Emerging market equities midyear outlook

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Analyst Kumar Gautam, with contributing analysis by Sufianti Sufianti. It appeared first on the Bloomberg Terminal.

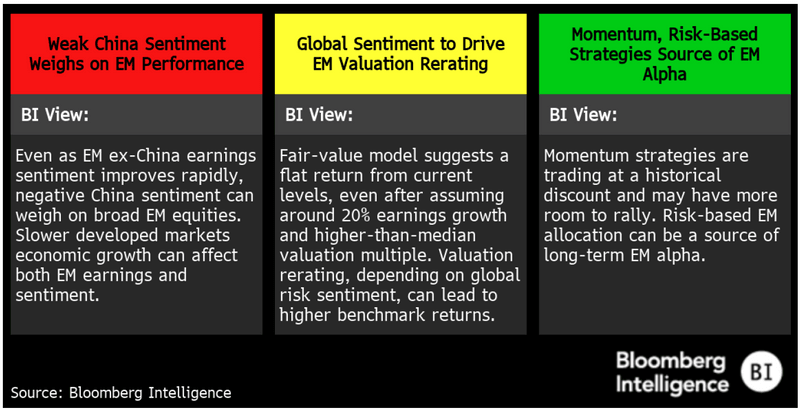

The MSCI EM Index is trading above its median valuation, but in the past– even at these levels — forward 12-month returns were close to 9%. Earnings revision is recovering but the China and EM ex-China trend is diverging — while EM ex-China earnings revision is positive and growing rapidly, China’s is deep in negative territory and is slow to recover. Our fair-value model projects a flat return over the next 12 months even after assuming 20% growth in EPS and valuation above the historical median. Our country model is overweight Mexico and South Africa. Our factor model is overweight momentum and has turned neutral on value.

Our risk-based model shows alpha both in the 20-plus-year backtest and 12-month period after first publication in July last year. It is currently underweight China and overweight India.

