ESG and carbon leaders’ changes to 3Q EPS positive

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Strategist Manish Bangard and Bloomberg Intelligence Strategist Rahul Mahtani. It appeared first on the Bloomberg Terminal.

Leading ESG and low-carbon emitting companies like Apple, Uber, Baker Hughes and Ecolab had positive 3Q EPS revisions after 2Q earnings. S&P 500 companies leading in ESG are aided by stronger average changes in six sectors — such as industrials, materials and consumer staples — where high scorers’ revisions outpaced the overall sector. Energy was among the key climate areas, as were industrials, materials and utilities, where low-carbon emitters changes were stronger vs. peers.

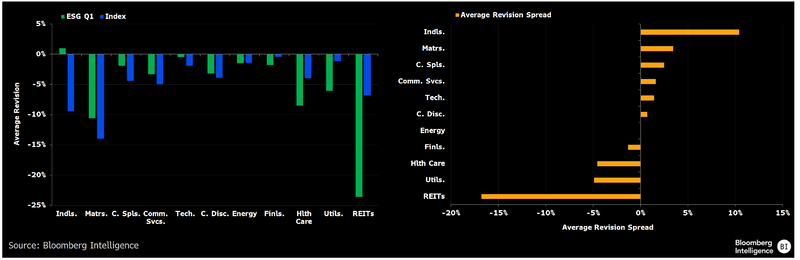

3Q EPS changes favor industrials, materials ESG leaders

The top quintile of ESG companies within the S&P 500 delivered higher average 3Q EPS estimate revisions in six sectors after reporting 2Q results. The gap is widest in industrials, where changes for ESG leaders’ averaged 1%, despite the sectors minus 9.4% mean. Similarly, high ESG scorers’ revisions in materials, consumer staples, communication services, technology and consumer discretionary were greater than their sectors’ average declines.

By contrast, favorable ESG scores had larger negative average revisions in five sectors: REITs, utilities, health care, financials and energy. REITs had the biggest negative spread where ESG leaders trailed the sector by 17%.

3Q EPS Revisions for Top ESG Stocks vs. Sectors

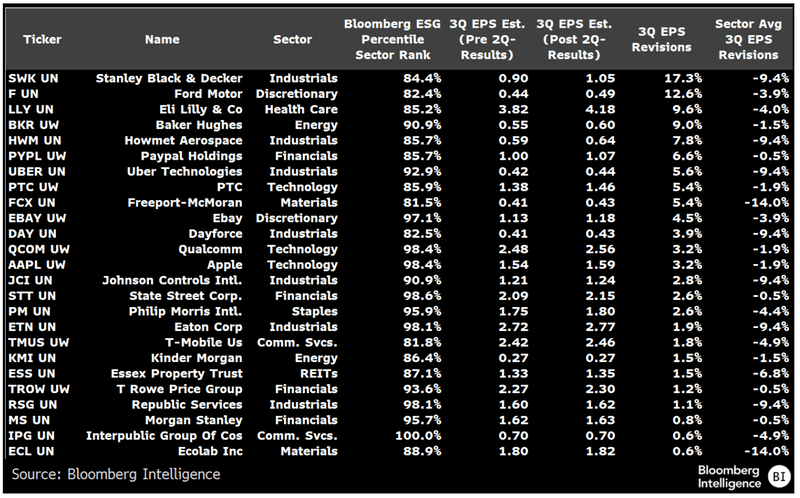

Black & Decker, Ford Top 3Q EPS revisions in ESG stocks

Twenty-five companies in the S&P 500 index with high ESG scores stand out with positive 3Q EPS revisions since their 2Q earnings. Of those, seven are industrials — including Stanley Black & Decker, Howmet Aerospace and Uber Technologies — with EPS changes of 17%, 8% and 6%, respectively. That’s despite the sector’s minus 9.4% average 3Q EPS decline. Financials followed with four names, including PayPal and State Street, with revisions of 7% and 3% vs. the sector’s mean minus 1%. Technology was next with three companies — PTC, Qualcomm and Apple — amid changes of 5%, 3% and 3% vs. a minus 2% sector average.

