Bloomberg Professional Services

This article was written by Mike Pruzinsky, Equity Indices Product Manager at Bloomberg.

Investing can be both an art and a science, a delicate balance of choosing the right mix of assets while managing risk and return. In equity markets, traditional indices with their broad diversification and market-cap–weighted approaches, have long been the standard of many investment strategies. However, the last decade has seen stock market returns being driven by an increasingly narrow group of stocks. A recent analysis showed that over 50% of the Bloomberg World Large & Mid Cap Index’s two year return was driven by just 25 stocks. With increasingly narrow market leadership by stocks like the so called magnificent seven, it may be worth re-thinking what it means to be well diversified while allocating to market leaders.

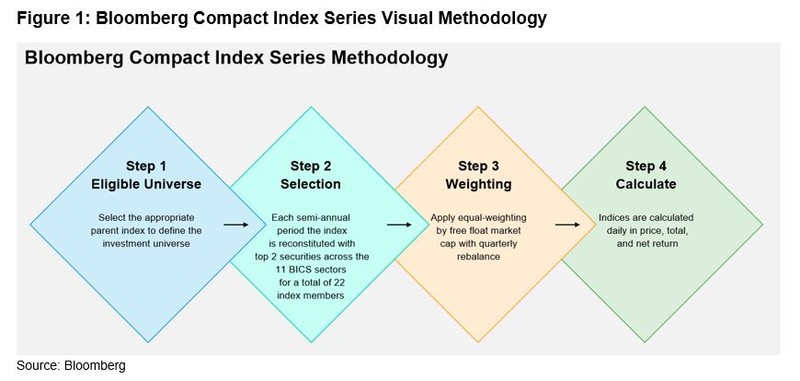

Enter the Bloomberg Compact Index Series which is a family of 7 indices that are designed with a streamlined methodology, offering a unique blend of concentrated exposure to all market sectors. The series was created in partnership with Global Macro Asset Management as a custom solution for the firm’s direct indexing platform. The index offering spans across select countries and regions aiming to provide equal-weighted exposure to the largest two securities by market cap from each of the eleven Bloomberg Industry Classification System (BICS) level 1 sector groupings of each parent universe.

Let’s delve into the key advantages of the Bloomberg Compact Indices.

Reduced volatility

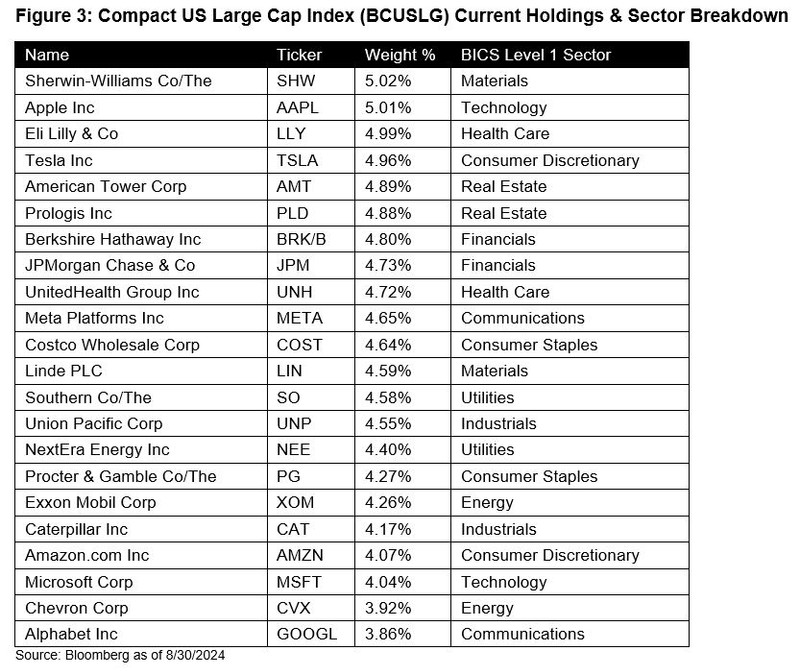

One of the most compelling reasons to consider the Bloomberg Compact Indices is their ability to reduce volatility through a carefully crafted diversified structure. By equally weighting across eleven economic sectors and including just two securities per sector, these indices offer a balanced exposure that minimizes concentration risk. This approach may allow for a greater ability to withstand sector-specific downturns across a variety of market cycles as it prevents outsized influence of any single stock.

