This analysis is by Bloomberg Intelligence Head-Hedge Funds and Private Markets Analyst Gaurav Patankar. It appeared first on the Bloomberg Terminal.

Asian family offices further tighten their embrace of Singapore

As Asian family offices evolve from patriarchal to professional, sweeping generational change requires a deeper embrace of more formalized processes, structures and governance. Family wealth of varying sizes is increasingly moving to Singapore, in our analysis, given its access to talent, network synergies and more globalized portfolio aspirations.

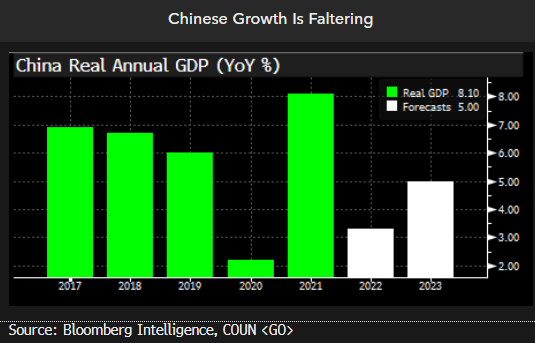

Xi’s extended term, slow growth push families from China

While the move to Singapore has been an ongoing trend for many wealthy mainland Chinese households, the recent Party congress which anointed President Xi Jinping for another term — and potentially a lifelong tenure — creates a tipping point for some citizens who are affluent investors. Hong Kong has become less attractive, given increasing mainland control. Fear of a wealth tax and rising scrutiny are big drivers of such moves, based on our anecdotal conversations.

China’s stalling growth and geopolitical isolation is prompting the country’s wealthy to consider Singapore as the hub for their wealth, especially as diversification out of Chinese assets becomes a paramount concern.

Generational transition key driver of Ambanis’ Singapore move

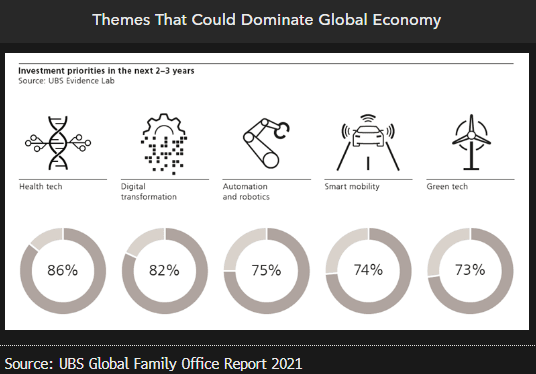

An unprecedented generational wealth transfer in coming decades, along with increasing market uncertainty, is altering how family offices allocate capital. There are four general needs of family offices — liquidity, lifestyle, legacy and growth — that influence allocation decisions. The Ambani family is an example, given its focus shifting to legacy and growth needs as the next generation takes over. The younger generation in such families typically end up being more global, demand higher returns and impact, and have more proclivity toward private equity and venture capital.

As the next generation explores asset opportunities in emerging asset classes, a location like Singapore becomes even more attractive.

Family offices turbo charge Singapore’s alternatives landscape

Searching for investment opportunities amid changing market conditions, global crises and the pandemic calls for a well-defined framework for risk-reward measurement, especially for non-traditional assets. Sources of alpha and their sustainability are primary factors to consider, followed by the investment horizon, mandates and risk profile of the family office. Alternatives leveraging a combination of low-correlation hedge funds and long-duration private equity in select familiar sectors might be more suitable than direct investing where family offices are less experienced. According to the Monetary Authority of Singapore’s annual survey released Oct 21., alternative AUM was up 30% year-over-year, with private equity and venture capital dominating at 42% and 48% growth, respectively.

Asian families embrace giving back as core concept

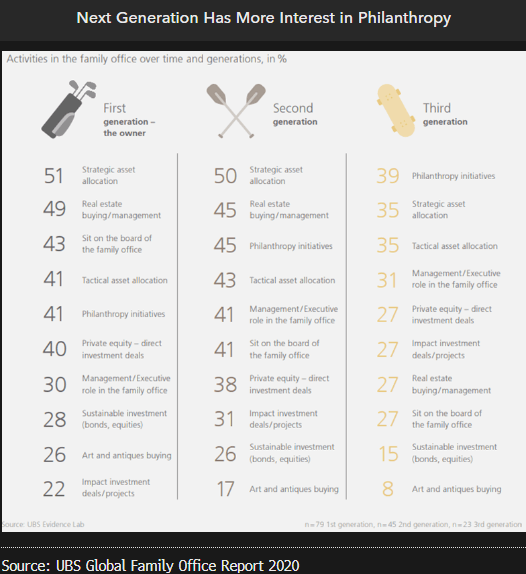

Philanthropy has been increasingly integrated into the investment decisions of family offices globally, and the next generation’s growing interest in these initiatives could accelerate the trend. Based on data from UBS Evidence Lab, younger managers are likely to focus more on philanthropy and impact investing than previous generations. Leveraging a family office’s assets as a change agent could affect the giving process and how these offices operate in accordance with ESG commitments.

Education and health remain the most-supported causes in family-office philanthropy, yet the pandemic and Russia-Ukraine war highlight increasing demand for flexibility to deploy capital for humanitarian causes.