This analysis is by Bloomberg Intelligence analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

Incentivized by China’s ban and the proliferation of revolutionary technologies such as crypto dollars and non-fungible tokens (NFTs), we expect the U.S. to embrace cryptocurrencies in 2022, with proper regulation and related bullish price implications. Stable coins may be misnamed, as most of them track the dollar. The unlimited supply of fiat currency should sustain rising prices, notably in Bitcoin and Ethereum, which have limited supply. What might trip up the advancing three musketeers — Bitcoin, Ethereum and crypto dollars — may be the more profound question for 2022, but we expect wider adoption to prevail and overcome most wobbles, like 2021’s near 50% correction.

Some normalization in stock-market returns and a continued decline in U.S. Treasury bond yields may shine on Bitcoin and Ethereum in portfolios.

Bitcoin, Ethereum, cryptos, the Fed and 2022 deflationary forces

Renewed impetus from the Federal Reserve to take away the punch bowl, and declining bond yields may point to a macroeconomic environment in 2022 that favors top cryptocurrencies Bitcoin and Ethereum. Crypto assets showing divergent strength vs. equities near the end of 2021 may portend continued digital-asset outperformance in 2022.

Is Bitcoin looking forward to a Fed end game?

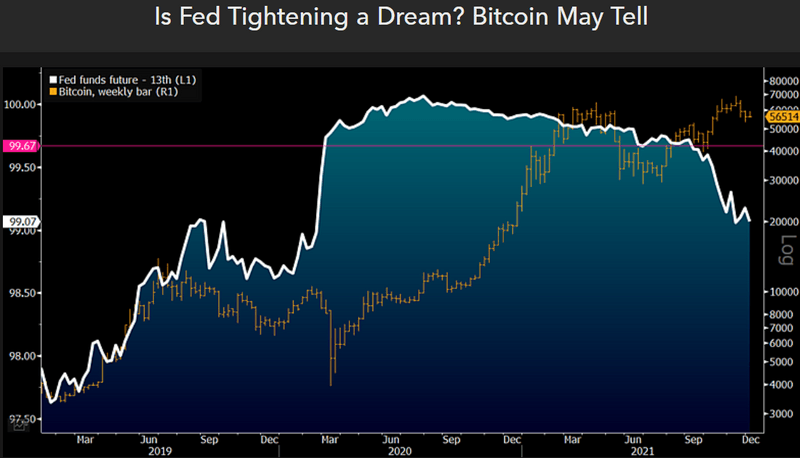

A primary force to reverse expectations for Federal Reserve tightening in 2022 is a drop in the stock market, which may be a bit of a win-win for Bitcoin. The benchmark crypto, well on its way to becoming a digital store-of-value, remains in a price-discovery mode and is a risk asset, and has been rising with the equity tide. Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices pressure bond yields and incentivize more central-bank liquidity, the crypto may come out a primary beneficiary.

Our graphic depicts the one-year-out Fed funds future pricing for higher rates in 2022. The facts of failed attempts by the Federal Reserve to sustain tightening cycles, notably since the 2015 hike, point to the U.S. following Japan and Europe toward negative yields.

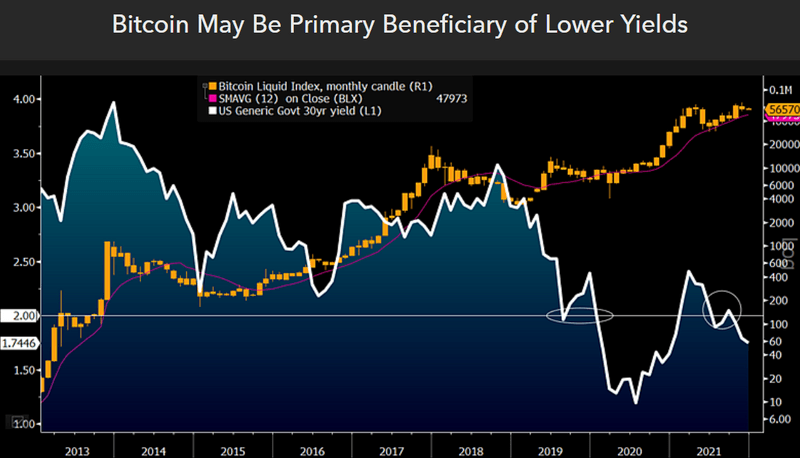

Against-consensus declining bond yields and Bitcoin

The inability of the U.S. Treasury long bond to sustain above 2%, despite widespread consensus for higher yields, may be a primary indicator of a transition back to a more deflationary environment in 2022 favoring Bitcoin. The long bond first dropped below the 2% threshold in February 2020, signaling the severity of the pandemic. Most risk assets followed in March. Our graphic depicts U.S. yields potentially on a trajectory to follow Japan and Europe into negative territory. The upcoming digital reserve asset may be a top standout to benefit.

