Bloomberg Market Specialist Adam Lynne contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

U.S.-listed global growth funds are once again outperforming their value counterparts, delivering an 11% return, on average, during the first quarter. This compares with global value ETFs’ 5.4% gain. AOT Growth and Innovation ETF (AOTG) posted the highest year-to-date return, at 23%, followed by the Fidelity Blue Chip Growth ETF (FBCG) at 21% and T. Rowe Price Growth Stock ETF (TGRW) at 17%.

Alphabet Inc. and Nvidia Corp. are helping drive growth exposure within AOTG. This trend was seen more widely in March 2023 through a tech-fueled rally in the Nasdaq that was driven by Alphabet Inc., Apple Inc. and Microsoft Corp. With fears of contagion in the banking industry, investors moved toward the cash-rich balance sheets and durable revenue streams of megacap tech stocks.

The issue

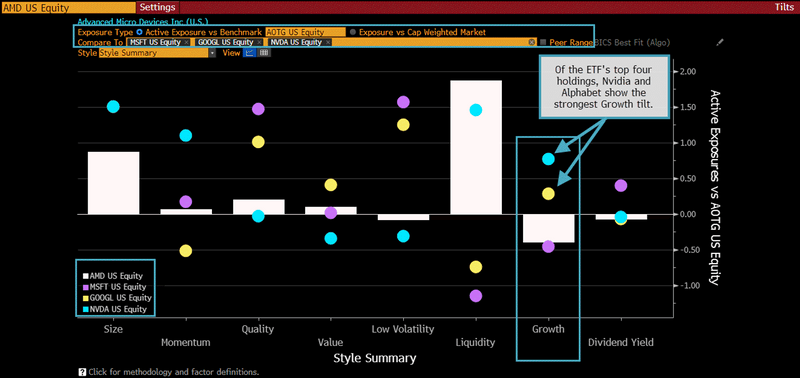

AOTG has a stronger tilt toward growth than its peer funds from Fidelity and T. Rowe Price, along with lower exposures to momentum, low volatility and dividend yields.

Of AOTG’s top four holdings, Nvidia and Alphabet are increasing the fund’s growth tilt, while AMD and Microsoft are pulling down its growth exposure. Nvidia ended the first quarter up 90%, the biggest gainer in the Nasdaq 100 and the S&P 500.

Meanwhile, the recent rise in popularity of Microsoft-backed ChatGPT and other artificial intelligence technologies are driving investors to add AI and robotics-focused ETF strategies to their portfolios this year.

By boosting its holdings of Nvidia and trimming AMD, AOTG could increase its exposure to growth.

Tracking

Use Bloomberg’s new TLTS function to dive into the factor exposures of funds and their individual holdings. Compare peers to see how adjusting top holdings might improve a fund’s tilt toward factors driving gains. For example, to compare the funds’ growth exposure:

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.