This analysis is by Bloomberg Intelligence Senior ESG Analyst Rob Du Boff and Director of ESG Research EMEA & APAC Adeline Diab. It appeared first on the Bloomberg Terminal.

In the year ahead, pressure will be on companies and governments to step up efforts to build a more sustainable and equitable future in the wake of last year’s momentous COP-26 climate summit. Companies worldwide will continue to enhance carbon targets, but time is running out to meet a 1.5-degrees Celsius temperature-increase limit. The capital markets and financial institutions will increasingly turn attention to their roles in the transition away from carbon, and we expect record sales of green bonds to accelerate this. Clean-energy funds sit at a tipping point for expansion as ESG assets overall may exceed $41 trillion this year. Activist shareholders and regulators alike are asking more of market participants.

Climate focus will soon shift to financers from CO2 emitters

Financial companies that provide capital to CO2 emitters will likely garner increased attention for their roles in the carbon transition, we believe. Global companies will continue to enhance their CO2-reduction targets as time runs out to meet a 1.5-degrees Celsius benchmark, while those that rely heavily on CO2 offsets may end up seeing higher costs.

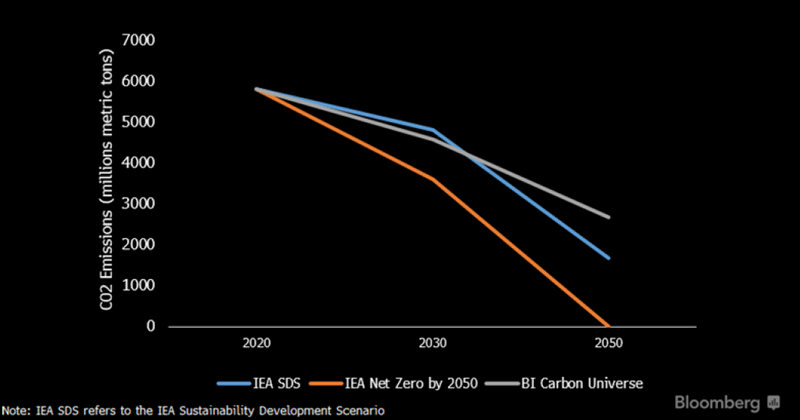

CO2 targets lack ambition to meet 1.5-degree benchmark

Companies will strengthen their CO2-reduction commitments in 2022, as the majority of current targets fail to meet a 1.5-degree Celsius benchmark. Our analysis of company-stated CO2-reduction strategies for over 300 companies, representing roughly 15% of global emissions, found that CO2 will fall by more than 20% between the latest year and 2030, and more than 50% by 2050. Holding emissions constant for those yet to establish a target, this group will miss the 40% reduction by 2030 from 2020 levels and to net zero by 2050 that the IEA has called for to limit warming to 1.5 degrees. Companies that fail to act risk increased costs, stranded assets and shareholder pressure.

Our analysis covers the oil and gas, utilities, metals and mining, steel, airlines, marine shipping, chemicals and automotive industries.

BI carbon: CO2 forecasts vs. IEA scenarios

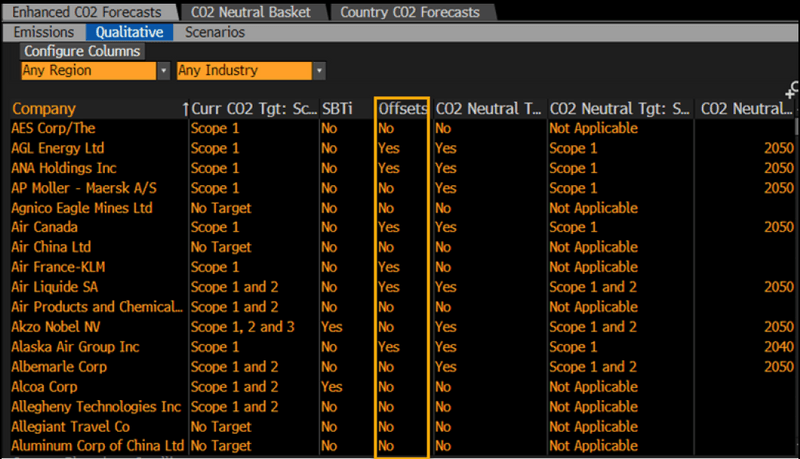

Shifts in offset market could lead to surge in costs

As demand for carbon offsets soars, and a shift away from avoidance offsets and toward removal ones takes shape, companies may see a dramatic increase in the cost of their decarbonization strategies. Our analysis of over 300 companies in the most carbon-intensive industries suggests that more than 50% of those with CO2-reduction targets rely on offsets. According to BNEF, a glut in supply of avoidance emissions has allowed prices to average $2.50 per metric ton, but a gradual shift toward removal offsets could cause prices to jump to $207 a ton in 2031 before settling at nearly $100 a ton in 2050.

