This analysis is by Bloomberg Intelligence Senior Credit Analyst Noel Hebert. It appeared first on the Bloomberg Terminal.

Inflation and, by extension, rate pressures are expected to leave much of fixed income struggling to generate positive total returns in 2022, with high-yield assets remaining relative outperformers on lower duration and higher carry. Those same inflation trends, and the monetary policy response thereto, may favor the dollar, while the yuan and Bitcoin could also enjoy relative strength.

Few pockets seen offering positive total returns

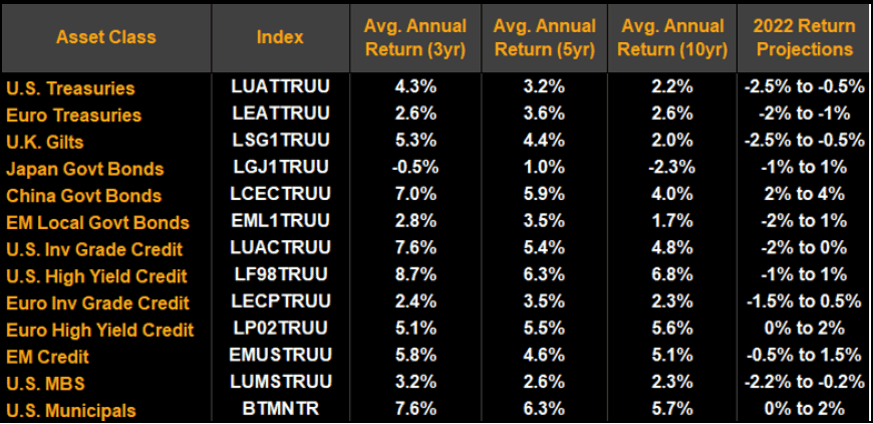

Fixed-income practitioners must contend with a still-weak beta environment, with few asset classes expected to generate positive performance over the next year. Based on our projections, China government bonds, European high yield and U.S. municipal debt could deliver positive total returns in the year ahead.

Accelerated Federal Reserve tapering, and increased policy rates more broadly, are the primary risks facing global creditors, with two-, five-, 10- and 30-year Treasury yields seen rising 40-65 bps.

Our fixed-income total return expectations

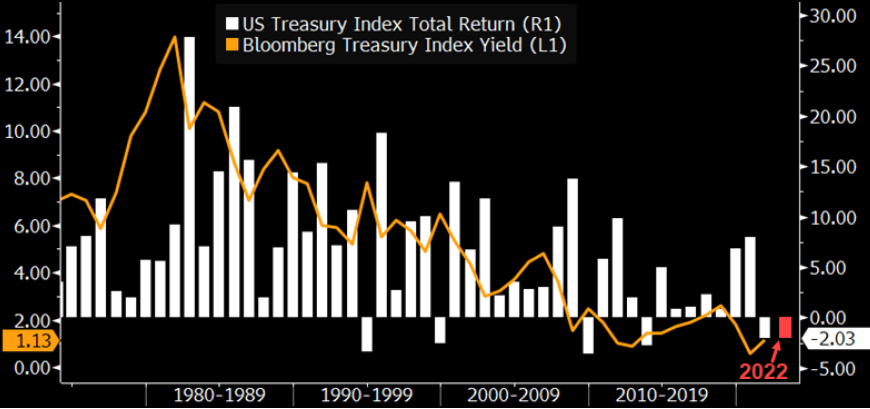

Treasury index to post unprecedented second negative-return year

The Bloomberg Treasury index may record a negative return for an unheard-of second-straight year in 2022 given that we see yields rising, led by the front end as the Federal Reserve begins hiking interest rates. Though the initial timing remains uncertain, we think a midyear liftoff most probable, which should cause Treasury-yield-curve flattening.

Second year of negative treasury index return?

Our expectation for higher yields across the curve implies the Bloomberg U.S. Treasury Index may post an unprecedented second-straight negative annual return in 2022. Over the past 50 years, negative Treasury Index returns were rare, even when interest rates rose. In the now distant past, Treasury yields sometimes rose multiple years in a row, yet coupon income was high enough for the index to eke out small gains — such as the late 1970s and mid-1980s. With market risk (duration) higher and small coupons, the risk of negative annual returns is greater today than in past decades.

If yields increase as we expect, 2023 will be a closer call for whether returns are positive or not. Income may be higher but not by much; and index risk remains above past selloffs, making three years of negative returns a distinct possibility.

