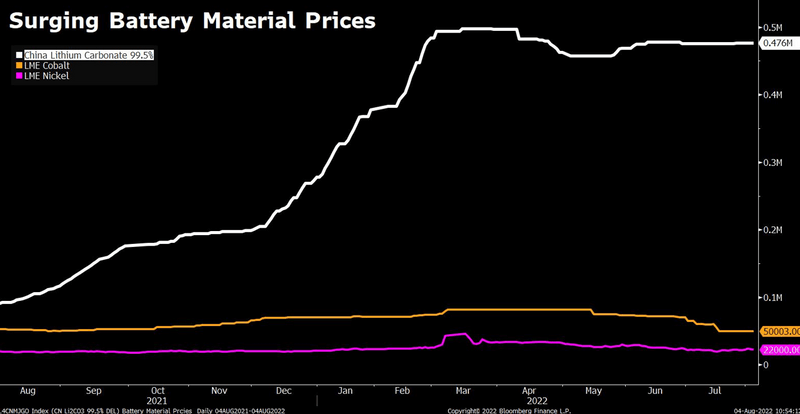

Prices of major battery components such as lithium, nickel and cobalt have all risen in the past year. This is largely exacerbated by supply -chain disruption due to the Russian-Ukraine conflict. A jump in battery raw material price, especially lithium, would increase cost pressure on battery manufacturers.

Accompanied by a 94 percent increase in EV battery shipments in 2021, lithium carbonate recorded a price increase of 427 percent. As the key component of high energy-density rechargeable lithium-ion batteries, it is expected to power all electric and hybrid vehicles when hydrocarbon fuel peaks.

Margin

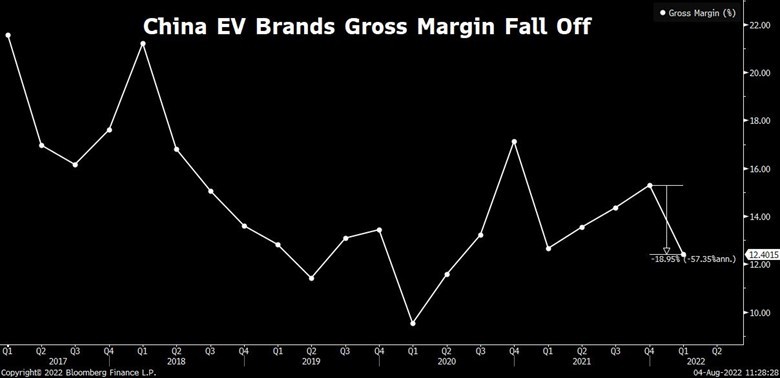

China domestic brands’ gross margin dipped 19 percent in the first quarter of 2022 compared with the previous quarter. Downstream battery makers are pressured to digest higher costs and thus have pushed up price tags. As trade conflict intensifies, margins may further dwindle in the upcoming earnings season. Nonetheless, new cell chemistries and simplified battery-pack designs could gradually bring down costs and stabilize future battery supply.

Conclusion

Settling in a precarious macro is never easy. Government support is vital to the growth of the EV sector. However, battery supply plays a key role in global EV manufacturing, which China is aware of as it aims to take the lead in battery manufacturing.