JetBlue, for example, could see significant cost increases, as it offsets emissions from all domestic self-operated flights, about 3 million tons.

BI Carbon: Reliance on CO2 offsets

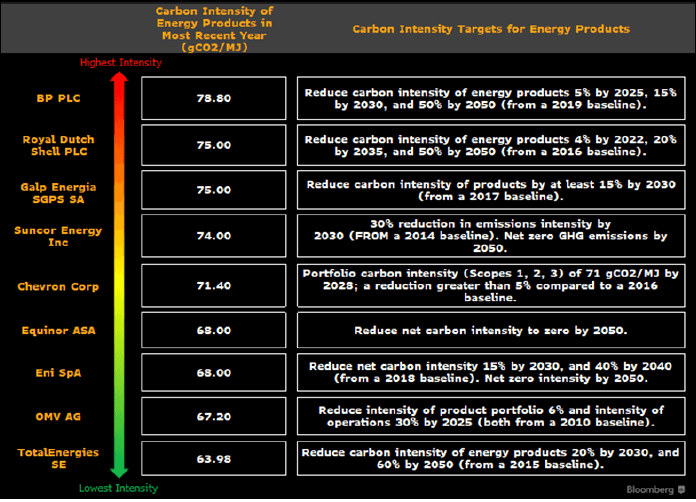

Climate clock ticks and disclosure on key metrics lacks

Climate-related disclosure has improved, but a lack of transparency on critical metrics is hindering analysis of the CO2 transition in certain industries. Less than half of integrated oil and gas companies disclose Scope 3 (use of products) and fewer disclose carbon intensity (CO2/MJ) of the energy products they sell. The latter is essential as companies, including TotalEnergies, base their transition strategies on providing less carbon-intensive forms of energy. In our peer set of 31 automakers, only 13 disclose Scope 3 (use of products) emissions, despite it being roughly 98% of the total carbon footprint for the average auto company. Only four disclose a sales-weighted average fuel economy, which would provide a better view of real-world fuel and carbon intensity, as less-efficient trucks and SUVs dominate sales.

Integrated oil and gas: Carbon intensity of energy

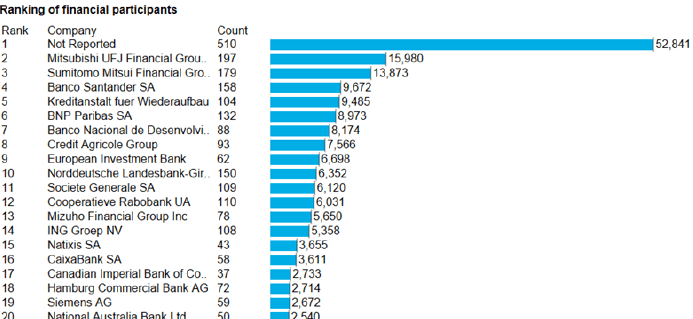

Financers take action on climate and Face increased scrutiny

Top CO2 emitters will remain in focus, but 2022 is likely to see a focus on financial institutions’ role in enabling — or hindering — the carbon transition. Climate risk will be the focus of the European Central Bank’s supervisory stress test this year, reviewing how banks incorporate these risks into their strategy, governance and risk-management frameworks. The Glasgow Financial Alliance for Net Zero (GFANZ), which includes over 450 financial firms responsible for more than $130 trillion in assets, seeks to raise net-zero ambitions across the financial system and support companies and countries in achieving the goals of the Paris Agreement.

Members of the insurance subsector, including Swiss Re and Munich Re, have committed to transition their underwriting portfolios to net-zero greenhouse-gas emissions by 2050.

Lead arrangers of wind projects 2015-2021