Carbon offsets price may rise 3,000% by 2029 under tighter rules

Bloomberg Market Specialists Jagteshwar Singh and Tiffanie Tan contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

COP26’s conclusion in November 2021 signaled to governments and investors that a zero-emissions world is on the horizon.

The Glasgow Climate Pact, negotiated by nearly 200 countries, radically cuts back coal usage, eliminates fossil-fuel subsidies and commits governments to carbon emissions reductions.

While many argue that the pact is overly ambitious without a radical transformation of industrial sectors and consumption, to others, it is a starting point. Carbon and its pricing will continue to gain significant importance as countries and companies seek to reduce carbon emissions by purchasing carbon offset credits.

The issue

The market for carbon offsets is highly dependent on worldwide regulatory efforts to hold countries accountable for their climate impacts.

BloombergNEF examines potential market outcomes based on different regulatory scenarios for carbon offsets, defined as verified reductions in climate-warming gases used to compensate for emissions that occur elsewhere.

Research results indicate that an oversupplied voluntary market would produce prolonged growth in prices. On the opposite end of the spectrum, a carbon-removals-only scenario could cause a pricing surge of as much as 3,000% by 2029.

The COP26 climate summit inspired a global push to reduce emissions. However, regulation of carbon-cutting projects is still a new concept plagued by “greenwashing” — cultivating a false impression or misleading information about how a company’s products are environmentally friendly. Only a small fraction of projects actually remove carbon dioxide from the air, and rules fluctuate from country to country, with carbon emissions often unregulated by any recognized body.

“The price of offsets could rise significantly, creating a $190 billion market as early as 2030,” BloombergNEF analysts wrote in a 2022 market outlook. “In other scenarios, prices could remain relatively flat for the next few decades, most likely preventing the market from ever really getting off the ground.”

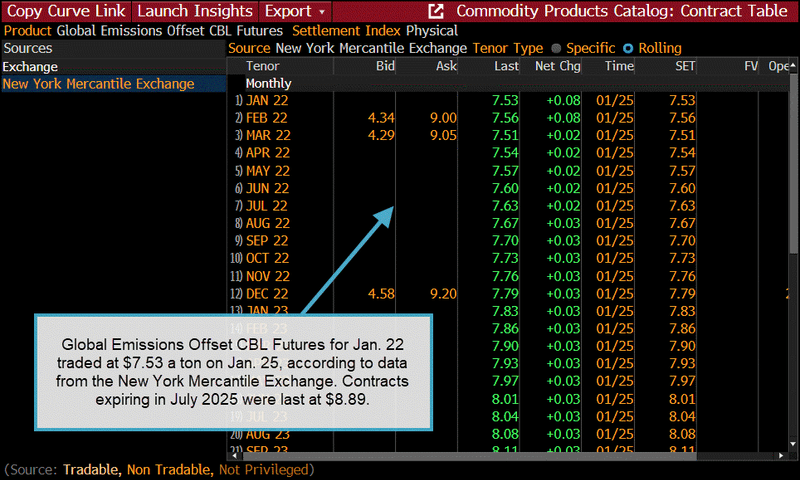

According to data from the New York Mercantile Exchange, Global Emissions Offset CBL futures for January 2022 traded at $7.53 a ton on Jan. 25. Contracts expiring in July 2025 were last at $8.89.

The emissions offset futures curve is in contango, with later-dated prices more expensive than near-dated ones. The curve has shifted higher from six months ago, suggesting futures trading above $9 in late 2025.

There are three basic scenarios in play, dependent on how carbon offsets are regulated:

Voluntary markets. The scenario predicts that offsets will be “unsustainably cheap” as supply grows from efforts to prevent deforestation, spur reforestation and sell clean cookstoves. If left unregulated, supply will flourish, and prices will grow slowly over time to $47 a ton in 2050. While low prices may be desirable for offsets buyers, other investors such as developers, banks and brokers will find little incentive to support the market.

Carbon removal. This scenario contains the best outlook for prices because companies are only allowed to purchase credits from the removal of CO2 to hit their sustainability targets, creating a limited supply. As a result, prices are projected to rocket 2,975%, to $224 a ton, in 2029 before tapering off to settle at $120 in 2050. This market would change industrial behavior on all levels as the world races to decarbonize.

Hybrid. This final scenario combines the first two scenarios and shifts the removals-only scenario-pricing shape to 2030, with a similar decline over time. Demand for carbon offsets remains consistent in all three scenarios, making the supply side essential to the final result.

Tracking the carbon trading market

For more information on this or other functionality on the Bloomberg Professional Service, request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.