Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Jonathan Palmer. It appeared first on the Bloomberg Terminal.

Health-care distribution performance through mid-2024 has been uneven, with distributor strength offset by pharmacy and clinical lab struggles. The industry continues to grapple with margin pressure amid a shift from pandemic highs to more stable, long-term models. The backdrop for distributors is favorable, while pharmacy turnarounds will take years.

McKesson and Cencora outperform peers

The S&P 500 has advanced 14.5% this year through June, with more cyclical sectors driving recent gains. By contrast, the historically defensive health-care supply-chain sector has declined 24%. Pharmaceutical distributors are the silver lining of the group, with McKesson notching a 26% return and Cencora 10%. The distribution sector is typically resilient in times of economic crisis given consistent demand for drugs.

Pharmacies are the group’s laggards, with Walgreens tumbling 54% and CVS 25% due to margin pressure and slow delivery on their reach into services. In Walgreens’ case, progress on its turnaround has taken a step back, with no easy fixes in sight. CVS has been further pressured by higher medical costs in Medicare Advantage, the lost Centene contract and Star rating declines.

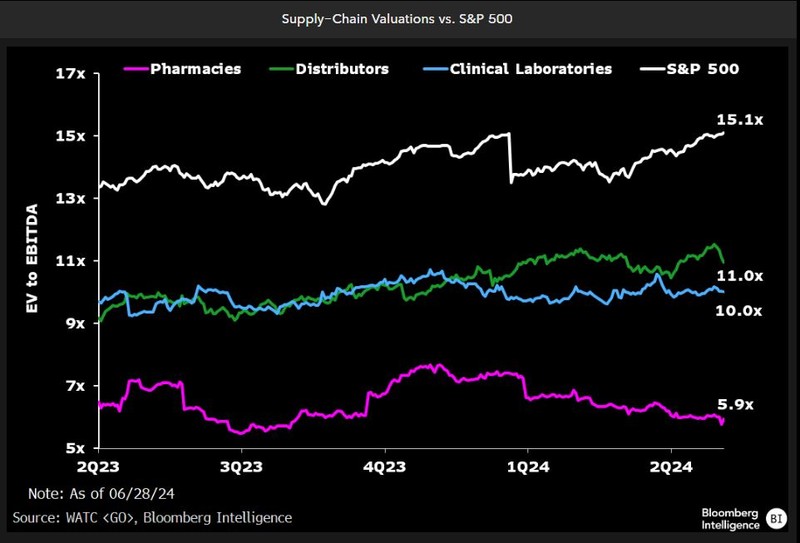

EV/Ebitda ratios decline; S&P records gains

The S&P 500’s forward EV-to-Ebitda multiple stood at 15.1x at midyear, 1.1x, or 7%, above its 52-week average and 3% ahead of its 1Q finish. The health-care supply-chain group has traded at a discount to the benchmark since 2016, though pharmaceutical distributors and clinical laboratories currently trade above three-year EV/Ebitda averages and north of 52-week baselines, with stable outlooks for the year ahead.

Cardinal is focused on maintaining momentum in its Pharmaceutical unit after losing the Optum contract. The EV/Ebitda ratio remains stable at 8.7x. Walgreens’ EV/Ebitda ratio has contracted 3x since the start of the year to 4.6x due to uncertainty around its operating model after consecutive fiscal 2024 guidance reductions, with additional earnings pressure expected in 2025.

Health-care distributors shine as market rallies

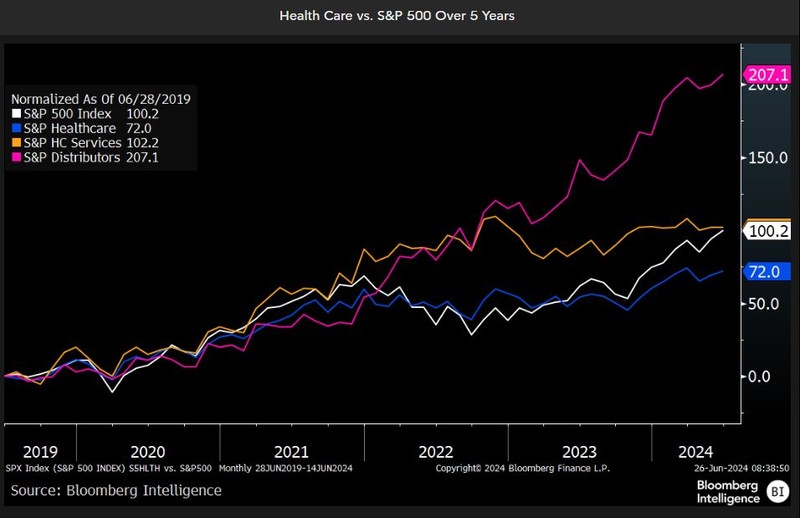

The S&P 500 has climbed over 100% through June since 2019, while the S&P Health Care Index lags behind with a 72% gain. The two have historically moved in tandem, though the health-care industry fared better than the broader market through 2022 due to lingering pandemic-response demand. The health-care index’s segment for clinical labs, pharmacies and pharmacy-benefit managers saw a 35% return. Distributors fared even better, surging nearly 200%, with the bulk of gains in 2024 driven by specialty drugs and GLP-1 growth.

Distributors (McKesson, Cardinal, Cencora) carry sizable weight in the health-care sector. Cardinal’s recent loss of the OptumRx contract to McKesson is significant and was likely factored into Cardinal’s outlook, but it hasn’t been reflected in McKesson’s.