Funds have been moving away from old analog gold and toward Bitcoin and Ethereum. The question for 2022 centers on reversal or acceleration of these flows. With bond yields in decline, our bias is toward the latter.

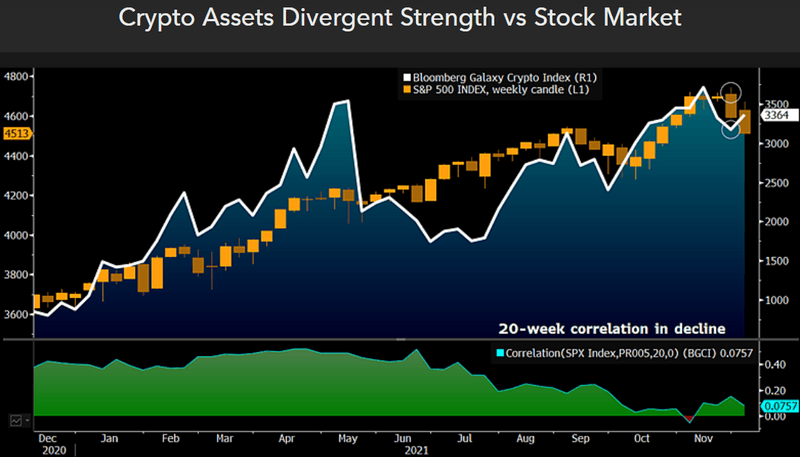

Do cryptos have an advantage vs. the stock market?

Divergent strength vs. the stock market and underpinnings from the sharp drawdown in 2021 may set the stage for further appreciation of cryptocurrency asset prices in 2022. Compared with broad equities, which haven’t had a 10% correction since the 2020 swoon, the crypto market may have a relative advantage in 2022. Our graphic depicts the Bloomberg Galaxy Crypto Index recovering despite the declining S&P 500 at the end of November. Cryptos are risk assets, but the primaries — Bitcoin and Ethereum — may be transitioning toward stores-of-value.

Diminishing supply is a key attribute shared by the top two cryptos. Digital assets, in early adoption-and-migration days into investment portfolios, may have an advantage vs. an extended stock market, at risk of wobbling, notably as the Federal Reserve reduces liquidity.

Three crypto stalwarts for 2022? Dollars, Ethereum, Bitcoin

Representing a better way to transact, a strengthening ecosystem and an asset class that’s here to stay, crypto dollars are the most significant advancing part of the digital-money revolution and the third leg of the crypto stool. Bull markets in the other two — Bitcoin and Ethereum — look as durable as the advancing market cap of stable coins tracking the dollar.

Bitcoin, Ethereum and crypto dollars in 2022

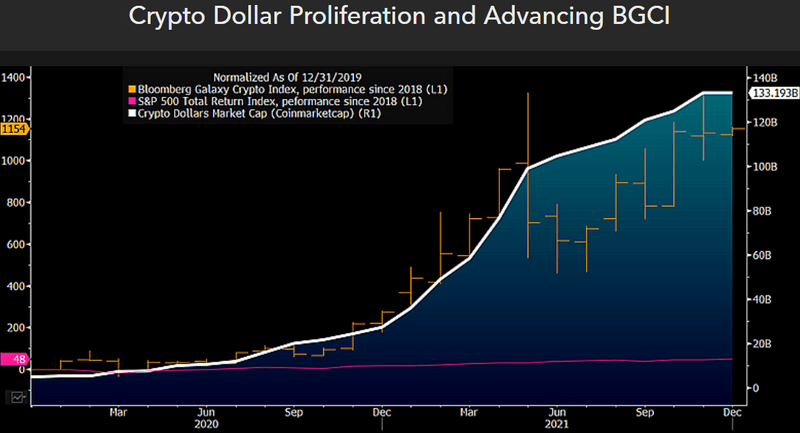

Past performance is no indicator of future results, but when a new asset class outperforms incumbents, naysayers have little choice but to join in. We see this process playing a primary role in 2022, as money managers may face greater risks if they continue to have no portfolio allocations to cryptos. Our graphic depicts the Bloomberg Galaxy Crypto Index (BGCI) increasing about 1,200% since the end of 2019 vs. closer to 90% for the S&P 500. Such outsized performance typically comes with volatility, and the almost 60% drawdown in the BGCI in 2021 could add underpinnings for further appreciation in 2022.

The BGCI is 80% Bitcoin and Ethereum. A solid trend of 2021 that we expect to accelerate in 2022 is the proliferation of crypto dollars. Our graphic shows the crypto dollar market cap rising above $130 billion.