Three keys for 2H: Emerging markets equities

Key Drivers

It’s time to ditch the old-school strategy for EM allocations

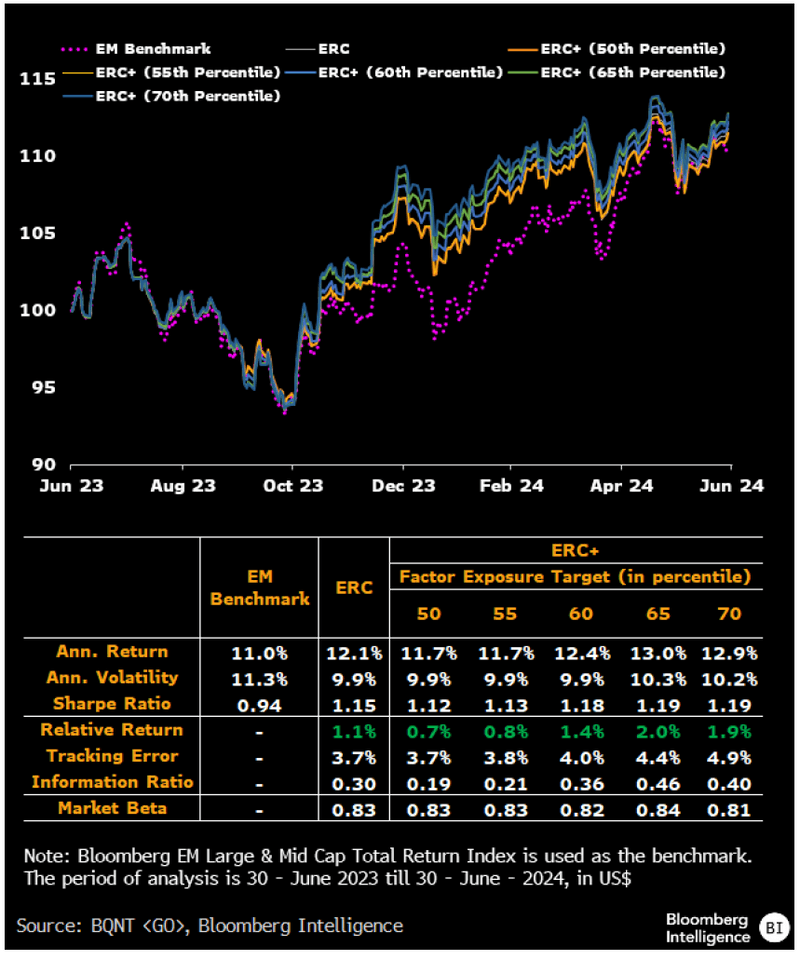

BI’s benchmark-beating model for allocating among emerging markets demonstrated higher returns with lower risk in its first year after publication, adding further evidence of the approach’s robustness. Our proprietary Equal Risk Contribution model showed positive alpha and a Sharpe ratio of 1.15 the past year, topping the standard, market-cap-weighted benchmark’s long-term risk-adjusted return with its alpha surviving transaction costs. In contrast, the popular and traditional approach of excluding China in EM allocations does not.

ERC beat the benchmark with lower risk

BI’s ERC strategy has outperformed the benchmark index with a lower risk since we first published it a year ago in July, adding to the long-term case for the model made through a backtest to 2003. The strategy generated 12.1% return with 9.9% volatility, resulting in a Sharpe ratio of 1.15. The benchmark’s return and volatility were 11.0% and 11.3%, implying a Sharpe ratio of 0.94.

ERC’s 0.83 market beta means it’s defensive in nature but can also capture market upturn — as was the case over the past 12 months. The tracking error, a measure that active managers often want to control while chasing returns, remained low at 3.7%.

BI ERC Portfolios: 1-Year Performance

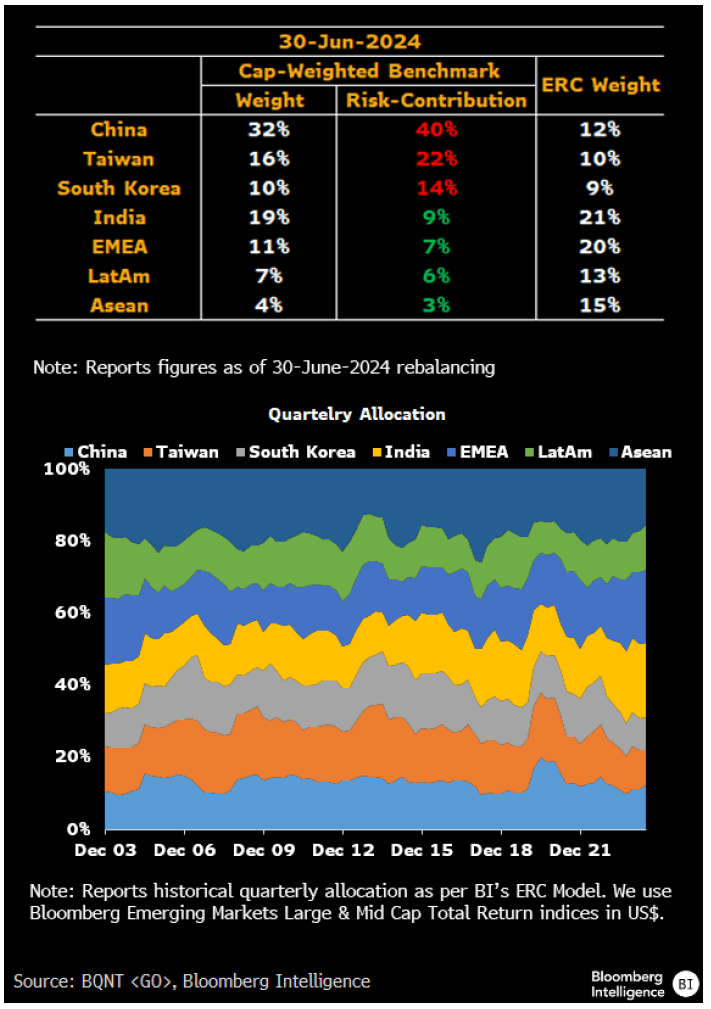

ERC still underweight China due to higher volatility

Our ERC model continues to underweight China and favor India, with June allocations of 12% and 21%, respectively, versus 32% and 19% in the benchmark Bloomberg Emerging Markets Large & Mid Cap Index. The model’s underweight China positioning is due to its high volatility versus other emerging markets. India’s low volatility means it gets a high weight in our model. Asean also gets a large allocation due to low volatility.

