This analysis is by Bloomberg Intelligence Senior Government Analyst Sarah Jane Mahmud and Director Larry R Tabb. It appeared first on the Bloomberg Terminal.

The results of our first European Equity Trading Survey suggest that MiFID II continues to widen the gap between the region’s money managers, despite an apparent easing of pressure on equity-research funding. Yet as regulators mull alleviating the ban on paying for research services via dealer commissions, traders appear to be wary of further change, in part because they believe order execution is better in an unbundled world. Meanwhile, bulge-bracket banks are still receiving the biggest slice of buy-side research budgets, though changes appear to be afoot.

Our interviews with 87 head and senior traders across Europe shine a light on shifting research-funding dynamics, notwithstanding the research-trading split.

Equity-research funding dynamics still shift after MiFID shock

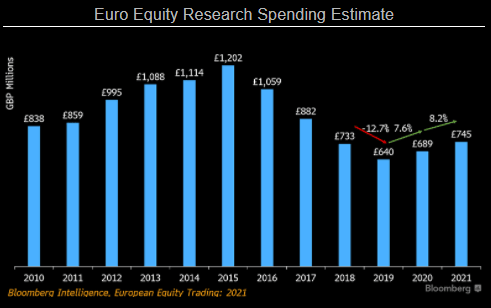

MiFID II pressure on investment research is easing, according to our European Equity Trading Survey, which points to a 8.2% funding rise this year. Yet the rule continues to magnify disparities between money managers. Our interviews with head and senior traders shine light on shifting research-funding dynamics, despite the research-trading split.

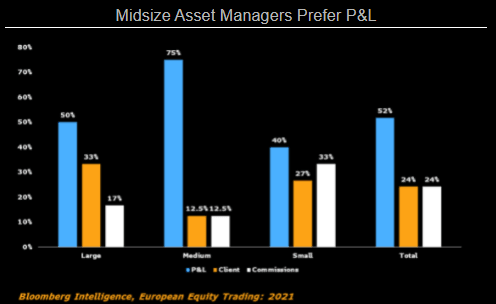

Buy side remains split over research funding

Europe’s buy side remains split over how it pays for investment research, with only a slim majority of those in our study choosing to absorb costs. This option is more popular among midsize firms, which have the resources and don’t want to hinder their ability to scale up by asking clients to pay. Smaller businesses make greater use of the research-payment account, whether funded by client money or transaction commissions. While this eases margin pressure, it comes with a raft of onerous compliance obligations.

COVID crisis calms corporate access conundrum

The majority of asset managers in our study appear to have overcome MiFID II’s ban on receiving free broker-provided corporate access some three years after the rule went live. We see a shift toward greater direct contact with companies, aided by the coronavirus-induced work-from-home trend that hastened the move to virtual meetings. While larger firms have built their own internal corporate access teams, we see signs smaller firms are gradually following suit, which will redefine the future of corporate access.

Key quotes

- “In terms of corporate access, generally we can go directly to the company ourselves and we have the research coverage we need, so we don’t actually need to pay for any corporate access.”

- Small U.K. Asset Manager

- “With MiFID II of course, we have less corporate access, but with Covid it has changed because now we’re doing the meetings over the phone or via Zoom. For us we could talk to more companies.”

- Small German Asset Manager

Research payments on pace to 16% increase from 2019 low

Research is one of the most significant services institutional investors consume. While MiFID II restricted how investors pay for equity research, the European Securities and Markets Authority (ESMA) didn’t preclude the use of brokerage ideas. Institutional investors increased their research funding 7.6% to 689 million pounds in 2020 after a decade-low 640 million in 2019. Our study points to 8.2% growth to 745 million pounds this year, driven by expansion of active management as well as increasing demands in understanding how the recovery from COVID-19 will affect the economy and corporate outlooks.

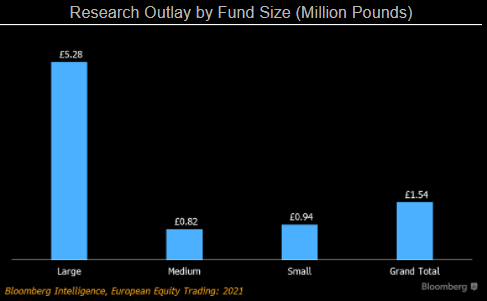

Larger funds spend 5x as much as smaller peers

Among the 87 participants in our European Institutional Equity Trading study, research spending by larger funds and those with heftier balance sheets outpaces smaller competitors by a wide margin. One of the major drawbacks of MiFID II research unbundling was to make buy-side firms pay for research out of pocket. Yet forcing them to buy research out of earnings, not commissions, magnified the disparity between managers; larger ones generally earn more and have greater resources to afford research.

Larger funds in our sample paid about 5 million pounds, on average, for research. Medium and smaller funds paid less than 1 million.