Private credit managers are helping banks keep risky clients

Bloomberg News

This article was written by Natasha White. It appeared first on the Bloomberg Terminal.

In the market for private credit, managers are increasingly partnering with banks to help them maintain lucrative contracts with risky oil, gas and coal clients.

It’s a model that allows banks to continue doing deals in areas like commodity trade finance, where exposures might otherwise clash with European restrictions on fossil fuels and capital requirements. By sharing risky exposures with private-credit managers, banks are figuring out how to stay on the right side of regulations without losing access to lucrative commodities markets.

The development is “creating new opportunities” for firms like Kimura Capital LLP, a commodity-focused private credit provider, says Sylvia Solomon, its chief sustainability officer. She cites “new minimum capital reserve requirement rules and pressure on banks to cut fossil fuel exposure” as key drivers behind the trend.

Banks that share balance-sheet risk with private credit managers may be more likely to maintain ties with clients in emerging markets like those in Africa, which have felt the fallout of strict European regulations particularly acutely. Solomon says Kimura considers social issues, including access to affordable energy, to be as important as environmental concerns when assessing the sustainability of deals.

“Several large merchant banks” have already exited Africa, Solomon said. Kimura estimates that there’s currently an $80 billion annual deficit in African trade finance that needs to be plugged, and it’s disproportionately hitting small and mid-sized firms.

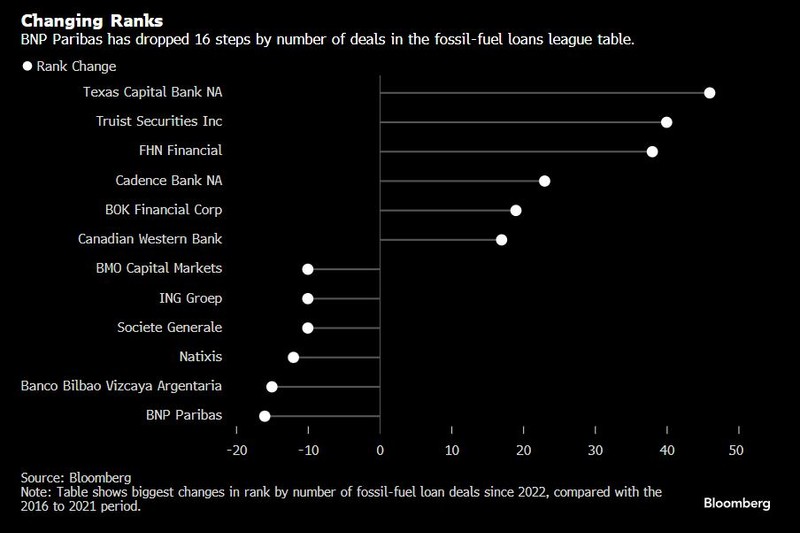

Banks in Europe are adjusting to the region’s shifting regulatory landscape, which has brought stricter climate rules than exist in other jurisdictions. BNP Paribas SA, the European Union’s biggest bank, and ING Groep NV, the largest lender in the Netherlands, are among financial firms to have stepped up restrictions on fossil-fuel clients in lending and bond underwriting. ING has also announced its plans to cut back its oil and gas trade finance.

And while regulations are driving much of the banking industry’s retreat from fossil fuels, the threat of litigation and reputational damage also plays a role. Both BNP and ING, for example, are currently fighting ongoing lawsuits brought by climate activists targeting their fossil-fuel business.

As banks exit fossil fuels, it’s becoming “more expensive for oil producers and traders to get trade finance, and there’s less availability of it,” Solomon said. “That’s partly why we are able to achieve good margins.”

It’s part of a larger trend whereby an ever greater share of fossil-fuel finance — and the associated emissions — are taking place out of public view. The aggregate value of oil and gas deals financed with private debt exceeded $9 billion in the 24 months through the end of 2023, compared with just $450 million in the preceding two years, according to data provided by Preqin, an analytics company that tracks the alternative investment industry. The data is based on the limited pool of deals reported publicly or disclosed directly to Preqin, and actual figures may be greater still.

Big commodity traders like Glencore Plc and Trafigura Group have also moved in as banks pull back. Jason Kerr, a partner in the energy group at law firm White & Case, says the scale of the shift is “dramatic” in Africa, where his work is focused. International oil traders “are going from fairly unsophisticated financing to quite complicated funding arrangements,” he said.

For private credit firms like Kimura, which is focused on trade finance, the development has coincided with growth in its core credit business in recent years, as the industry benefited from a cocktail of higher interest rates after the pandemic and stricter regulatory requirements curtailing bank lending. Kimura is now based in 15 countries, has 23 employees and lends about $500 million each month. Solomon, who joined the firm this year, is its first ever chief sustainability officer. She says private credit can ultimately help steer the transition toward greener energy.

Kimura mostly provides short-term loans on a revolving basis, and can regularly revisit targets such as emissions cuts or cocoa-related waste limits. And its focus on mid-sized companies means Kimura has “a larger say and more influence,” Solomon said.

“Many companies that people might think of as pure-play fossil fuels are trying to turn their business around and need the capex to do that,” she said. “That’s where we can add value, and in our lending terms be very specific with key performance indicators.”