This analysis is by Bloomberg Intelligence Senior Government Analyst Sarah Jane Mahmud and Director Larry R Tabb. It appeared first on the Bloomberg Terminal.

Execution algorithms are the most important buy-side-trader tool, according to our European Equity Trading Survey, which points to a rise in algo-broker engagement. While Europe lags behind the U.S., we see signs that the gap may soon close as more sophisticated algorithms help source liquidity in an increasingly fragmented market.

Algo-trading is slowly on the rise

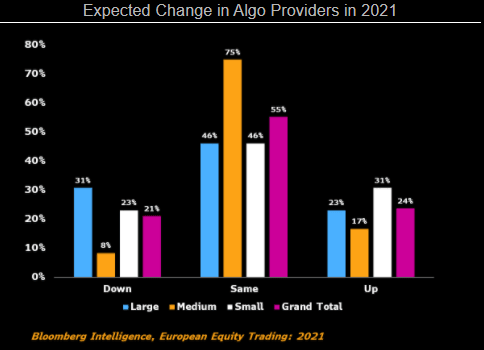

Algorithms are gradually gaining greater prominence among Europe’s buyside traders, with marginally more survey participants anticipating they’ll add additional algo brokers in 2021. Some 24% look to lengthen their list while 21% are ready to reduce it. While, overall, traders seek to sustain the status quo over the short-term, we see signs smaller firms are more keen to add to their toolkit than their larger peers.

The growth in automated-tool-use may suggest an improvement in algorithmic trading at sourcing liquidity from a fragmented market. It also suggests firms are better managing performance via algo wheels (software that compares and ranks the best broker or formula).

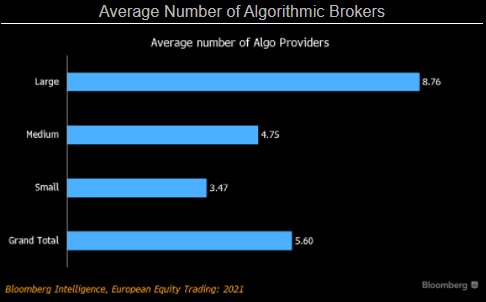

European traders access five-plus algorithmic suites

Though algorithms are the most critical trading tools, the use of “algorithmic suites” by each buy-side study participant is more limited in Europe than in the U.S. The average European trader accesses 5.6 algorithmic suites, which is 1.5 fewer than in the U.S. Larger European buy-side traders average closer to nine broker tools vs. 3.5 for the smallest rivals.

Algorithmic suites tend to include at least six basic models: volume- and time-weighted average price, implementation shortfall, dark, opportunistic and, increasingly, market on close. Buy-side traders customize many of these models to their own trading styles.

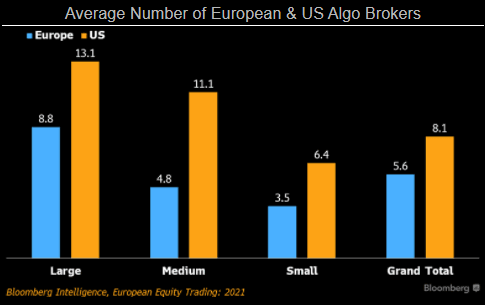

European traders use 5.6 algo brokers, fewer than U.S.

Though European buy-side study participants use more brokers than U.S. counterparts, they’re less inclined to tap those specializing in algorithmic trading. The average European buy-sider engaged just 5.6 algo brokers compared with 8.1 in the U.S. This was most pronounced among midsize funds (6.3-point gap), but Europe lags behind across the spectrum, with larger U.S. peers using 4.3 more algo brokers on average and small funds engaging with almost double the number.

We believe the gap will gradually decrease as European funds become more comfortable with algo wheels, which enable traders to more easily on-board and measure broker algorithms.

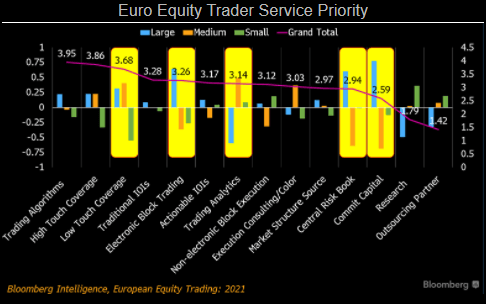

Trading algorithms, high/low-touch services most critical

Execution algorithms are the most important buy-side trader tool for study respondents, with 47% of European equity flow executed by a model. European buy-side traders say that execution algorithms are the most critical differentiator in soliciting business, as better models receive more flow. Outside of trading models, high- and low-touch service, followed by traditional indications of interest, the accessibility of electronic block liquidity and actionable indications of interest are the most differentiating broker services.

The average response is the magenta line, while the bar by size represents the difference above/below the mean.