Search for South Africa banks’ growth resumes

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Philip Richards. It appeared first on the Bloomberg Terminal.

Political stability after the elections and fewer electricity blackouts have eased the pressure on South Africa’s largest lenders like FirstRand and Standard Bank, yet significant revenue growth remains elusive. That suggests analyst will keep paring estimates in 2H for falling interest rates, weak economic expansion and rising impairments.

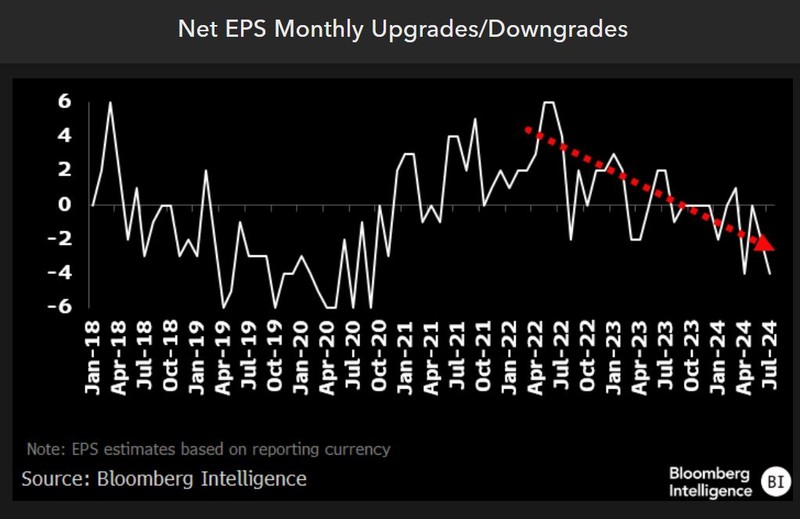

EPS estimates stall on economic slowdown, charges

The formation of a new coalition South Africa government is set to ease the political impasse and uncertainty, though tough challenges remain to kick-start the weak economy, with an unemployment rate of 30%-plus. Sluggish loan growth and rising impairments have led to local lenders’ earnings estimates being downgraded in recent months, marking a U-turn from net upgrades two years prior. Political developments could help both elements, yet there’s unlikely to be a quick resolution. A rebound in banks’ earnings forecasts will require both business and consumer confidence to be lifted.

Our basket, comprising the six leading South African banks, shows raised or lowered EPS estimates each month, based on 12-month forward consensus. The net balance each period ranges from plus six (all upgrades) to minus six (all downgrades).

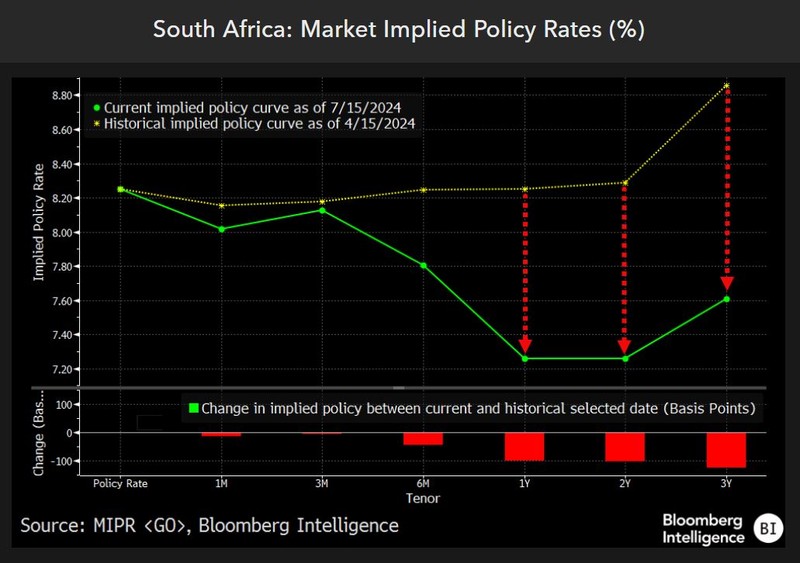

Slashed rate expectations to weigh on revenue

Market-implied interest rates now indicate expectations for a sharp 100-bp interest-rate cut in South Africa over the next 12 months — which will inevitably drag on lenders’ revenue expectations — as opposed to the stability anticipated as recently as three months ago.

