Google likely faces behavioral remedies in search suit loss

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Jennifer Rie. It appeared first on the Bloomberg Terminal.

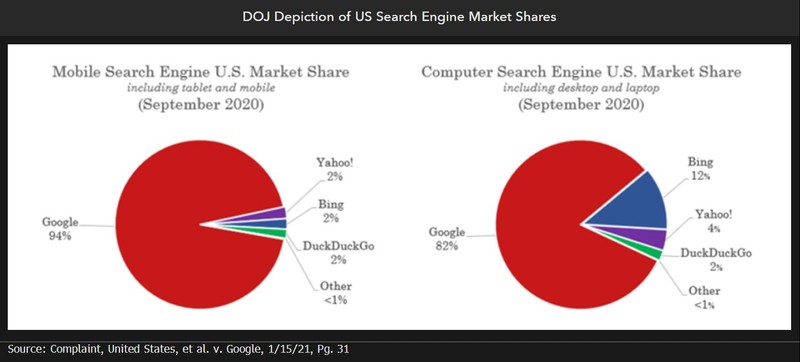

With an Aug. 5 ruling in the US Justice Department’s lawsuit against Alphabet’s Google holding it liable for illegally maintaining its monopoly in general search and related text ad markets (as we expected), Google will likely have to change the the way it operates those businesses. An order to break up the company is unlikely, we believe. Remedies will likely be hashed out in the next 6-12 months. In the meantime, Google will appeal and also likely seek to stay the remedies process.

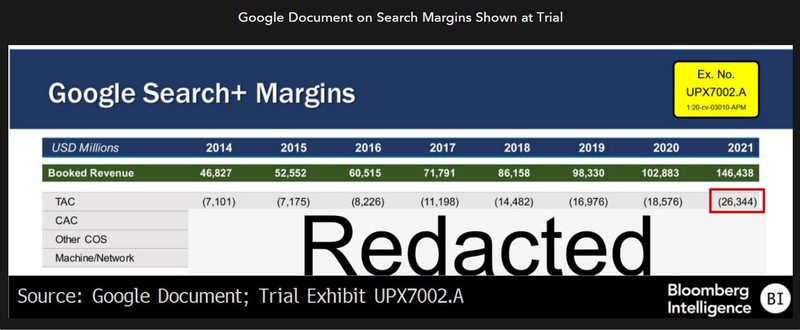

Our Thesis: Alphabet’s search revenue — more than $146 billion in 2021 — is vulnerable given its loss at trial on liability, but this will depend on the remedy imposed. Behavioral changes could result in the loss of the default position and market share. The ultimate impact would depend on the injunction’s breadth and subsequent user behavior.

What’s the status?

Google will likely appeal the Aug. 5 decision against it on liability, and also seek a stay on any remedy proceedings pending its appeal. Though there’s little precedent for this and the law is mixed, we believe it unlikely the judge would grant the request. The appeal could take more than a year, longer if a Supreme Court review is sought. It’s possible the judge would agree to stay implementation of remedies pending appeal, but probably not the process of deciding what they should be. A hearing to flesh out a schedule for remedies proceedings is set for Sept. 6.

What’s at stake?

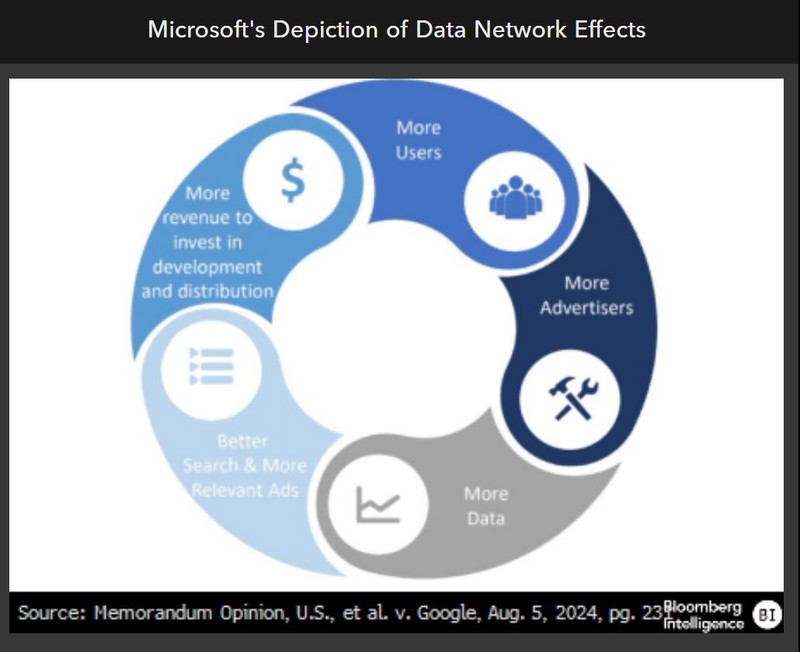

Behavioral remedies are likely, we believe, though difficult to craft. The most apparent options aren’t great: a ban on paying for default status might hurt Apple and Mozilla more than Google, though Google has modeled a $28-$33 billion loss from losing default status on iOS devices (but $26 billion in traffic acquisition costs would also decrease). Adding screens to Android devices to give users a search choice hasn’t had much impact in the EU, and forced data sharing could raise complications and privacy issues.

The Justice Department is likely to pursue a breakup of Alphabet, such as the sale of its Chrome browser, but we believe the effort would probably fail. Though the judge called Google an illegal monopolist, he also commended the company’s continued investments and innovation. He could be concerned that a structural change could upset that dynamic. Further, his apparent cautious approach, as well as adherence to an appellate court’s 2001 decision against Microsoft probably helps Alphabet. The appeals court vacated a lower court’s ruling that Microsoft should be broken up, despite agreeing with many of the findings against the software giant on liability.

The court counseled against adopting “radical” structural relief, noting that a remedy should be tailored to fit the harm, and divestitures imposed only with great caution.

What’s the outlook?

Google is likely to appeal the judge’s liability ruling, but we think the decision will stick. It was well-reasoned and based on straightforward antitrust legal precedents. Further, determinations by the judge that Google has a monopoly in two markets, and that its default status agreements were exclusionary, had anticompetitive effects and lacked procompetitive business justifications, were based on his interpretation of the evidence. An appeals court will give deference to those calls.

We don’t believe that a change in administration in 2025 increases the already low possibility of a settlement in this case. Though there are similarities between this lawsuit and the DOJ’s Microsoft litigation in the 1990s, which was brought and litigated by the Clinton administration but then settled by George W. Bush’s DOJ, the political climate today is different. Neither Trump nor Vance are a friend to Google; Vance is actually an advocate for a structural break up of the company. Though we believe a Harris/Walz ticket might ease up a bit on antitrust enforcement, it would probably be slight and more likely to manifest in FTC and DOJ monopolization suits against big tech platforms that are weaker than this one (such as those against Amazon.com and Apple).