APAC ESG-linked financing outpaces green, as issuance breaks record

This article was written by Balkis Ammal, Sharon Chen, Adrian Yim, and Ken Yamaji at Bloomberg.

Background

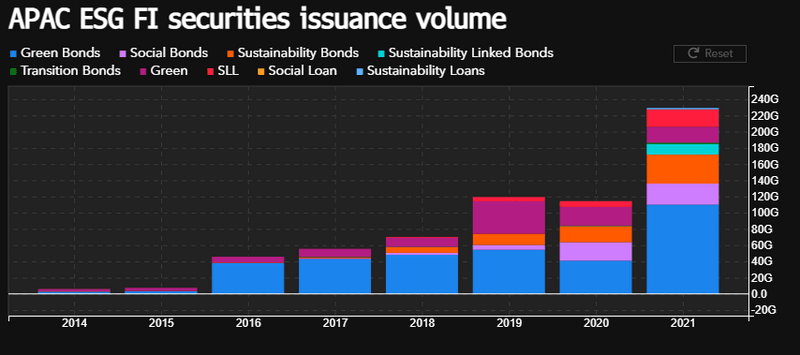

The nascent sustainable debt market in Asia-Pacific continues its blistering growth with more than $229.2 billion in ESG issuance year-to-date, more than a five-fold increase from its 2016 level. This is largely a result of issuers embracing corporate sustainability and governments acknowledging the importance of climate risk to economic sustainability. Across Asia, regulators are implementing initiatives to drive access and ESG disclosure, contributing to this growth. This article deep-dives into ESG Debt Trends, covering Asia’s largest ESG markets.

The issue

ESG bonds

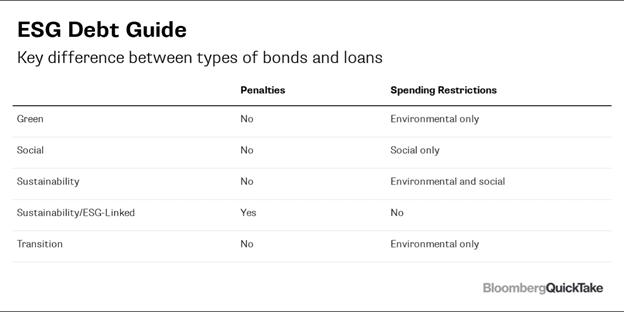

Since the launch of ICMA Green Bond Principles in 2014, new ESG instruments have emerged in the market such as social, sustainability, sustainability-linked (SLBs), and transition bonds. APAC ESG Bond market volume has reached $185 billion year to date, with 119.9% year-on-year growth. Green bonds account for 59.2% of total bond issuance with SLB’s starting to emerge as a popular instrument.

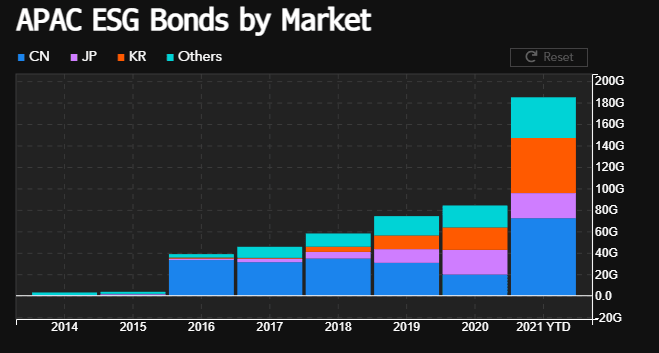

China has taken over Japan and Korea as the largest ESG bond issuer in Asia this year, driven by a green issuance surge of 230.3% year-on-year to US$60.5 billion. In May 2021, People’s Bank of China released guidelines for green lending, incentivizing borrowers towards financing environmental projects. By sector performance, the financial service sector’s green issuance grew by 1815% year-on-year. This is followed by the power generation sector’s issuance growth of more than 800%. China has earlier pledged to be carbon-neutral by 2060.

South Korea is APAC’s second largest ESG bond issuer. Its growth in social and sustainability bonds issuance is in line with the government policy of supporting local demand with measures to increase employment and income for the middle class and small businesses. South Korea accounted for 50.6% of APAC Social and Sustainability bond issuance, where the majority was issued by government agencies and government development banks.

Japan’s ESG issuance volume remains steady at US$23.5 billion YTD. Sustainability bonds and SLBs volume in Japan expanded 52.2% year-on-year to $8.8 billion, while social and green bonds volume decreased by 24.5% and 6.4% respectively. This year, the first domestic transition bond was issued by Nippon Yusen KK. As the government develops roadmaps for zero-emission solutions, more ESG issuance from diverse sectors is expected. Banks and automobile manufacturing sectors increased issuances by 1192.8% and 592.2% year-on-year.