Consumer discretionary, energy, materials and communication services all had two companies in the top 25, including Ford Motor, Baker Hughes, Freeport-McMoRan and T-Mobile US.

Top US ESG Stocks with Positive 3Q EPS Changes

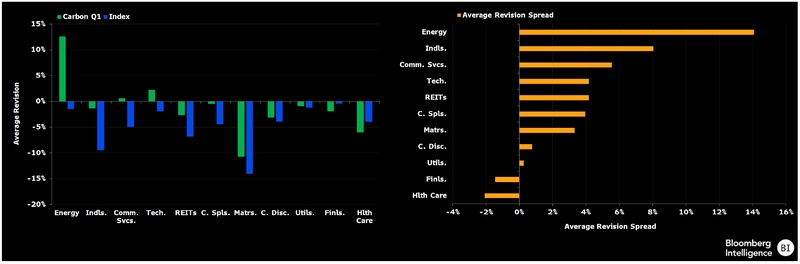

Energy excels within low-carbon on 3Q EPS revisions

Within low-carbon emitters, top energy companies stand out with robust average 3Q EPS changes of 13% vs. the sector’s minus 2% average. Low-CO2 companies in three key climate-transition sectors — energy, industrials and materials — have seen stronger 3Q EPS revisions post-2Q results, relative to sector averages. These companies aren’t only in the bottom quintile of sector-relative carbon intensities — based on Scope 1 and 2 emissions over sales — but also had 3-14% higher revisions vs. sector peers.

Nine sectors saw higher average revisions for low emitters, including technology and communication services. Yet low-carbon stocks’ were weaker by 1-2% in health care and financials.

3Q EPS Revisions for Top Carbon Stocks vs. Sectors

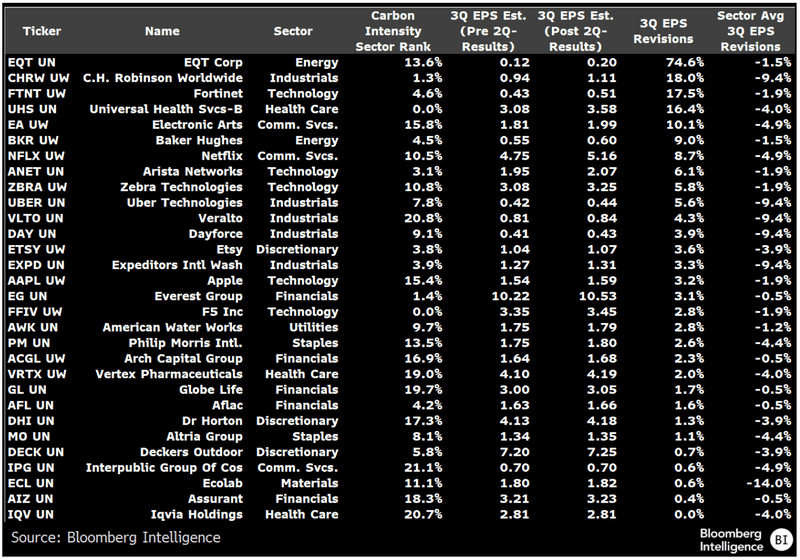

Apple, Uber shine among carbon amid 3Q EPS revisions

Of the low-carbon emitting companies in the S&P 500 index, 30 have positive 3Q EPS revisions after reporting 2Q results greater than their respective sector averages. Those include Apple, Uber Technologies, Netflix, Baker Hughes and Aflac. Industrials, technology and financials all had five names with average revisions for low-carbon emitters above sector peers.

The low emitters have carbon intensities (Scope 1 and 2 emissions over sales) in the bottom 20%

of their sectors.

Carbon Q1 Stocks with Positive 3Q EPS Revisions

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.