Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Senior Commodity Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

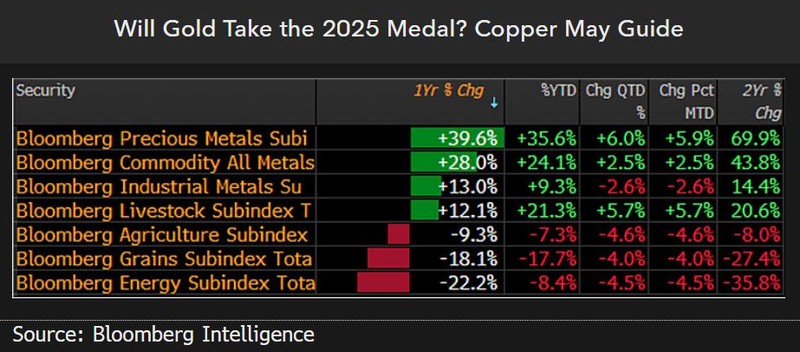

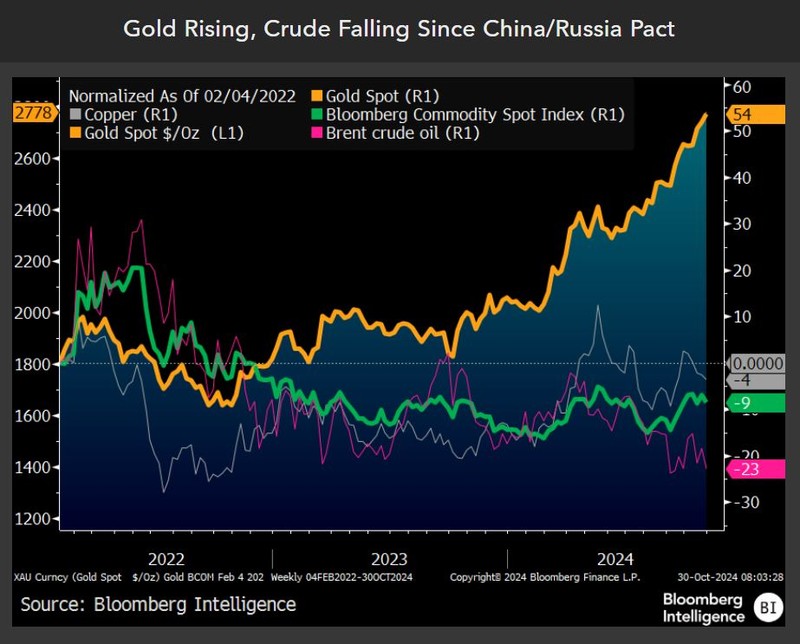

Some combination of a rising US stock market, more stimulus from China, less OPEC supply, poor growing conditions and a weaker dollar may be needed for broad commodities to rise in 2025. That gold is up over 50% and the Bloomberg Commodity Spot Index down about 10% since the top commodity importer — China — announced the tilt to Russia and away from its best export customers — Europe and the US — may augur geopolitical underpinnings for the precious metal. What stops these trends?

A Republican sweep in the US elections might add fuel to rising gold vs. most commodities. The checks and balances of a Democratic president and Republican Congress could be a gold headwind. Most commodities are on a similar track as US natural gas toward low-price cures. Standout copper may need to rise to avoid tumbling dominoes.

Copper may need to rise to avoid commodity deflationary dominoes

Substantial US deficit spending and fiscal and monetary stimulus in China are tailwinds for gold and stock markets, but not necessarily for broad commodities. Copper may share the US equity markets’ inordinate burden to keep rising and avoid broadening deflation from most commodities.

Inordinate burden? Copper’s do or die

If copper drops, the deflationary implications from most commodities falling and gold rallying could be historic. Gold’s more than 50% gain since February 2022 is juxtaposed by crude oil’s almost 25% decline and copper’s roughly 3% fall. If copper stays below $9,000 a ton, it would join downward trajectories in energy, grains and iron ore, adding to deflation contagion. Our bias is industrial metals need to rise to show China stimulus is working, which may portend an inordinate burden on copper to go up, akin to the US stock market.

Falling energy and agriculture prices have helped record-setting equities, but on the back of massive US deficit spending, with reversion implications. China’s tilt toward Russia at the start of 2022 could stay a top headwind for most commodities.