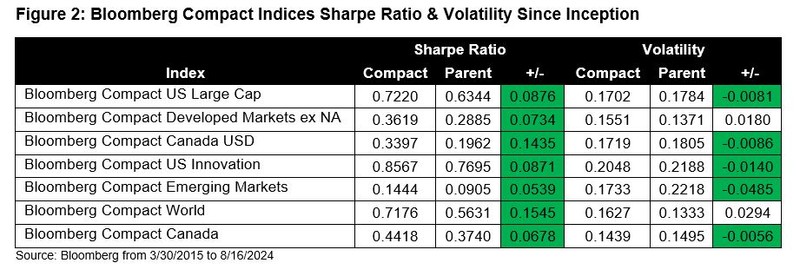

Furthermore, the equal weighting of securities within each BICS sector means that recognition is given to each market leading security in the same proportion. This reduces the risk of overexposure to a single security, in contrast to traditional market-cap-weighted indices where large-cap stocks can disproportionately influence performance. Figure 2 compares each Bloomberg Compact Index relative to its parent index universe. Since inception, all 7 indices have a higher risk-adjusted return as measured by Sharpe ratio and 5 of the 7 indices have had lower realized volatility.

Simplicity

Another significant advantage of the Bloomberg Compact Indices is their simplicity. Selecting index constituents should be straight-forward and transparent, versus the complexity of traditional indices which may include hundreds or even thousands of securities. The sheer volume of constituents in market cap weighted indices necessitates constant monitoring and corporate action handling, all of which can be time-consuming and costly.

Compact Indices simplify these processes by limiting the number of securities included typically to just twenty-two. This streamlined approach makes the index easier to manage on several fronts:

- Monitoring: Monitoring the index becomes less burdensome, as investors only need to keep an eye on a select group of securities. This makes it easier to stay informed about changes in performance, corporate actions, or market conditions that might affect the index.

- Relatable: Index methodologies at times can be complex, but the Bloomberg Compact Indices have a transparent, easy to understand set of rules governing index selection.

- Rebalancing: Rebalancing decisions are more efficient when dealing with a smaller number of securities.

With a clearly defined set of rules, the Indices represent the most highly capitalized and prominent companies in the markets they track.

True sector diversification

While reduced volatility and simplicity are attractive features, a key part of the allure of the Bloomberg Compact Indices lies in true sector diversification. By design, the Indices leverage the Bloomberg Industry Classification System (BICS) a proprietary, market-based industry classification system that creates groupings of issues with similar activities. BICS classifies companies by primary source of bottom up revenue allowing for comprehensive granularity. This results in only the largest market-cap companies being included from each BICS level 1 sector.

The focus on limiting the number of companies selected also means that compact indices are often more resilient during market downturns. High-quality companies with strong balance sheets and competitive advantages are typically better equipped to weather economic storms, providing a relative cushion against severe market corrections. Moreover, these companies are typically leaders in their sectors, driving innovation and capturing market share, which can translate into superior long-term growth potential

Compelling alternative

In today’s complex financial landscape, the Bloomberg Compact Indices offer a compelling and innovative alternative to traditional indices. By balancing exposure across multiple sectors and carefully selecting top-tier securities, the compact indices streamline the number of securities included in the index while maintaining robust market representation. This power packed solution is a smart and efficient way for investors looking to achieve diversified exposure while only selecting blue-chip securities.

Learn more about the Bloomberg Compact Index Series Methodology

Global Macro Asset Management has licensed the Compact Indices for direct indexing. Visit their website for more information on how to incorporate these innovative indices into your investment strategy.