Building materials: Industry profitability and growth

This analysis is by Bloomberg Intelligence analysts Sonia Baldeira and Iwona Hovenko. It first appeared on the Bloomberg Terminal.

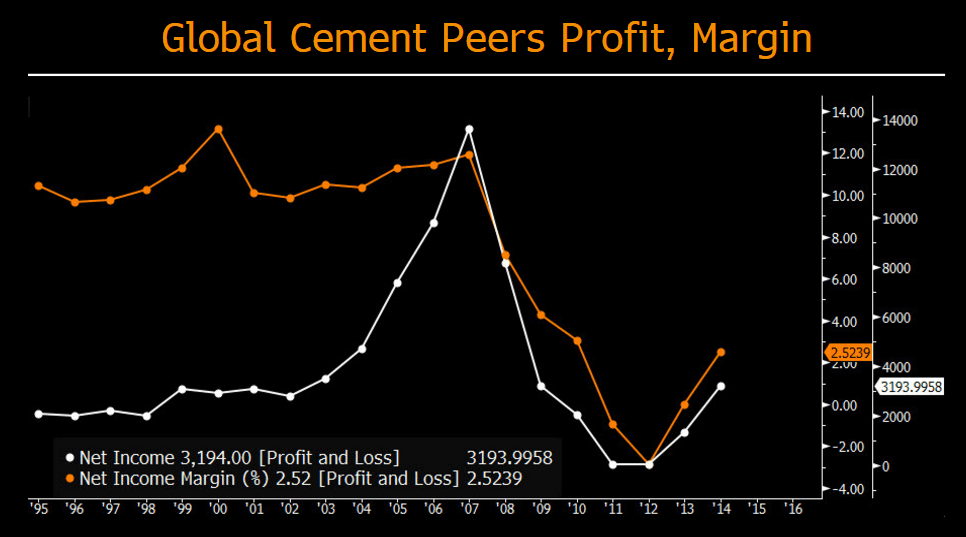

Cement makers sustain net profit margin recovery

The cement industry remains in recovery mode, after recording its worst annual average net profit margin loss of 2% in 2012 vs. the 2007 peak of 12%. Margins have improved as companies have cut costs and reduced debt, while selling non-core assets and improving the quality of their portfolios. Cement-makers’ average net profit margin rose for the second straight year in 2014 to 2%, according to Bloomberg Intelligence’s global peer group data.

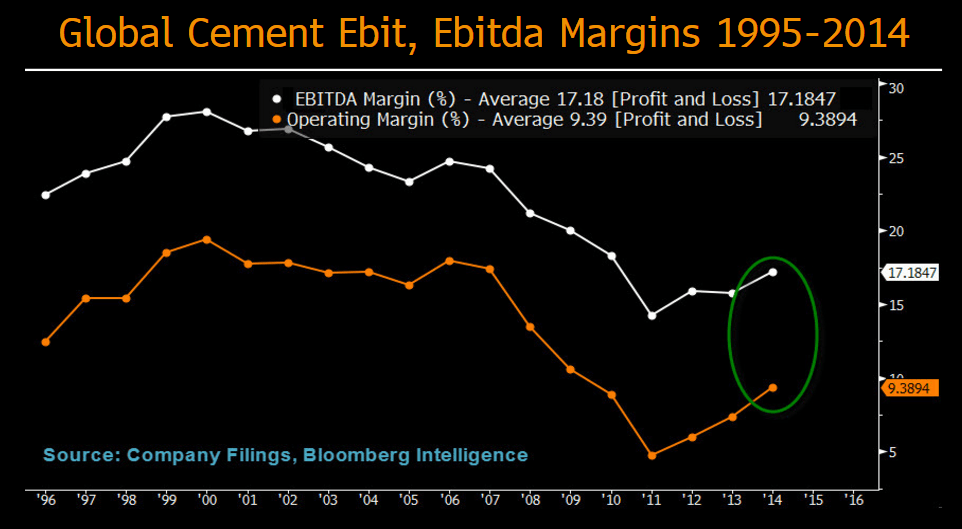

Cement margins may rise for 3rd year from 20-year low

The operating margin of Bloomberg Intelligence’s global cement-makers peer group may reach 10.5% in 2015 vs. 9.6% in 2014, when it widened for the second straight year. The group’s Ebitda margin may increase to 17.8% from 17.2% a year earlier. The industry has reduced costs and capacity to revive margins from the 2012 low of 7%, when an economic slowdown subdued demand. Margins peaked at 18% in 2006. Cement makers need elevated operating margins given the business model’s high capital intensity.

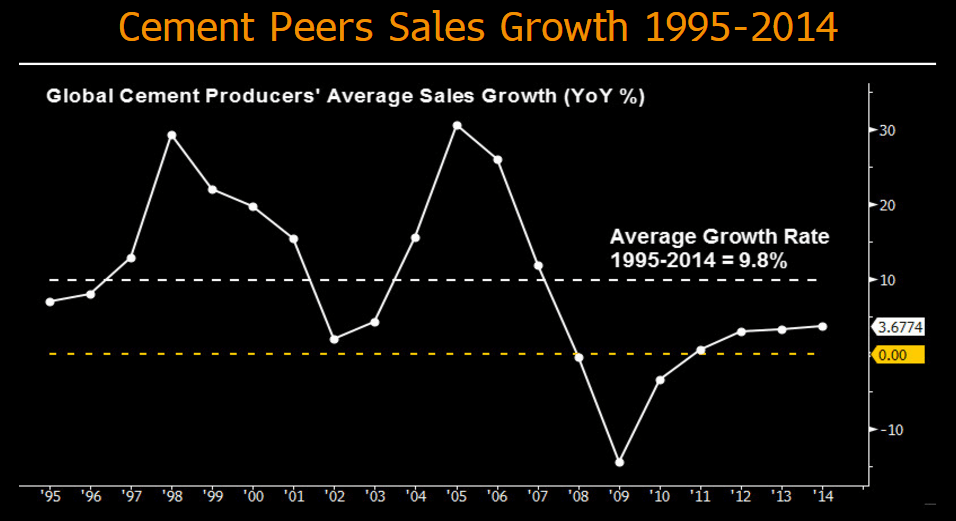

Cement sales up most since 2007, led by Latin America

Median sales growth for global cement makers may have reached 8.3% in 2015, based on consensus. This would exceed the average growth of 3.8% in 2014, which was the fastest pace since 2007. Latin American companies led in 2014, with jumps of 19% for Cementos de Chihuahua and 17% for Cementos Argos. Worldwide sales fell in 2009 and 2010 due to an economic slump, after rising as much as 29% a year during the boom of 2004-06. Growth averaged 9.8% between 1995-2014, with peaks in 1998 and 2005, and a trough in 2002-03.