Lower interest rates (now seen at 7.25% in mid 2025) will curb banks’ net interest margins, and in turn, their revenue scope. Alongside subdued lending expansion and rising impairments, that has been the key drag on estimates, with further downgrades likely.

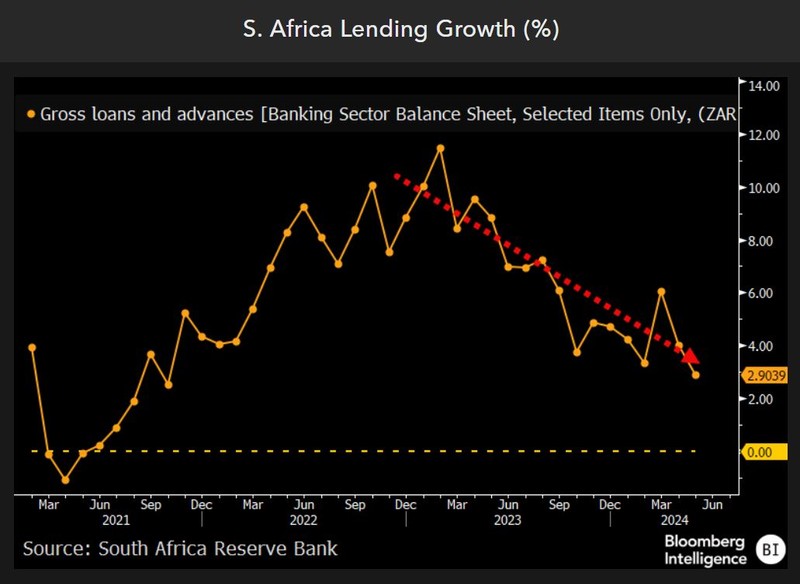

Lending growth set to remain subdued

South Africa’s lending growth has weakened as a result of the challenging and deteriorating economic backdrop, weighing on local banks’ prospects, with lending expansion more than halving to just 3% from 10%-plus in early 2023. The more certain political backdrop is supportive, yet the lethal cocktail of a weak housing market, low corporate confidence and elevated unemployment have kept lending growth within a subdued 3-6% range through 2024, which looks like being sustained through 2H and into 2025.

That implies negative growth in real terms, given inflation of 5-6%, with per-capita growth also negative. A revival is key to boosting banking-sector revenue potential.

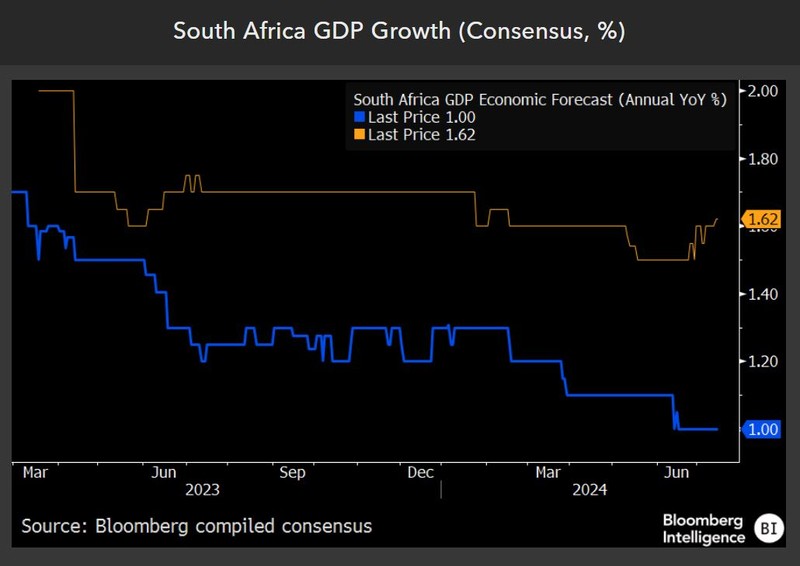

Prospects beset by stalled economy

A key drag on the earnings prospects of domestic lenders such as FirstRand and Standard Bank is the collapse of business confidence and a slowdown in South Africa’s economic growth. The Bloomberg-compiled consensus has slashed 2024 economic growth to just 1%, with only a modest uptick to 1.6% next year. Boosting economic activity is key to bolstering lending, given the margin squeeze of pending interest-rate cuts.

A longer-term opportunity exists for local lenders from the investment in renewable-energy sources by corporates and households, but coal-based electricity generation is likely to remain South Africa’s primary near-term energy source.