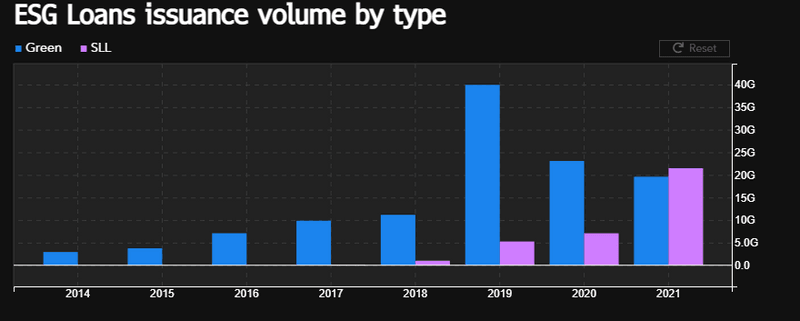

ESG loans

Sustainability-linked loan (SLL) issuance has overtaken green loans for the first time, cementing its growing popularity in the region. APAC Ex-Japan SLL volume posted a monumental 332% growth year-on-year, bringing in about US$21 billion from 49 deals.

Since 2019, Singapore has been the largest APAC ESG Lending market. In 2021, Singapore accounted for 33% of APAC Green Loans volume and 36% of APAC SLL loans volume, totaling US$12 billion year-to-date. Singapore’s ESG issuance growth of 67% yoy is underpinned by the latest government initiatives emphasizing ESG focus. In 2020, Monetary Authority of Singapore launched the Green and Sustainability-Linked Loans Grant Scheme for Corporations & Banks to boost access to ESG financing by reducing issuance costs.

China firms are also forging ahead in the green loan market, gaining momentum to match the global ESG lending boom. China green loans soared 195% year-on-year to US$4.3 billion, reaching a 9-year record high. As with the Green Bonds market, this growth is supplemented by China’s carbon neutral focus and ESG lending guidelines. China Green Loans took up the second largest market share, 22% of APAC Green Loans market. As ESG reporting is becoming an emerging topic in China, the SLL volume has climbed at a record pace to US$3.95 billion, taking up 18% of APAC SLL market and only lagging behind Australia by 2%.

Similarly, the Australia & New Zealand ESG market faced a two-fold increase in volume to US$9.2bn, from a massive rise in SLL issuance. In addition, this market saw the launch of the first social loan by Te Pukenga and the first sustainability loan by Royal Adelaide Hospital PPP in 2021.

Sector-wise, Green Loans issuance remains concentrated within Renewable Energy, Real Estate and Power Generation sectors, which accounted for 60% of volume. For SLL, sector distributions are more diverse: Real Estate (28%), Consumer Staples (29%), Refining & Marketing (12%), Hardware (8.6%), and Health Care (5.5%).

Issuer preference towards SLL

Overall, it appears that sustainability-linked debt has gained swift popularity over other ESG instruments as it provides spending flexibility while offering margin reductions if ESG KPIs are achieved. Other ESG instruments generally have pre-imposed spending restrictions (i.e. limited to environmental/social projects). However, sustainable financing growth has raised greenwashing concerns. As the market matures, more measurable and transparent ESG metrics would be preferred over generic ESG scores (blackbox from score providers) for SLL reporting.

Tracking

For Fixed Income Insights, subscribe to NI FIXI <GO> to stay updated on trends.

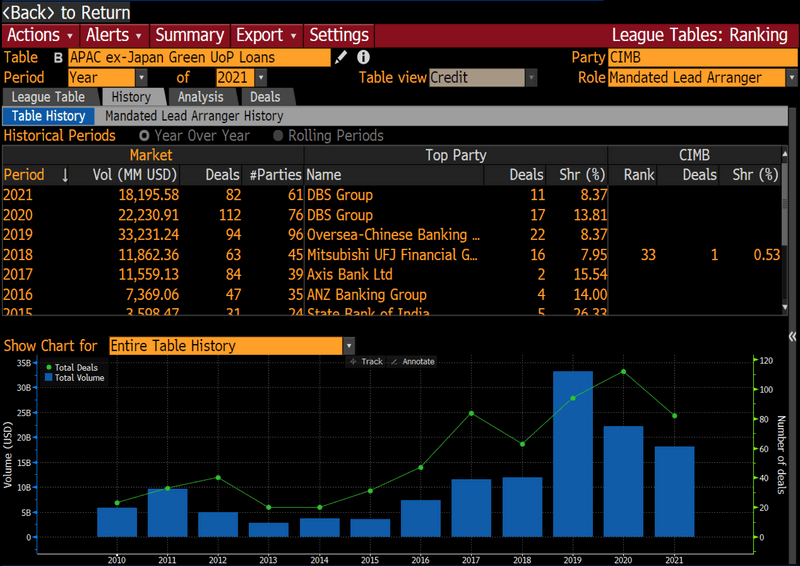

To track ESG Issuance, run LEAG and click into any of our ESG tables (example below):

For more information on this or other functionality on Bloomberg Professional Services, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.