Aluminum supply continues to decline while demand for the metal and raw material continue to grow

This article was written by Yukari Chilnik and Todd Sibilla at Bloomberg.

Chinese alumina imports have nearly doubled while concern regarding the impact of government oversight grows

Aluminum prices reached a ten year high across the global LME and Shanghai Futures exchanges during the last week of August 2021. As the world’s largest producer of aluminum, China’s conflicting attempts to curb carbon emissions and conserve electricity, yet unwavering dedication to economic growth is causing extra price volatility. It therefore may go without saying that the markets are paying special attention to the near term supply of industrial metals are monitoring China may once again use trade policy for geopolitical means.

As pockets of the global economy awaken from the Covid-19 pandemic, we are seeing renewed demand for the inventories that amounted in 2020 through 2021. Trading houses have been tracking the build in China’s smelter capacity and the impact on supply.

As Mark Burton and Jack Farchy report, “Aluminum is heading for a seismic shift as a long-running supply glut starts to fade, setting the stage for shortages and a price rally that could run for years.”

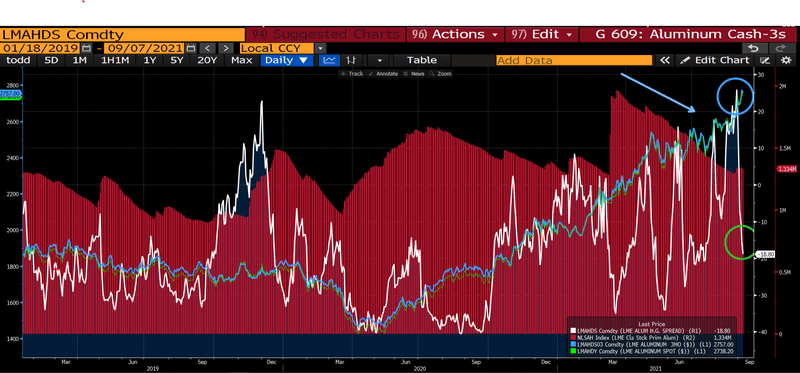

The LME “Cash to 3s” relationship – the relationship of Spot Metal to the 3 month forward benchmark – has been rising along with demand throughout the summer as evidenced by market backwardation. A higher price now, compared with a future point indicates near term demand for a commodity. At the end of August, the spread suggested that the demand for metal was increasing as the inventories were bleeding off.

The red histogram indicates global LME inventories. As prices for all forward points for aluminum rose, the Spot has remained higher than the 3 month (represented by the white line) and the LME aluminum spread.

Further, recent news of a coup in Guinea, a top producer of the raw material bauxite, has elevated prices for both the spot and near term 3 month due to potential supply chain concerns. The immediate impact was magnified on the 3 month, thus the spread decreased significantly on Sept 7 to roughly negative 19, marked by the green circle in the chart. We’ve seen a pattern of the near term spread returning to contango (where the futures price of a commodity is higher than the spot price) with negative values appearing throughout 2021 as observed with the white line.

As the market digests the political and economic news, the demand for materials continues. For professional market players, tracking who is using what is critical.

Sustainability, light-weighting of manufacturing in autos and aerospace, as well as traditional uses, all combine to increase demand for aluminum, but there are many other less visible industries having their own impact on the market. These other industries are often under analyzed due to the complexity of collecting, organizing and visualizing the data.

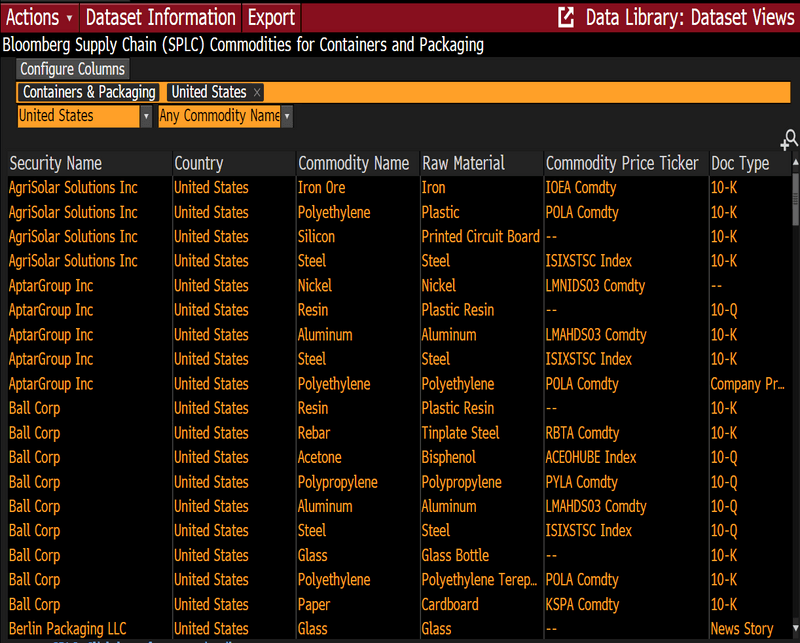

Bloomberg’s Supply Chain Data has released a new dataset covering the raw materials and commodities used by companies in the containers and packaging sector; a subset of the new raw materials dataset, which captures publicly disclosed raw material exposures from regulatory filings and news sources.

Those in the business of mitigating risk for materials should consider additional players who have an interest in the same commodities. This dataset can be used to discover and understand interest from other players in selected materials.

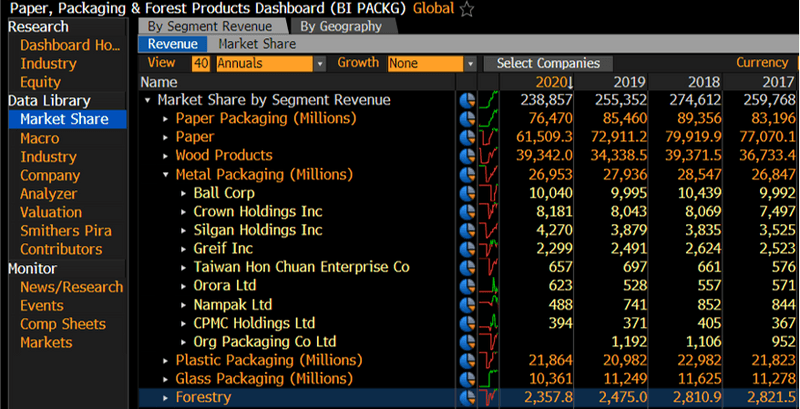

For example, among “container & packaging” companies in the United States, Ball Corp has the highest market share among those in the metal packaging sub-category.

However, Ball Corp not only has the exposure to aluminum but to other commodities. As aluminum consumption impacts the global manufacturing complex, the availability of the material will demonstrably weigh on company costs/profits as well as the related materials. These Bloomberg tools help show this next derivative in the commodity cycle.

These tools help monitor the commodity consumption of peers and competitors, allowing better risk management associated with given materials and stability of vendor networks most exposed to volatile supply and demand.

Additional reading: Bloomberg Quicktake – Why China Is Falling Out With Australia (and Allies)