Bloomberg Professional Services

Background

When Brian Niccol took the helm at Starbucks Corp. on Sept. 9, shares jumped 24% on the news.

Why such high hopes? Niccol previously served as CEO of Chipotle Mexican Grill Inc. and oversaw roughly 40% in annualized returns — while competitors generated roughly 2% gains.

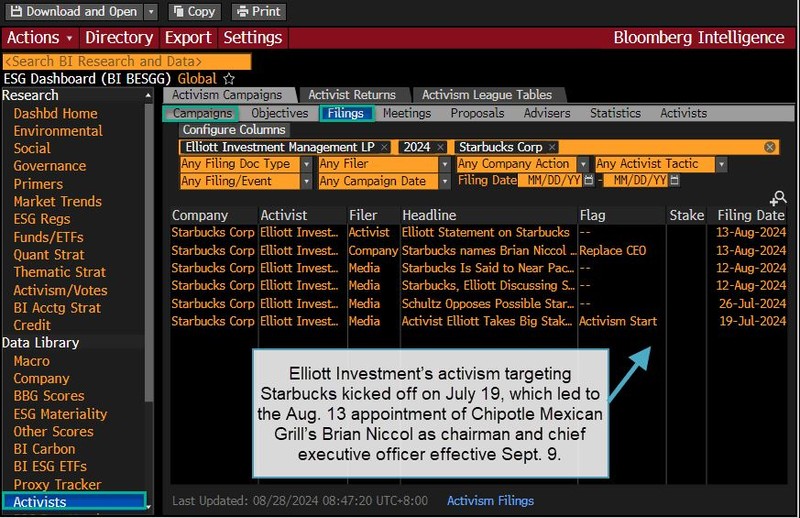

The leadership shake-up came in response to several quarters of slumping sales for Starbucks as demand declined, particularly in the U.S. and China. The appointment is seen as part of a broader activist campaign from Paul Elliott Singer’s Elliott Investment Management LP.

The issue

Elliott Investment began targeting Starbucks in mid-July and played a role in the August 13 selection of Niccols. The firm has a proven track record, including a 217.9% gain from its investment in Arconic Inc. during 2016-23.

Analysts also appear to be willing to give Niccol a bit of runway, with Bloomberg Intelligence’s

Michael Halen saying that hiring “arguably the top public restaurant CEO” in the US is a “no-brainer.”

However, options traders appear to be betting against Starbucks in the short term. A 2.15 put/call ratio shows a bearish bias.

So will Elliott’s bet likely pay off?

Tracking

Use Bloomberg’s BI ACT to analyze securities and track activist investor campaigns. Run SBUX US Equity GP RCMND to see the Recommendation Ratio study for Starbucks.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.