Making sense of sustainable debt labels

Bloomberg Professional Services

(Article updated)

About the sustainable debt market

Why is sustainable debt important?

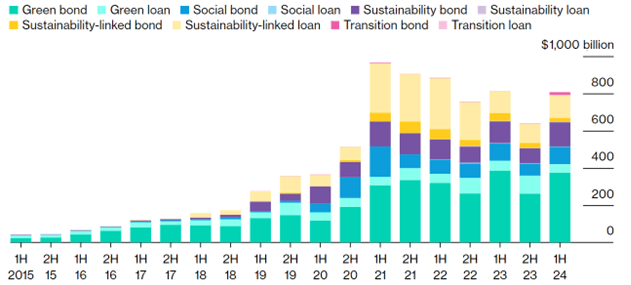

Sustainable debt is a type of borrowing, via loans and bonds, that is used for environmental or social outcomes. The sustainable debt market is $6.0 trillion in total issuance outstanding as of June 2024 based on Bloomberg data. While the scale of this market is impressive, it is also complex with distinct sustainability-related formats. The following blog provides an overview of the structure of this market and how Bloomberg supports transparency and tagging of sustainable debt instruments.

How does the sustainable debt market work?

This borrowing typically takes two forms:

- Use of proceeds-based: “Green” bonds/loans, “social” bonds/loans, “sustainability” bonds/loans, and “transition” bonds/loans raise money to finance new, or refinance existing green, social, sustainability or transition projects and activities.

- Entity-based: “Sustainability-linked” loans and bonds typically raise money for general purposes. Instead of necessarily allocating the proceeds for certain sustainability activities, they are tied to an issuer’s sustainability targets. Targets applied can vary, for example a greenhouse gas emission reduction goal, or a quota for diversity in the workforce.

What are the instruments issued in the sustainable debt market?

Source: BloombergNEF, Bloomberg Terminal. Note: Green bonds include TAP issues, municipal bonds and mortgages. Transition debt is based on the issuer’s self-labeling. Based on pricing date. Read report

What is a “green” instrument?

Green instruments work in the same way as any other bond/loan, in that the investor is lending money to a company or government. In the case of green instruments, the issuer will then use that money to finance a project or activity with an intended environmental outcome. Green bonds/loans can raise money for both new and existing projects.

What is a “social” instrument?

Social instrument proceeds finance or refinance new and existing projects that are intended to address or mitigate social issues. Social bond/loan proceeds include but are not limited to financing for health, housing, education, employment and culture.

What is the difference between a “green” instrument and a “sustainability” instrument?

Sustainability bonds/loans are used to finance projects that are intended to bring environmental and/or social benefits, whereas green instruments only focus on activities that are intended to benefit the environment.

What is a “transition” instrument?

Transition bond/loan proceeds are often linked to the issuer’s climate goals. Transition bond/loan issuance has been very limited with market preference for either use of proceeds-based green instruments or entity-level sustainability-linked instruments.

What is a “sustainability-linked” instrument?

Unlike green bonds/loans, where the use of proceeds go towards an environmental outcome, sustainability-linked instruments can be used for general purpose finance. A sustainability-linked bond/loan typically includes a coupon or an economic-related payment structure tied to predefined and time bound sustainability targets. The aim of these instruments is to incentivize entities to meet their sustainability goals.

What are the accepted standards or frameworks for defining instruments?

The market has embraced a variety of voluntary frameworks. Broadly accepted definitions include: ICMA’s (International Capital Market Association) Green Bond Principles, Social Bond Principles and Sustainability-Linked Bond Principles; and the Climate Bond Initiative framework. For more information on the ICMA Principles, click here.

Policymakers and regulators are also taking steps to promote standardization. For example, the European Commission adopted the European Green Bond Standard Regulation to create a common framework for issuers. For more information about the European Green Bond Standard Regulation, click here.

How does Bloomberg support the sustainable debt market?

Bloomberg supports transparency across the labeled bond/loans market with relevant data and instrument labels.

Bloomberg analysts review offering documents including, but not limited to, term sheets, prospectuses and offering circulars. If the issuer in the offering document states that the instrument finances projects or activities with social and/or environmental outcomes, transitional outcomes, and/or if the instrument includes organizational sustainability targets, Bloomberg will assign one or more labels according to a methodology.

For more information on Bloomberg’s Sustainable Finance Solutions, please click here.

Bloomberg makes no claims or representations, or provides any assurances, about the sustainability characteristics, profile or data points of any underlying issuers, products or services, and users should make their own determination on such issues.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except that Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products in Argentina, Bermuda, China, India, Japan and Korea. BLP provides BFLP with global marketing and operational support. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. BLOOMBERG, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG TELEVISION, BLOOMBERG RADIO and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries. © 2024 Bloomberg.