Treasury index annual return

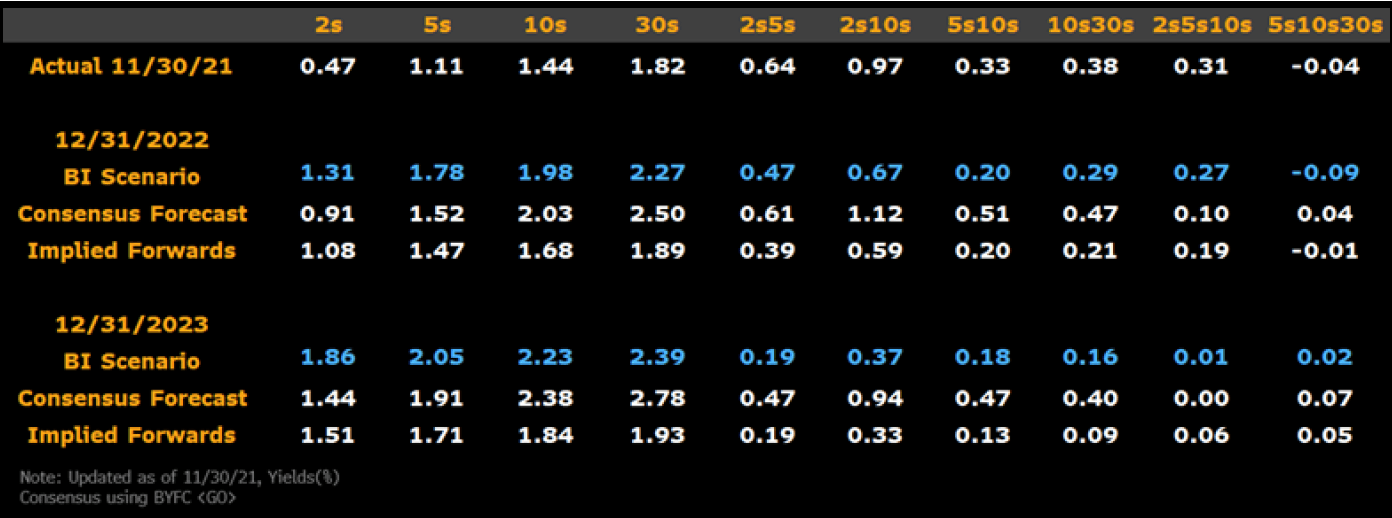

Two-year yield to climb as hikes approach

The two-year Treasury yield may climb more than consensus and implied forward rates imply, potentially rising to 1.31% by the end of 2022. This yield is derived from a bootstrap of our projections of the federal funds rate (which is similar to the Bloomberg Economics view) over the next several years. We continue to believe the belly of the curve (five-year Treasury yield) should underperform into 2022 but some time before midyear may begin a trend of outperformance, particularly as front-end yields move higher.

Our expectations for longer-maturity yields are little changed from last month, which continues to suggest curve flattening more than consensus yet overall yields climbing more than forwards are implying.

Treasury yields: Our view, consensus & forwards

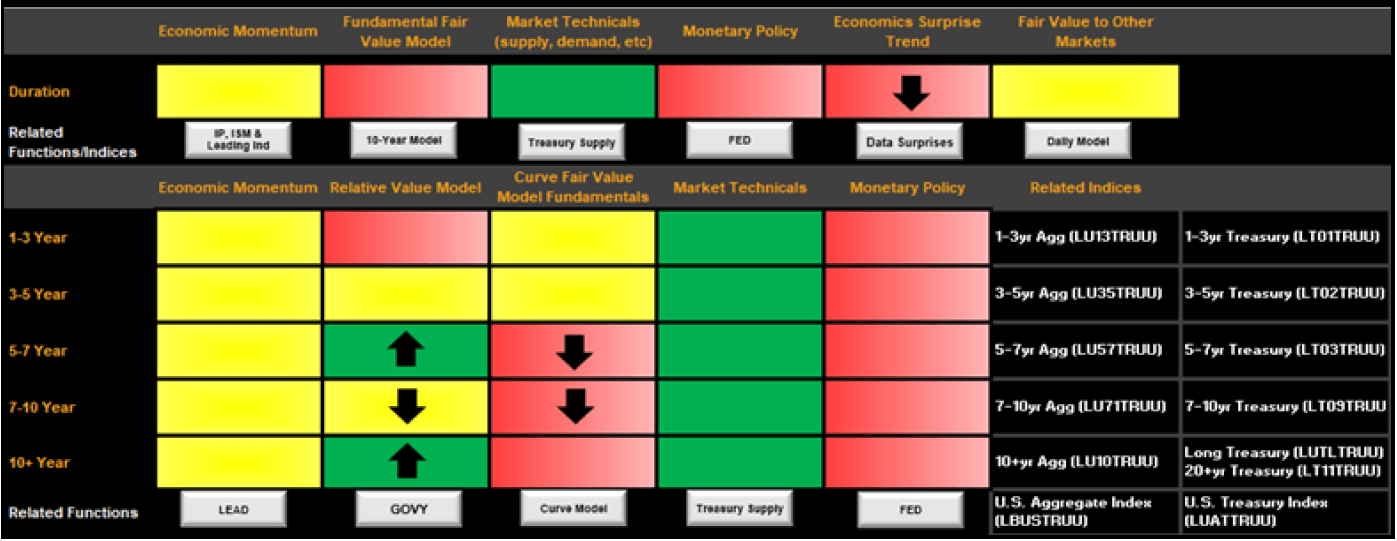

Duration scorecard cautious treasury market

The recent increase in the Bloomberg Economic Surprise Index has moved our Treasury duration scorecard more cautious, with three of the six indicators now flashing warning signs that the market may sell off. The Treasury Department continuing to reduce coupon issuance is currently the only positive indicator in the duration scorecard as our fundamental models suggest yields should be higher and the Fed will continue to taper asset purchases, adding to effective supply.

The yield-curve scorecard is once again neutral on the view of the curve, though GOVY <GO> shows shifts in some sectors to the exponential spline model are too steep and should flatten, our curve models suggest potential steepening given economic fundamentals.

Treasury yield and duration scorecards