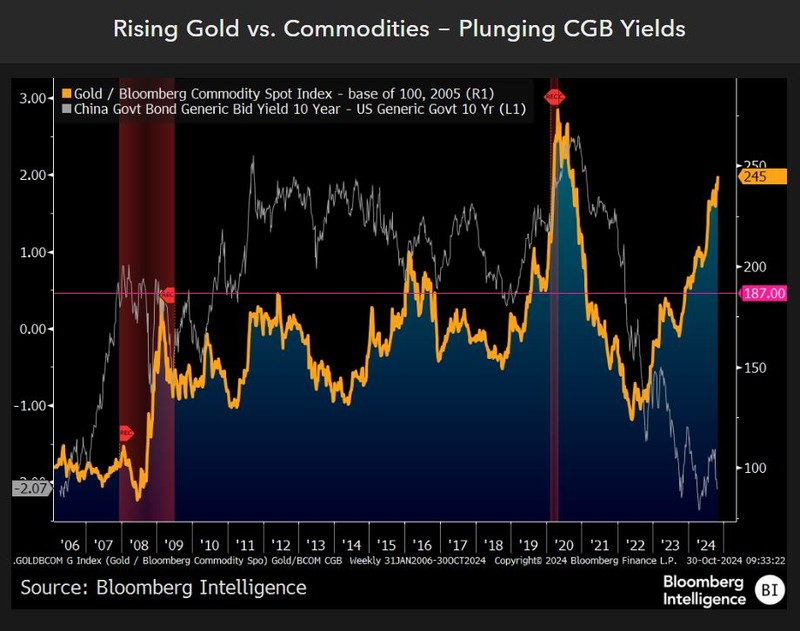

Deflationary cliff’s edge: Gold and CGBs vs. Treasuries

Chinese government bond (CGB) yields at about half of US Treasuries show deflationary inklings from the top commodity importer, with headwind implications for material prices and underpinnings for gold. Our graphic shows the ratio of the metal vs. Bloomberg Commodity Spot Index on a global recessionary trajectory and approaching the 2020 peak. The key question is what stops it? If CGB yields can revert upward toward Treasuries, it might suggest reflation in China and copper could be a top leading indicator/companion.

A big risk is if Treasury 10-year yields at about 4.25% on Oct. 30 drop toward CGBs at 2.16%. The primary force for that may come on the back of a decline in the US stock market and related recession leanings. On a deflationary cliff’s edge is how we see commodities at the end of October.

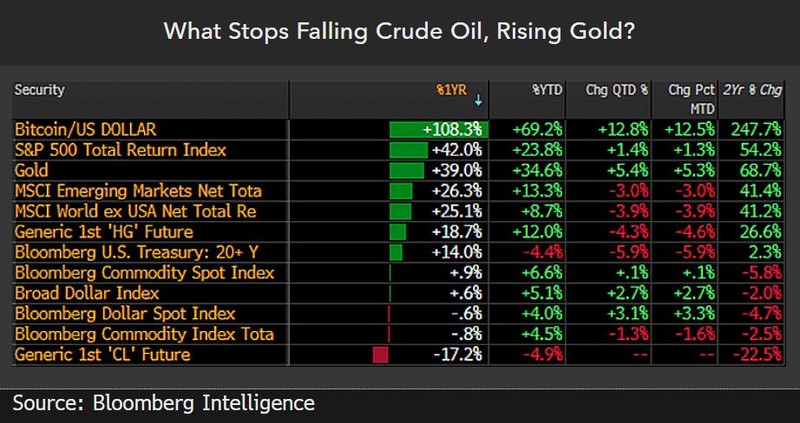

Inflating gold vs. Deflating crude – What stops it?

Bitcoin, the S&P 500 and gold at the top of our annual performance scorecard and crude oil on the bottom may reflect investors betting on a potential reelection of former President Donald Trump, with reversion implications. Regardless of who will be president, crude appears likely to keep gravitating toward the US break-even cost around $56 a barrel and may drop to about $40 if the pattern since the 2008 $147 peak is intact. We think it’s as indicated by the 1H plunge in US natural gas and grains nearing break-even costs.

A poor 2025 South American growing season or sustained recovery in crude imports from China could portend a commodity nadir, yet both appear unlikely. It’s the risk of some normal bull market back-and-fill in the US stock market that we find the most disconcerting to join deflating commodities.

Global recessionary trajectory from commodities

Gold’s year-over-year 40% gain to Oct. 30 vs. falling agriculture, grain and energy prices is a global recessionary track. It’s a question of the potential for reversal or continuation in 2025, and our bias leans with the trend, especially if there’s a red sweep in US elections. Drill-at-will, tariffs, pushback on the Federal Reserve and uncertainty — and the potential volatility of a second Donald Trump term — are tailwinds for gold and headwinds for crude and grains.

Industrial metals are stuck in the middle, which narrows our focus on the need for copper to stay above $10,000 a ton to show the potential for global reflation vs. the risks of falling below $9,000 and joining tumbling commodities, with the notable exception of gold. Our bias is up for the precious metal, but a Kamala Harris win might be a bump in the road.