This analysis is by Bloomberg Intelligence Senior Industry Analyst Matt Ingram and Bloomberg Intelligence Senior Industry Analyst Julie Chariell. It appeared first on the Bloomberg Terminal.

Buy-now-pay-later (BNPL) growth in the U.S. and China’s $11.3 trillion e-commerce markets could lift volume by 40% a year through 2023. High BNPL fees face pressure from merchant and consumer advocates. Valuations top tech peers, likely reflecting opportunities and lingering M&A interest, but providers need to improve ESG disclosures.

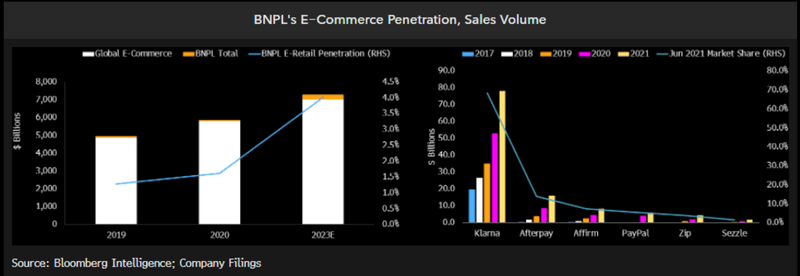

Rapid BNPL growth, yet penetration still low

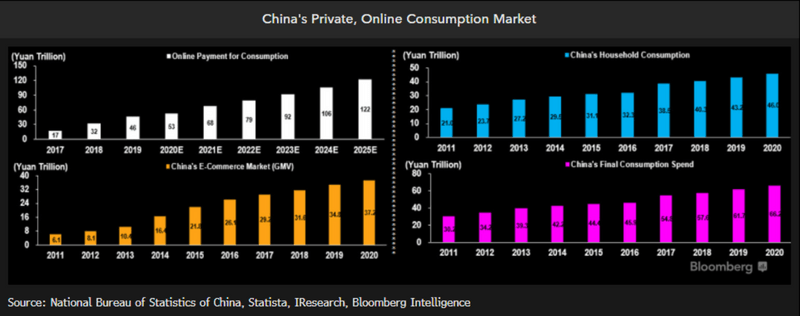

BNPL’s sales volume could top $181 billion by 2022 from $93 billion in 2020, growing more than 40% a year. This could push penetration to 4% of retail e-commerce vs. 1.6% in 2020, which appears low, given 70% of millennials — BNPL’s target customer — prefer online to in-store shopping. E-commerce may provide further BNPL tailwinds, potentially raising long run global retail sales beyond 19% penetration. China’s nascent BNPL market may be massive if Alipay and peers can penetrate the $5.7 trillion e-commerce market.

Klarna dominates for now, given 1H21 annualized $78 billion global sales volume and 250,000 merchants, but Affirm and Afterpay are gaining ground. Incumbents’ U.S. businesses may face competition from PayPal’s Pay in 4 installments service which leverages its 20 million merchants, providing a huge advantage.

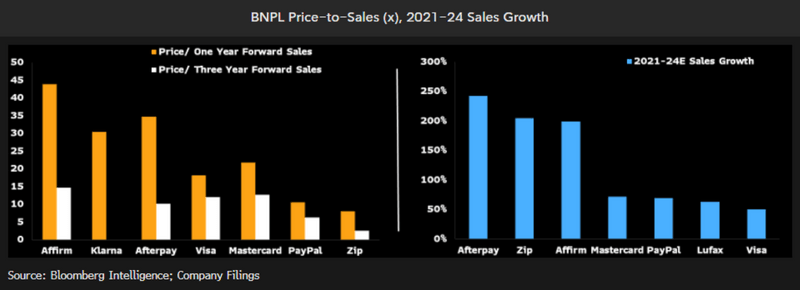

Affirm valuation now tops sector

Affirm’s 118% rally since Aug. 31 boosted its fiscal 2021 price-to-sales to 44x, topping the BNPL segment including former leader Afterpay, which stands at 35x on the same metric. The sector is generally expensive, as all listed BNPL providers’ valuations exceed the tech-focused Nasdaq. Afterpay’s fiscal 2024 10.6x price-to-sales represents a substantial drop, falling below Visa and Mastercard, but Affirm’s is still well above payments peers. Unlisted Klarna’s $639 million June fundraising valued it at about $46 billion, or 30x sales, which may be justified due to its market leadership.

