Treasury yield curve to bull steepen, but not yet

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Chief US Rates Strategist Ira Jersey and Senior Associate US Rates Strategist Will Hoffman. It appeared first on the Bloomberg Terminal.

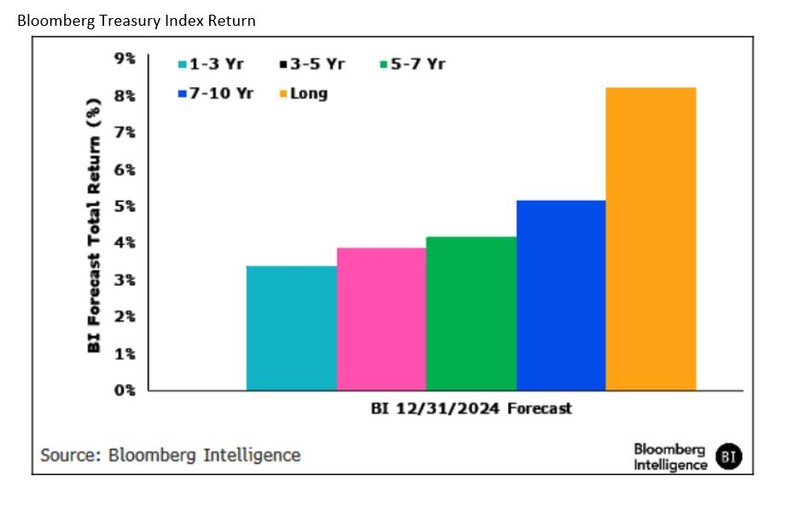

The economy is cooling but we don’t think it’s happening fast enough to provide the Federal Reserve the comfort it needs to cut rates before its November meeting. By contrast, Bloomberg Economics anticipates a summer economic slowdown will allow the Fed to cut in September and again before year end. We see the Bloomberg US Treasury Index posting positive second-half returns, led by longer duration Treasuries and TIPS as the market prices for more 2025 rate cuts.

Key takeaways

- Bull Steepening Eventually: We think the Treasury yield curve could remain inverted until after the Fed begins easing policy rates, partly because levered investors can’t stay in the negative carry of the front end for long. Once the curve starts to steepen, we believe it will be much more pronounced than the market is currently pricing in.

- Little Election Influence: Political partisanship doesn’t look as if it will improve during this election cycle, and neither leading presidential candidate has shown fiscal discipline, suggesting deficits and Treasury supply will remain elevated. Depending on the election results, the three top officials at the Federal Reserve Board could change.

- TIPS Yields to the Fore: TIPS yields could lead the rally, as inflation breakevens might remain stable and within a range. TIPS supply might increase slightly for the program to keep pace with the growth of nominal Treasuries.

- Treasury Supply Firm: Gross Treasury supply should stay the same until early 2025, with T- bills outstanding changing very little, while the current coupon issuance schedule funds the expected deficit through the 2025 tax season. Demand at Treasury auctions may remain volatile, with investor sentiment the day of the auction determining the outcomes.

Already a customer? Access the full report here.

Not a terminal user? Click here to learn more.