Products / Indices / Bloomberg Fixed Income Indices

Tradable Trackers

Intraday pricing to support tradable product innovation

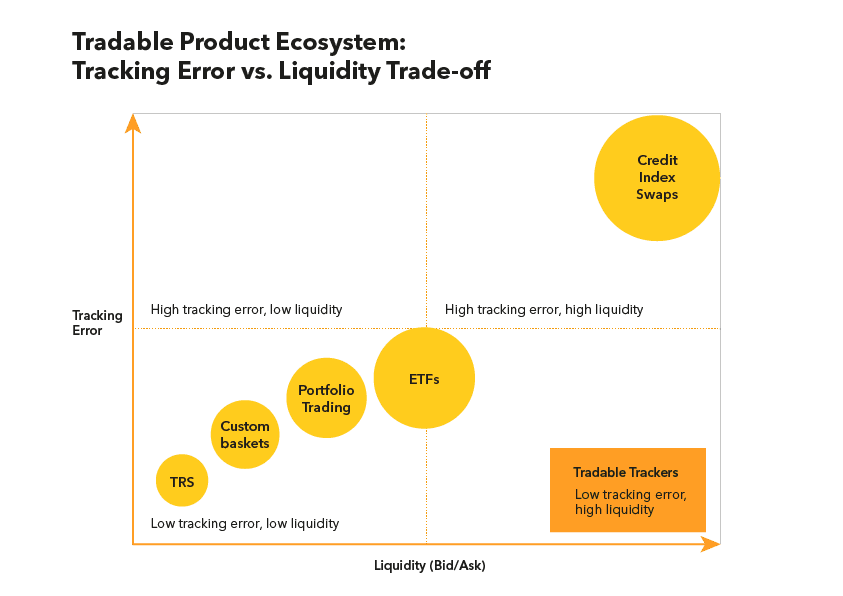

Bloomberg has developed a new suite of tradable indices based on Bloomberg’s industry-leading Fixed Income Indices. Unlike traditional end-of-day indices, Tradable Trackers are designed to be liquid indices, with intraday pricing, that tightly track to the flagship Bloomberg Indices.

Tradable Trackers will support innovation in the index-linked products market, facilitating the development of standardized and listed products. Tradable Trackers aim to provide the market with tools to hedge portfolio risk, efficiently gain credit exposure and identify trading opportunities.

Tight tracking to the most widely used flagship indices

Rules-based indices, designed to match the duration and sector exposures of the parent indices.

Bond selection based on liquidity ranking

Constructed using a liquid subset of bonds from the parent indices.

Replicate our flagship indices easily

Trade a standardized liquid basket of bonds efficiently

It can be challenging to replicate the performance of an index quickly due to liquidity issues of underlying bonds. With Tradable Trackers, we’ve selected a subset of highly liquid bonds from the parent index so you can efficiently gain credit exposure.

Tradable Trackers provide low tracking error and highly liquid index constituents

How Tradable Trackers are constructed

The underlying constituents of each Tradable Tracker will be based upon the market the index is intended to track. The first Tradable Tracker index (TTIGCU) is constructed by partitioning the US IG Corporate Bond sub-index (LUACTRUU) into Bloomberg Class 3 industry sectors and determining the appropriate issuers (100) per sector and most liquid bonds per issuer (2) to arrive at the 200 constituents for each Tradable Tracker Index.

To ensure the index matches the duration and sector exposures of the parent index, issuers are selected based on the sector’s market value weight, with bonds determined based on a liquidity ranking. The constituent bonds are then priced in real time by Bloomberg’s high quality, consistent intraday pricing product (IBVAL), using all available data inputs.