The valuations may reflect high growth expectations — consensus forecasts Afterpay’s sales will grow 242% in 2021-24 vs. a peer group average of 98% and Nasdaq’s 25%. Lingering M&A interest may also be supporting the sector.

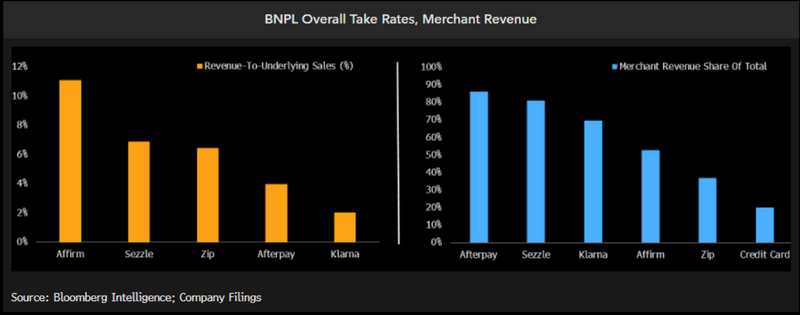

Fee pressure from multiple angles

BNPL fees may be pressured on many fronts, but it seems Afterpay and Sezzle may face less from consumer advocates for now, as 86% and 81% of revenue comes from merchants, respectively. Affirm may face the most pressure, as its 11% revenue to underlying sales tops peers and is driven by 47% of revenue from customers, including a 30% interest rate. PayPal’s “Pay in 4” merchant hit is 2.5%, perhaps pressuring others which charge up to 8% of transaction value on merchants. Afterpay says competition has not been an issue thus far, but we think its average 4.5% take rate could decline.

Afterpay received notice in October when the Reserve Bank of Australia said that removing BNPL “no-surcharge rules” would be in merchants’ best interests. This may force BNPL to cut merchant fees, but Afterpay said the impact isn’t material.

U.S. presents immense opportunity

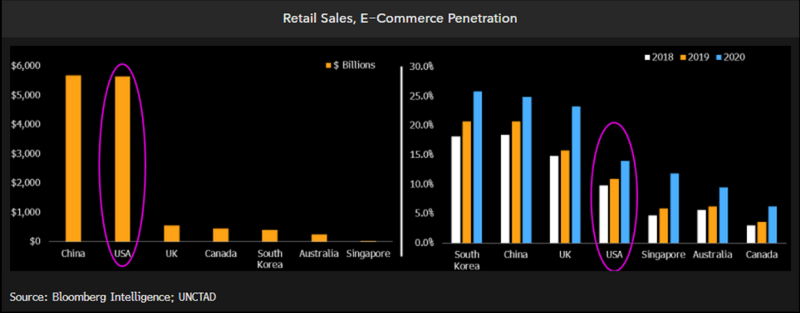

The U.S. presents a big opportunity — lifting BNPL and e-commerce penetration to Australia and U.K. levels potentially adding about $100 billion to U.S. underlying sales, a fivefold increase. The U.S.’s BNPL penetration was perhaps 3% of e-commerce in 2020 vs. around 10% for Australia. U.S. retail sales of $5.6 trillion are topped only by China, yet America’s 14% e-commerce penetration is nearly half of South Korea, China and the U.K.’s uptake. Improving e-commerce penetration may be driven by demographics, as Affirm says 70% of millennials prefer online shopping and Covid-19 may have been a catalyst to boost this penetration.

The U.S. opportunity is evidenced by Klarna, which grew its U.S. GMV by 334% to annualized $6 billion from 1H18 to 1H21 while Affirm added $8 billion in GMV over the same period.

China’s $5.8 trillion e-commerce market

BNPL has potential for exponential growth in China, which had an e-commerce market of 37.2 trillion yuan ($5.8 trillion) in 2020. One percent of penetration, or total sales of $58 billion, could be attainable within three years given China’s 87% fintech adoption rate. Many BNPL players, led by Alibaba, Pinduoduo and LexinFintech, started operations in early 2021. Bloomberg Intelligence estimates BNPL’s penetration of global retail e-commerce at 1.6% in 2020, and it could expand to 4% by 2023. It may take another 10 years for China to meet the 4% mark, which would turn it into a $233 billion market on the basis of 2020’s gross merchandise value.

BNPL could also expand its footprint in China’s offline consumption market (66.2 trillion yuan in 2020), experiences in overseas markets suggest.