The ERC optimization allocates weights such that each asset contributes equally to the portfolio’s total risk. Our EM ERC approach allocates weights to seven markets: China, Taiwan, Korea, India, Asean, EMEA and Latin America. We rebalance quarterly and use US dollar-denominated Bloomberg total return indexes. ERC allocation doesn’t use market returns in optimization as they often are hard to forecast.

BI ERC Portfolio: Quarterly Allocation

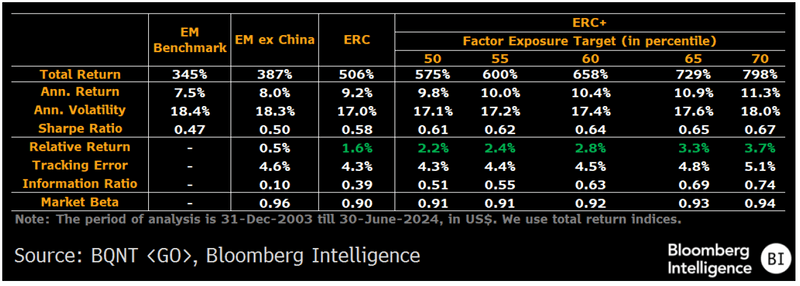

ERC approach a source of long-term alpha

BI’s ERC approach is a source of long-term benchmark alpha. The cumulative return of 506% (annualized 9.2%), is 162 basis points per year over the cap-weighted benchmark’s return (annualized 7.5%), based on our backtest from Dec. 31, 2003, to June 30, 2024. A high excess return is achieved with a low 4.3% tracking error. The volatility is lower by 1.4 percentage points. Higher return and lower risk improve the Sharpe ratio by 23%. The ERC strategies which take factor exposures further improves Sharpe ratios in the range of 29% to 40%.

Excluding China is often prescribed as a solution to improve on the EM benchmark’s decade-long poor performance. Our analysis, however, shows excluding China makes no significant improvement in the benchmark’s long-term performance.

BI ERC Portfolios: Long-Term Performance

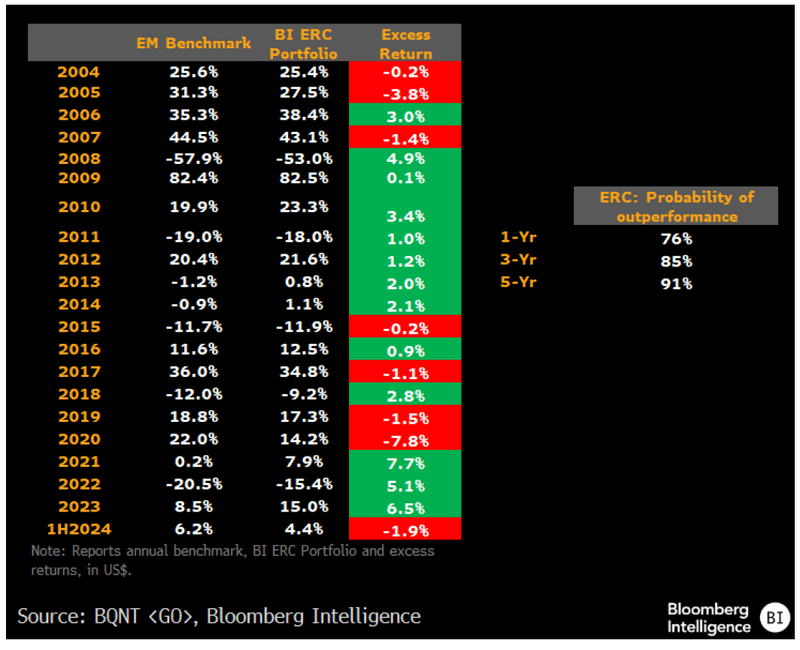

ERC shows 90%-plus five-year outperformance probability

The ERC strategy’s benchmark alpha is not concentrated in any particular period or solely dependent on underweighting China in recent years, and the portfolio’s chances of beating the benchmark improve with an increasing investment horizon. It rises to 85% from 76% as the horizon increases to three years from one, and is 91% over a five-year investment horizon. The probability of outperformance is even higher for ERC strategies targeting factor exposures.

The strategy suffered a touch from limited exposure to China in 1H24, but not enough to make a material difference to performance overall. Its excess return in 1H24 was negative (minus 1.9%), but positive in 13 out of 20 years — implying a 65% hit rate. The average of positive and negative annual excess returns are 3.1% and minus 2.3%.

Probability of Outperformance

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.