Challenge to Maryland digital tax could save companies millions

This analysis is by Bloomberg Intelligence Government Analyst Andrew Silverman. It appeared first on the Bloomberg Terminal.

A state court challenge to Maryland’s digital tax, which could cost companies such as Amazon.com $250 million a year, appears poised to succeed, though recently finalized regulations weaken Maryland’s case. Digital companies may save billions annually if Maryland’s tax is struck down, as other states might steer clear.

What’s at stake?

Maryland tax of $250 million; billions more in other states.

Maryland says the tax will cost companies such as Alphabet and Apple $250 million a year, and we believe that if it’s not struck down, similar levies will appear across the U.S. Other states have proposals similar to Maryland’s. Widespread use of digital taxes by states could result in $14 billion in new levies on U.S. internet companies annually, according to Bill Fox, a University of Tennessee economist. Allowing Maryland’s tax may weaken constitutional interstate-commerce protections.

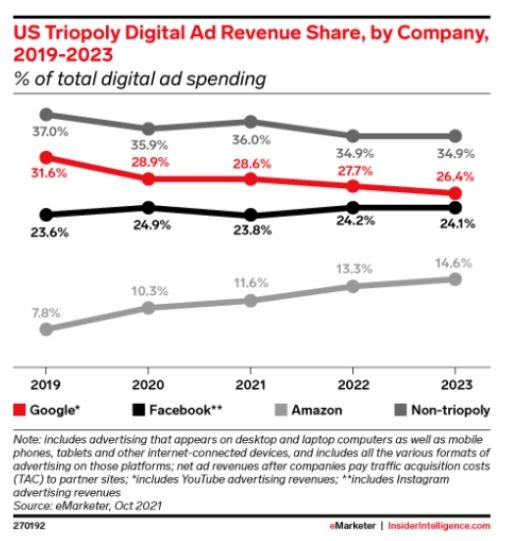

U.S. digital advertising market share, 2019-2023

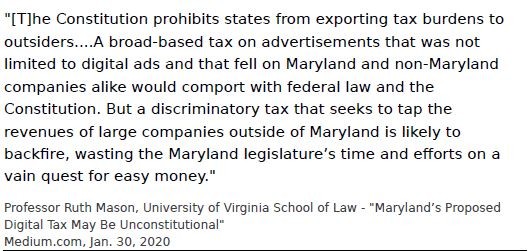

Statement

Who’s favored?

Internet companies.

The tax likely violates the Internet Tax Freedom Act, which bars discriminatory e-commerce taxes. It also probably violates the U.S. Constitution and that of Maryland given it applies more heavily to out-of-state companies and limits free speech. Regulations finalized in December further imperil Maryland’s case because the tax is to be applied far too broadly in terms of the kinds of income covered and the locus of that income (i.e., some of it not arising in Maryland).

What’s next?

Pretrial-motions period.

The state of Maryland, the defendant and plaintiffs Comcast and Verizon are in the pretrial phase of the case. Similar cases in the same circuit court have taken about a year and a half to complete the motion period. A trial in the case is likely because plaintiffs are attempting to invalidate a state law; settlement may be impossible. We would expect a decision in the case around the start of 2023. Yet the trial-court decision probably won’t end the case and it could go to federal court.

Next key event:

- Pre-Trial Motions

Last key event:

- Defendant’s response

- Nov. 19, 2021

What’s the issue?

Viability of state digital taxes.

Challenges to Maryland’s tax are a bid to nip all state digital taxes in the bud. The tax applies to companies with $1 million or more of gross ad revenue from the state and at least $100 million in total sales. The rate ranges from 2.5-10%. The tax went into effect in January and the first filing obligation is in April. The final regulations suggest that income sourcing — using inexact geolocation devices and an overinclusive apportionment formula — may result in double taxation.

Docket:

- Comcast of California Maryland Pennsylvania Virginia West Virginia LLC, et al. vs. Comptroller of the Treasury of Maryland

Companies impacted:

- Google, Apple, Facebook, Amazon.com, Microsoft

Court:

- Maryland Circuit Court for Anne Arundel County

Date filed:

- Apr. 15, 2021